At a Glance:

U.S. natural gas prices have risen over 200% in the last twelve months. With a large portion of electricity generation coming from natural gas, this has not only affected retail gas prices but electricity rates as well. As an energy sales professional, it is difficult to navigate a volatile market when you cannot offer lower rates to your customers. Here are some great energy sales tips for selling in a volatile market.

Selling Energy Futures.

Electricity and natural gas commodities trade in both physical and financial markets. Physical markets represent cash transactions for physical commodities that are either used, stored, or resold. Financial markets, on the other hand, are standardized digital contracts that represent the future purchase or sale of a commodity. This future agreement to buy or sell a product is often referred to as a futures contract and trades in a futures market. To truly understand why a futures market exists, let’s look at coffee…

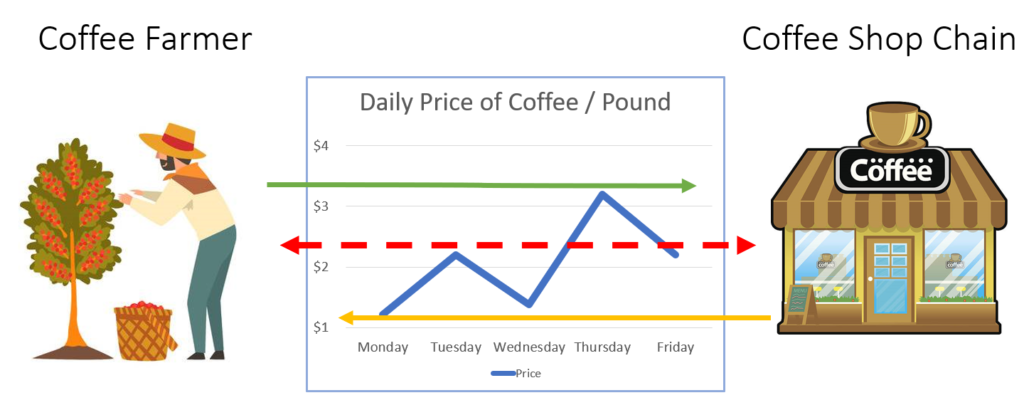

In the example above, the coffee farmer grows coffee beans and sells them to the coffee shop chain. Both parties, while partners in the transaction, have different incentives.

The Coffee Farmer: The farmer loves it when the market price of coffee is high. Since his costs to grow and harvest the beans are relatively constant, when the price of coffee is high he makes more profit. On the other hand, if the market price of coffee goes too low, he cannot pay his bills.

The Coffee Shop Chain: The coffee shop chain, on the other hand, has just the opposite incentive. They love it when the price of coffee is low, so they can purchase cheaply and make more profits. However, when the price of coffee is too high, it eats into their profit margin.

Enter the Futures Market: In an effort to find some sort of middle ground, the coffee farmer and the coffee chain come to an agreement that no matter what the market price of coffee does they will transact with each other at an agreed upon price for a certain period of time. In other words, the coffee farmer agrees to sell coffee beans to the coffee chain at a certain price in the “future”. The beans might not even be planted, yet a futures contract has transpired.

What Does This Mean For You?

Just like coffee, energy is a commodity that moves up and down with the market. Like the farmers, generators of electricity like when electricity prices are high, and consumers of electricity like when prices are low. On the energy futures market, these two parties can agree to enter into a futures contract in order to stabilize their costs and revenues for the years to come. When you sell a customer a 36 month electricity contract, the customer is entering into a futures contract with the energy supplier to purchase electricity in the future at a certain price.

How To Sell Energy Futures

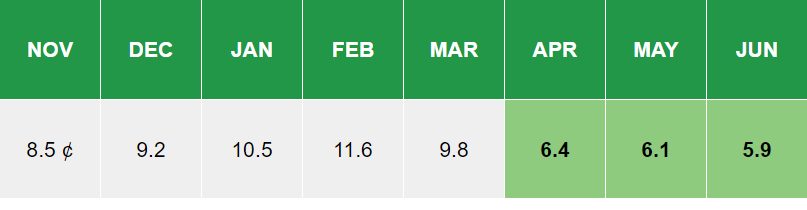

Whenever you sell an electricity contract for a certain term (12 months, 24 months, 36 months), the total price of the contract is the average of all the prices for each month of the contract. For example, a 12 month contract starting in January 2022 is the average of January’s price, February’s price, March’s price, etc. Because each calendar month has a different price, different contract terms and start dates affect the total price of the electricity or natural gas contract. Since most of the recent market volatility is in the immediate short term calendar months (November – March), you could sell a contract to a customer that starts in April or May for a lower price.

