Energy Procurement for Multi-Site Businesses

Managing energy procurement across multiple locations introduces complexity that goes far beyond price. Different utilities, tariffs, contract terms, and regulatory rules can quickly turn energy into an administrative and financial burden. Without a centralized strategy, multi-site businesses often face misaligned contracts, missed market opportunities, and unnecessary exposure to risk. This guide explains how centralized energy procurement helps multi-site organizations streamline contracts, reduce costs, and manage market volatility with a structured, portfolio-level approach.

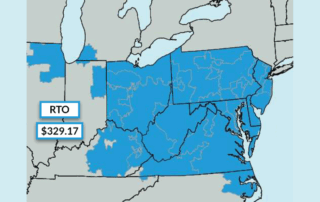

PJM 2026/27 Base Residual Auction Results: Record Capacity Prices in PJM

On July 22, 2025, PJM Interconnection released the results of its 2026/2027 Base Residual Auction (BRA), clearing at a record-high FERC-imposed cap of $329.17 per megawatt-day. This 22% increase from the previous year signifies escalating demand and tightening capacity across PJM's 13-state region, leading to continued elevated electricity prices for industrial and commercial energy users.

How Are Commercial Electricity Rates Determined?

Commercial electricity rates are influenced by a complex interplay of generation, transmission, and capacity costs, alongside local market dynamics. Understanding these key factors and how they are calculated is essential for businesses seeking to manage and reduce their electricity expenses.

Energy Procurement Management: Process, Benefits & Best Practices

Energy procurement management is a strategic process crucial for businesses looking to control energy costs, especially in deregulated energy states. This article will outline the energy procurement management process, highlight best practices, and explain why many businesses trust Diversegy with their procurement plans.

On-Site Power Generation: How Large Energy Users Are Making Their Own Power To Offset Rising Capacity Costs

Rising capacity charges, unpredictable market prices, and mounting sustainability targets are prompting a growing number of businesses to generate their own electricity on-site. This article explores the forces driving adoption, the technologies leading the movement, and how companies are using on-site generation to protect their bottom line.

Natural Gas Futures And Speculation In Energy Markets

Natural gas futures are pivotal in commercial energy retail pricing, particularly in deregulated markets where suppliers offer various fixed-price options. Understanding how speculative trading, hedging, and overall market outlook drive these futures markets is essential for energy buyers to manage cost risk and time supply contracts effectively.