Business Gas & Electricity Comparison

As energy prices continue to rise globally, understanding and managing your energy procurement strategy is more important than ever. Whether you are a large electricity user, natural gas user, or both, this article will help you understand what drives both costs, how to shop for lower-cost energy, and the best ways to develop an effective energy strategy for your business.

On-Site Power Generation: How Large Energy Users Are Making Their Own Power To Offset Rising Capacity Costs

Rising capacity charges, unpredictable market prices, and mounting sustainability targets are prompting a growing number of businesses to generate their own electricity on-site. This article explores the forces driving adoption, the technologies leading the movement, and how companies are using on-site generation to protect their bottom line.

Natural Gas Futures And Speculation In Energy Markets

Natural gas futures are pivotal in commercial energy retail pricing, particularly in deregulated markets where suppliers offer various fixed-price options. Understanding how speculative trading, hedging, and overall market outlook drive these futures markets is essential for energy buyers to manage cost risk and time supply contracts effectively.

Minimum Offer Price Rule (MOPR) And Its Impact On PJM Capacity Market Participants

The Minimum Offer Price Rule (MOPR) is a controversial policy in the PJM capacity market, designed to prevent market manipulation by ensuring state-supported power plants bid at a fair minimum price. Understanding MOPR is crucial for brokers, consultants, and large energy users to navigate procurement strategies and predict capacity costs in this evolving market.

Impact Of Electric Vehicles (EVs) On The Grid

Electric vehicles (EVs) are quickly becoming a cornerstone of consumer transportation in the U.S., with their adoption profoundly reshaping how our electrical grid operates. This article explores how the rise in EV charging demand impacts the electricity market and what consumers can do to mitigate rising costs.

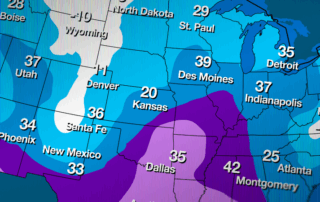

How Weather Affects Energy Markets: Risks, Volatility, and Strategic Planning

In today’s interconnected energy markets, weather is often the main driver of short-term price swings and long-term infrastructure challenges. For commercial energy customers and brokers, understanding this connection is essential to navigating energy procurement and mitigating risk.