Why Data Centers Need Specialized Energy Procurement Solutions

With the rise of artificial intelligence, data center development is at an all-time high. Powering these facilities, however, requires a tremendous amount of power, and with rising costs, controlling energy expenses is a significant challenge for operators. New demand from data centers has driven up wholesale power costs across the country, as evidenced by the recent capacity auctions in PJM and MISO, hitting record numbers. To control these costs, data center operators are turning to energy consulting firms, like Diversegy, to develop and implement sophisticated energy procurement strategies and hedging protocols. Securing low electricity prices is paramount for these hyperscale facilities.

Core Data Center Energy Solutions

Energy management, through efficient procurement strategies, is the most direct path to immediate savings. Many data center operators confuse infrastructure optimization, such as cooling hardware, airflow, and energy efficiency, with energy management, which is centered around power sourcing, pricing, and hedging. To properly control costs, operators must match their load profile with the best-fit power products to pay the least per unit of electricity consumed. To succeed in the energy markets, data centers need an effective mix of energy strategies.

1. Procurement

Strategic Energy Procurement.

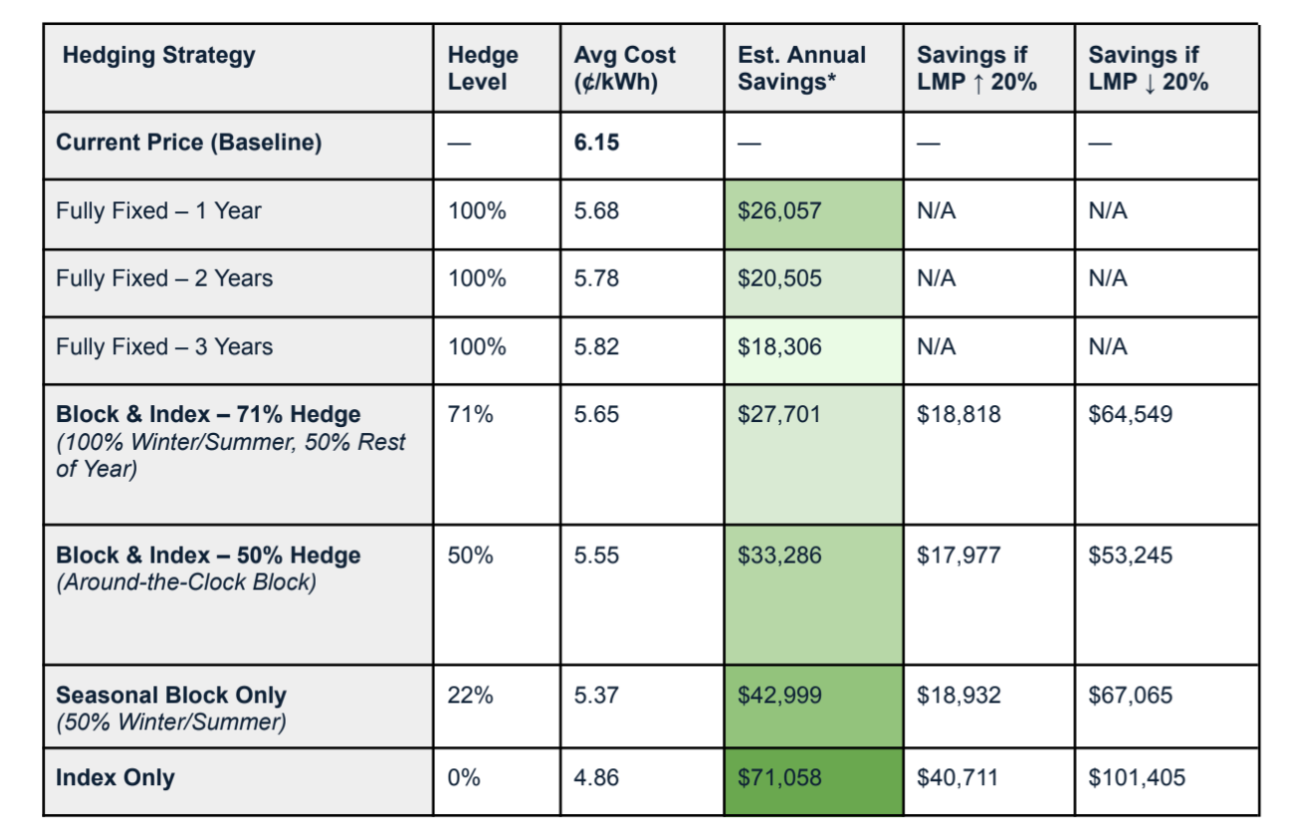

Strategic energy procurement involves modeling several price structures to determine the best-fit product for the data center’s budget goals and risk tolerance. Standard fixed-rate products do not apply to these power loads, as centers will pay a premium for the fixed rate and lose out on wholesale market exposure during low-cost, off-peak hours. Some complex strategies best-fit for data center load include:

