Electricity Costs Are Spiking: Here’s How Large Energy Consumers Are Responding

Electricity prices are rising faster than many large energy consumers have ever experienced, driven by structural changes in power and capacity markets. For organizations with significant electricity spend, the challenge is no longer just securing a competitive rate, but managing long-term price risk and budget uncertainty. This guide explains how large energy buyers are responding with structured hedging strategies to control costs, reduce price exposure, and stabilize energy budgets.

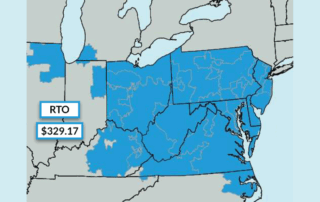

PJM 2026/27 Base Residual Auction Results: Record Capacity Prices in PJM

On July 22, 2025, PJM Interconnection released the results of its 2026/2027 Base Residual Auction (BRA), clearing at a record-high FERC-imposed cap of $329.17 per megawatt-day. This 22% increase from the previous year signifies escalating demand and tightening capacity across PJM's 13-state region, leading to continued elevated electricity prices for industrial and commercial energy users.

On-Site Power Generation: How Large Energy Users Are Making Their Own Power To Offset Rising Capacity Costs

Rising capacity charges, unpredictable market prices, and mounting sustainability targets are prompting a growing number of businesses to generate their own electricity on-site. This article explores the forces driving adoption, the technologies leading the movement, and how companies are using on-site generation to protect their bottom line.

Natural Gas Futures And Speculation In Energy Markets

Natural gas futures are pivotal in commercial energy retail pricing, particularly in deregulated markets where suppliers offer various fixed-price options. Understanding how speculative trading, hedging, and overall market outlook drive these futures markets is essential for energy buyers to manage cost risk and time supply contracts effectively.

Minimum Offer Price Rule (MOPR) And Its Impact On PJM Capacity Market Participants

The Minimum Offer Price Rule (MOPR) is a controversial policy in the PJM capacity market, designed to prevent market manipulation by ensuring state-supported power plants bid at a fair minimum price. Understanding MOPR is crucial for brokers, consultants, and large energy users to navigate procurement strategies and predict capacity costs in this evolving market.

Price Elasticity Of Energy Demand

In deregulated energy markets, understanding how electricity usage changes in response to price shifts can give brokers and businesses a major advantage. By leveraging price elasticity insights, energy buyers can align procurement strategies, manage risk, and uncover new opportunities to reduce costs in volatile market conditions.