Giving your customers the option to buy a future-dated contract to avoid expensive winter months is a great way to act as a true energy advisor and offer them lower rates. Using the example below, you might start a contract in the month of April to avoid the more expensive months (November – March).

Need help structuring a supply contract for one of your customers? Call us today and speak to one of our expert energy pricing advisors!

Discussing Risk/Reward.

If you’re customers do not have a fixed rate contract to carry them through the Winter, discussing risk/reward with them is another prudent action. Many experts are anticipating that energy prices will continue to climb through the colder Winter months. It is important to present the risks of “riding out the Winter” on the utility’s rate compared to locking in a fixed rate that will offer price protection. Both options have risks and rewards. Here are some things to consider when having this discussion with your customers:

- Do you know the local utility price to compare rate? (does not apply to Texas brokers)

- Does the utility price to compare rate have a chance to change mid-Winter?

- How do fixed supplier rates compare to the utility price to compare?

- If the supplier fixed rate is higher, how much more will the customer pay over the utility through the Winter?

- Is the extra cost worth the peace of mind of having a fixed price through the Winter?

- Is the extra cost worth paying for price protection if the utility rate is subject to change with market upswings?

Consider a Hedge Product.

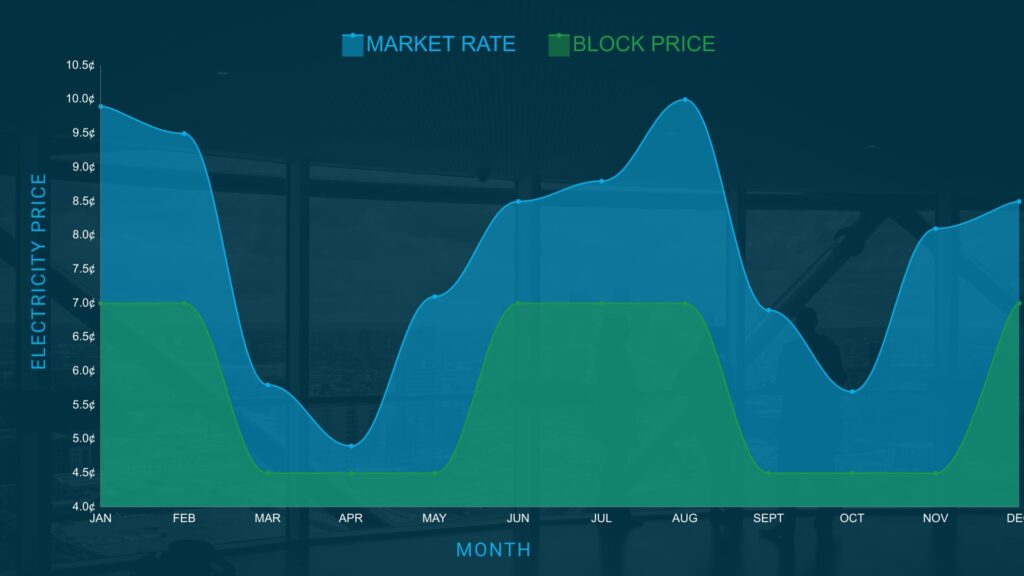

Based on your customer’s risk tolerance, considering a hedge product might be a great alternative to a standard fixed rate. Hedge products allow customers to lock in certain volumes or percentages of their energy usage while floating the open, index market for other volumes. If your customer uses the majority of its power or natural gas during certain times of the day, it might be worth considering locking in those volumes and floating other volumes. If your customer uses lots of power during off-peak hours, it may be worth exploring a product that introduces market exposure during those hours when market volatility is less. A traditional block + index hedge product might look something like this:

If you’re still confused on how a hedge product might work for your customer, do not fret! Our team of seasoned energy pricing analysts can help you prepare and present a proposal. Contact us today to discuss custom energy hedging solutions.

Look For Market Opportunities.

Not all utilities are created equal. If your local utility company’s rate is low than supplier rates due to current market conditions, consider looking to sell in other markets where utility rates are high. Some utility markets in New England have risen considerably and supplier fixed pricing there is very attractive. Not licensed to do business in all deregulated states? Talk to us today about become a sales partner and get instant access to all deregulated markets!

Get Mileage From Your Past Success.

If you’ve been selling energy for the last few years, chances are that you have customers who are currently under low, fixed rate contracts. Now is the perfect time to follow up with these customers to show them how well they are doing. It’s always nice to be the bearer of good news and calculating how much money you are saving them from your fixed rate is a great way to further your relationship. It is also a good time to ask for referrals so you can grow your customer base into the future!