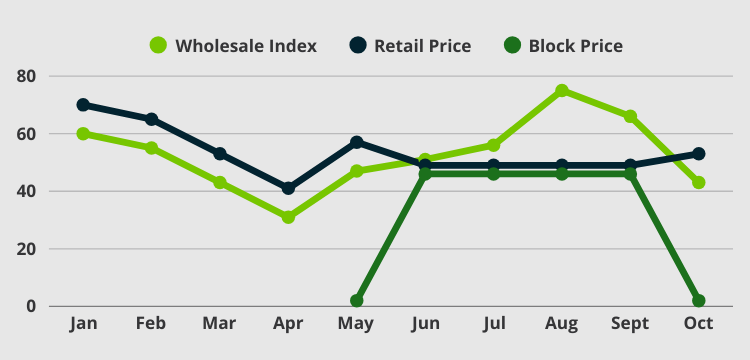

Block + Index Products.

A standard block + index product allows the data center to hedge certain volumes of power during specific time windows. The remaining load floats on the open, wholesale index market.

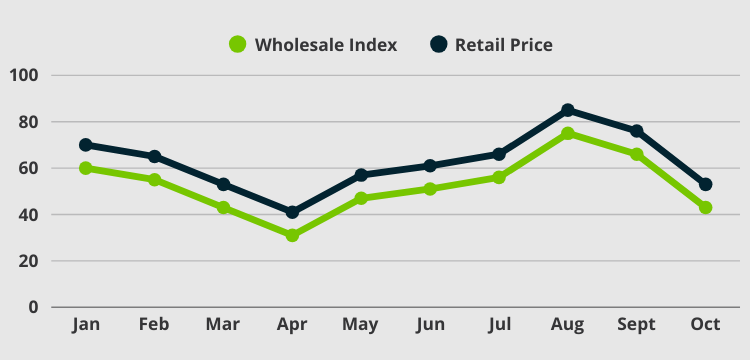

Load-Following Fixed Blocks.

Unlike a traditional block and index product that hedges specific block volumes, regardless of load shape, a load following block allows the data center to hedge matched usage volumes each hour. While most suppliers charge a slight premium for this capability, these load-shaped blocks reduce market risk from overusage during peak hours.

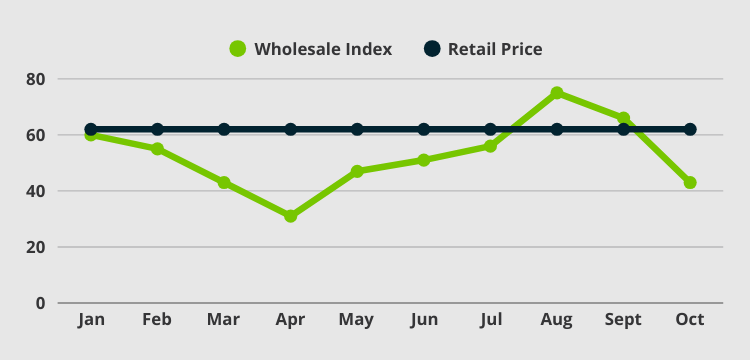

Index-Based Products.

Many large users of electricity elect to purchase power at the spot. Index products give large users direct access to day-ahead and real-time wholesale market prices, where they are charged the wholesale rate for the volumes consumed:

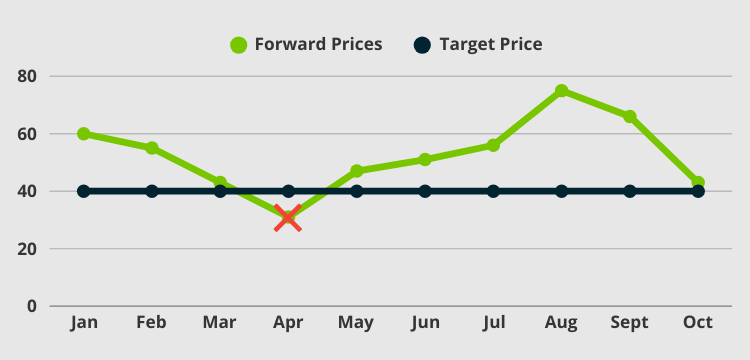

Portfolio Management.

