Site Selection

We tailor our search to sites that meet your needs and can accommodate current and future demand.

Expedited Set-Up

Through our in-house energy experts and real estate partners, we can help you expedite your operation’s setup.

Deregulated Energy

We help you navigate the free-trading energy markets so you can save on your biggest expense – energy.

Additonal Savings

We can implement and manage other savings initiatives, such as demand response energy load curtailment.

How We Help Our Clients Get Up and Running Fast.

Having expert energy advisors in your corner is the difference between profitability and bankruptcy when setting up a bitcoin mining business. Our energy advisors have over 100 years of combined experience in the free-trading and regulated energy markets. We guide our clients in finding low-cost solutions for energy that can help them increase profits. These are the first areas we look at when conducting an initial analysis.

Site Selection

One of the biggest challenges for large mining operations is finding locations with cheap, readily available power. Our site selection process matches locations based on your specific operation’s needs. For example, we can tailor our search based on:

- Grid/Region/State Preferences

- Required Delivery Voltage

- Current and Projected MW Demand

Supply Product Structure

There are an infinite number of electricity supply structures available in deregulated states. And, in regulated states, there are various utility billing schedules available to certain commercial customers. The first step in procuring low-cost electricity for your mining operation is to understand the products that are available to you and to put your business in a winning position from day one. Here are a few examples of what we can offer in deregulated markets:

- Fixed – Locked in price. Great for risk-averse companies looking for a predictable budget.

- Index – This product is great for companies who want the best possible price and are risk-tolerant. With the option of fixing various components in a fixed adder, the overall price adjusts with the real-time or day-ahead markets.

- Block & Index – Best of both worlds, we can lock in hedges to reduce risk while still providing the cost-benefit of an index price.

Load Shedding

Across the country there are load curtailment programs such as demand response, that can help you generate cash for load shedding. These programs can significantly offset electricity costs and crypto mining operations are often ideal participants. Our experts can guide you through various energy efficiency solutions to help generate savings and reduce your total impact on the grid.

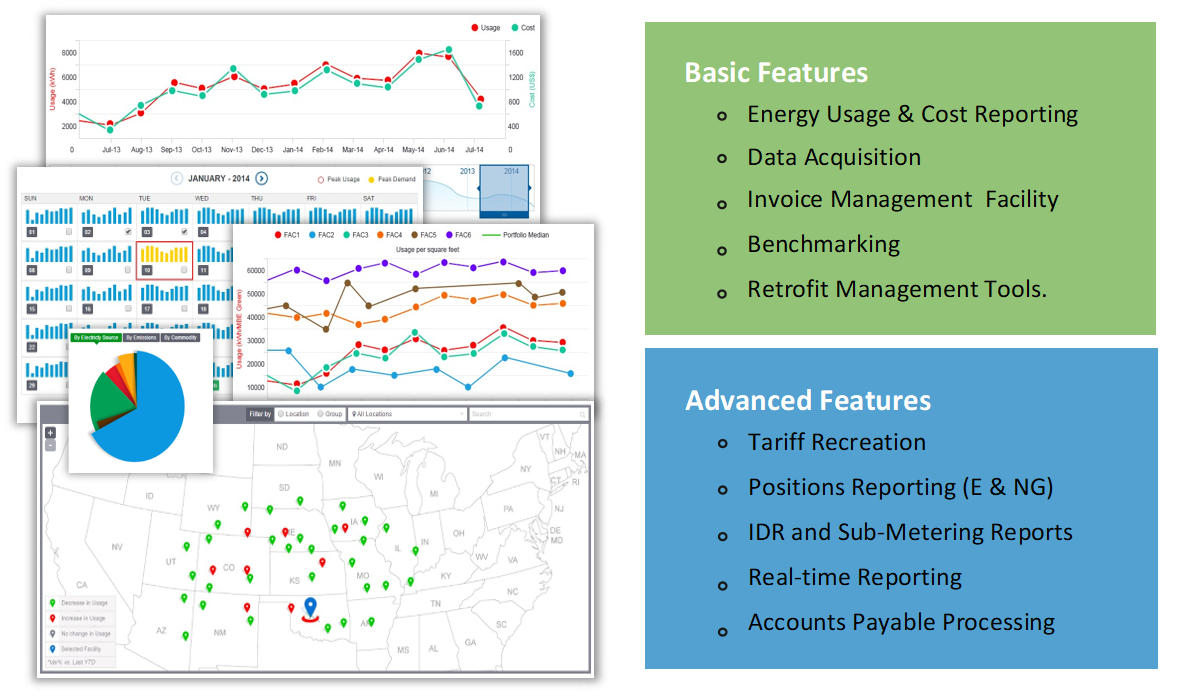

Facility Data Reporting and Transparency

Having data and tools for managing energy and sustainability provides insights to reduce costs.

Diversegy’s Energy Intelligence platform allows users to reduce administrative costs, centralize all bills, benchmark, and powerful reporting analytics. Even receive notifications to help identify inefficiencies and track facility-level usage.

Although several ESCOs offer similar suites of products, our service isn’t affiliated with an ESCO: You can freely run RFPs and change suppliers without concerns of losing access to the service or data.