On-Site Power Generation: How Large Energy Users Are Making Their Own Power To Offset Rising Capacity Costs

Rising capacity charges, unpredictable market prices, and mounting sustainability targets are prompting a growing number of businesses to generate their own electricity on-site. This article explores the forces driving adoption, the technologies leading the movement, and how companies are using on-site generation to protect their bottom line.

Minimum Offer Price Rule (MOPR) And Its Impact On PJM Capacity Market Participants

The Minimum Offer Price Rule (MOPR) is a controversial policy in the PJM capacity market, designed to prevent market manipulation by ensuring state-supported power plants bid at a fair minimum price. Understanding MOPR is crucial for brokers, consultants, and large energy users to navigate procurement strategies and predict capacity costs in this evolving market.

Impact Of Electric Vehicles (EVs) On The Grid

Electric vehicles (EVs) are quickly becoming a cornerstone of consumer transportation in the U.S., with their adoption profoundly reshaping how our electrical grid operates. This article explores how the rise in EV charging demand impacts the electricity market and what consumers can do to mitigate rising costs.

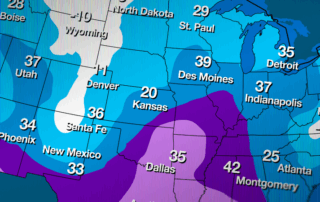

How Weather Affects Energy Markets: Risks, Volatility, and Strategic Planning

In today’s interconnected energy markets, weather is often the main driver of short-term price swings and long-term infrastructure challenges. For commercial energy customers and brokers, understanding this connection is essential to navigating energy procurement and mitigating risk.

Global Energy Supply: Trends Shaping The Future Of Energy Markets

Global energy markets in 2025 are being reshaped by a powerful mix of geopolitical risks, surging demand from AI and electrification, and record renewable growth. For businesses and energy brokers, understanding these supply-side trends is essential to anticipate volatility, control costs, and align procurement strategies with a rapidly evolving market.

Price Elasticity Of Energy Demand

In deregulated energy markets, understanding how electricity usage changes in response to price shifts can give brokers and businesses a major advantage. By leveraging price elasticity insights, energy buyers can align procurement strategies, manage risk, and uncover new opportunities to reduce costs in volatile market conditions.