Some electricity suppliers offer portfolio hedging products that allow clients to automatically hedge costs in the futures market when prices meet target prices. These products enable semi-automated hedging in an effort not to miss critical market dips.

2. Legal

Supplier Contract Negotiation.

Another key element to your energy strategy involves access to all retail electric suppliers. While wholesale market prices are consistent across each market, access to forward hedges depends on each supplier’s ability to contract in the futures market. Having access to all licensed suppliers is a key advantage when shopping for electricity. It is prudent to work with an energy brokerage firm that has relationships and access to all suppliers and prices.

Furthermore, the ability to contract in the future with forward-dated contracts is restricted on a supplier-by-supplier basis. Big suppliers with large credit facilities allow customers to contract up to five years in advance, which presents an advantage when prices are favorable. Working with smaller suppliers can put a facility at a disadvantage if they are not able to forward-date contracts past a certain time frame.

3. Physical

On-Site Energy Integration.

Many data centers are turning to on-site power generation as a means of supplementing wholesale market supply. Assets such as solar and natural gas turbines are a great way to generate electricity at the facility and help to offset peak usage and capacity contributions. Understanding how to financially model these assets is critical when determining the best-fit application.

Some data centers turn to virtual PPA models so that these assets do not hit their balance sheet. Furthermore, since all data centers have redundancy risk, many are integrating battery storage solutions as a complement to on-site generation. Batteries can capture excess production from solar arrays that can be used at a later time. Some are even deploying battery assets into the wholesale market when not being utilized to generate additional revenue streams. Battery banks can also substitute expensive fossil-fuel-powered backup generators.

4. Analytics

Load Profile Analysis & Cost Auditing.

To discover the best electricity supply structure for your data center, a deep load analysis must be performed that analyzes the volume of power consumed at each hourly interval. This data can help determine a model that can be regression tested against historical market performance. Furthermore, ongoing audits of monthly bills and product performance must be conducted due to energy market volatility. Unhedged positions can be rolled into fixed blocks when index pricing is high. Volumes that underperform hedges are automatically sold back to the real-time market for on-bill credits.

Data Center Challenges We Solve.

The data center energy team at Diversegy helps our clients solve an array of complex power issues, including:

Capacity Tag Management

Capacity costs are one of the biggest energy expenses for data centers. Measured during peak coincident hours each summer, capacity tags directly impact your annual capacity contribution to the wholesale RTO/ISO. At Diversegy, our team can help you develop strategies to mitigate peak demand risk during coincident hours. Through on-site generation, load shifting, peak shaving, and demand response participation, we help our clients reduce capacity load and save money.

Multi-Site Complexity

For those operators with facilities across multiple utility markets or states, managing energy procurement becomes even more challenging. Wholesale energy prices trade differently in each region based on real-time supply and demand dynamics. Choosing the right supplier for each market becomes critical to your success. Furthermore, understanding local utility tariffs plays an important role in your demand-side distribution costs. Having a firm like Diversegy in your corner, managing the nuances of each market becomes an invaluable resource.

Cost Forecasting

Power costs for data center developers are at the forefront of their plans. Understanding how to properly model and predict accurate electricity costs is a key aspect of development, financing, and planning. Our team has deep experience in building accurate financial models and cost forecasts to help you predict your costs.

Scalability

As your data center starts to scale, it’s important that your energy procurement strategy can keep pace. Structuring contract terms that allow additional usage bandwidth is critical if you plan to grow. Nothing is worse than having to pay prices at the market for additional consumption. An energy contract expert can help you negotiate these custom contract terms to ensure your hedge strategy covers your current and future load.

How Diversegy’s Data Center Energy Process Works.

How Diversegy’s Data Center Energy Process Works.

At Diversegy, we have a specific process for evaluating data center energy load and developing custom energy procurement strategies.

Why Data Centers Choose Diversegy.

Why Data Centers Choose Diversegy.

Data center operators choose to partner with Diversegy due to our deep energy market experience. We specialize in helping hyperscaler data centers in developing effective energy strategies to control costs and manage market risk. In addition to our robust commodity hedging expertise, we help our clients manage capacity tag risk, structure contract terms to meet their growth plans, and vet multiple supplier price offers to obtain the lowest possible prices. If you are developing a data center and looking for energy cost forecasting or are looking to optimize prices at your existing facility, we can help. Contact our team today for a complimentary energy analysis.