So, you might be hearing a lot about deregulated energy and wondering about the difference between energy brokers and energy traders. We understand! The retail energy markets can seem complex and confusing if you are not a professional energy broker or energy trader. In this article, we will outline the key differences between retail energy brokers and energy traders and trading companies.

What Are Energy Brokers & Energy Traders

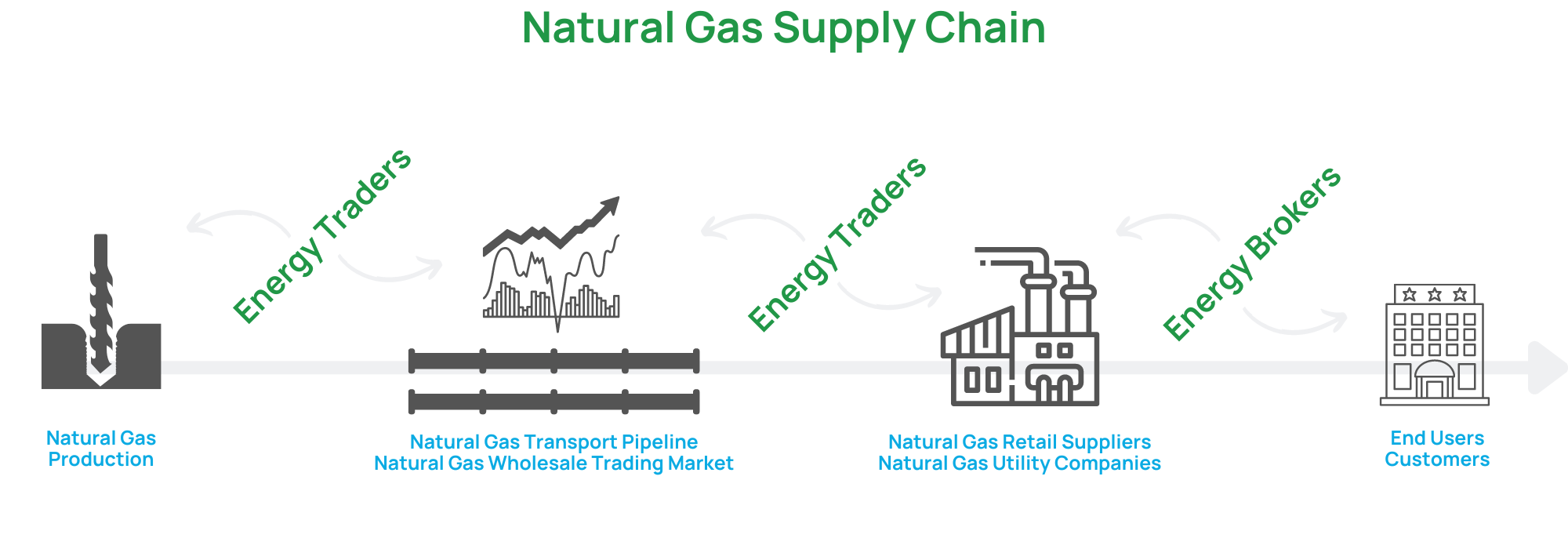

Energy brokers and energy traders are not the same, and in some cases, they do not even operate in the same areas of the energy market. To understand the similarities and differences between these two types of energy players, you need to first understand how they fit into the energy industry.

Energy Brokers

When most people mention energy brokers or energy brokerage companies, they are referring to retail energy brokers operating in deregulated energy states. These companies act as middlemen between retail energy suppliers and customers in those markets. Retail energy brokers bring value to their customers and the supply chain by finding low-cost energy, facilitating the purchase of third-party energy supply, and managing customer energy contract renewals.

An often overlooked energy broker is the wholesale energy broker that helps energy traders, speculators, hedgers, and suppliers purchase energy in the financial markets. Wholesale energy brokers are lesser-known market participants who make money by filling trading orders for wholesale energy suppliers or other companies purchasing energy.

Energy Traders

Energy traders, on the other hand, are quite different from energy brokers. Energy traders are individuals or organizations that purchase energy futures contracts, options, or swaps in the wholesale financial markets in an attempt to turn a profit through market speculation or to help their clients secure wholesale energy supply. In the retail energy market, energy traders play a critical role in helping suppliers purchase energy on behalf of their retail customers. Some retail energy suppliers employ an energy trader or groups of energy traders to help them when purchasing electricity or natural gas futures in the wholesale market. Other smaller energy suppliers get their energy from energy wholesalers, who often have energy traders on staff.

Let’s explore some of the main differences between these two types of energy market participants…

Energy Brokers vs Energy Traders: Differences

Energy Brokers Do Not Purchase Energy

One of the key differentiating factors between brokers and traders is that energy brokers do not actually purchase energy. Energy brokers simply negotiate the purchase of energy supply between their customers and retail energy suppliers. Energy traders, on the other hand, place trades in the wholesale energy markets and make actual purchases using currency. Although, most energy traders do not purchase the physical supply of energy and schedule it for delivery. Rather, energy traders purchase financial contracts that represent an amount of energy. These contracts are usually sold back to the market for a profit or loss based on their value compared to that of the market.

Energy Brokers Operate In The Downstream Retail Markets

Since the energy industry supply chain is quite complex, the various parts of the supply chain have been coined “upstream”, “midstream”, or “downstream”. Upstream markets are closest to the production of electricity or natural gas, and downstream markets are closest to where the energy is being consumed by an end user. Energy brokers operate their businesses downstream. They are involved in helping end users find better prices for energy. Energy traders, on the other hand, can be involved higher “up the stream”.

Energy traders that are speculators do not participate in the retail energy markets whatsoever. Rather, they are simply involved in the buying and selling of energy on a financial exchange in an attempt to make profits. Some energy traders working for energy wholesale suppliers or retail suppliers are involved further downstream and help execute the purchase of energy in the wholesale market. Here is a chart explaining where these two types of energy companies exist in the supply chain:

Energy Market Knowledge

Another key differentiation between energy brokers and energy traders is their knowledge of the energy markets and what drives prices. Although energy brokers have a much deeper understanding of energy prices than laypeople, it is typically not their job to strictly follow the fundamentals of the market minute by minute. Energy brokers follow macro price trends to make recommendations to their customers.

Energy traders, on the other hand, follow the minute-by-minute details of the market. Since traders usually have large bets placed on the directional movement of the energy market, they must closely follow the factors that affect price change and movements. Energy traders are known to have a much deeper understanding of energy prices when compared to retail energy brokers.

The Diversegy Difference

Most energy brokerage companies do not have access to energy traders or trading resources. These brokers make recommendations based on public information that often is published after movements in the market happen. Diversegy, however, through its publicly-traded energy parent company, Genie Energy, has access to a team of energy traders and their insights. Since Genie owns several electricity and natural gas retail energy supply companies, it employs energy traders to help with its purchasing decisions in the wholesale markets. Diversegy’s customers and brokers benefit from having access to this information so they can make more informed decisions. Are you looking for a professional energy broker? Contact us today to learn more about our service offerings.