In today’s interconnected energy markets, weather is often the main driver of short-term price swings and long-term infrastructure challenges. From winter storms freezing gas pipelines and wind turbines to summer heatwaves driving peak demand, extreme conditions can influence supply, demand, and pricing at every layer of the energy supply chain. For commercial energy customers and brokers, these events are forces that can affect contract costs, risk exposure, and energy strategy planning. Understanding the connection between weather and market pricing is essential to navigating energy procurement. This article explores the demand and supply dynamics shaped by weather, real-world examples of its impact, and strategies for mitigating risk in the current market climate.

How Weather Affects Energy Demand

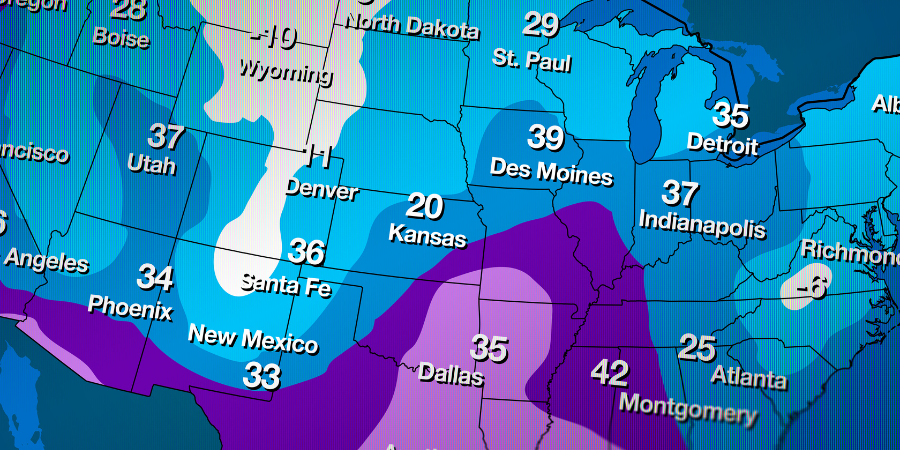

Weather has a direct impact on energy consumption. Extreme temperatures create sudden surges in demand that ripple through the wholesale markets. In the summer, heatwaves drive electricity usage for cooling. In winter, cold snaps push up demand for natural gas, heating oil, and electricity for heat pumps.

Seasonal variations further shape consumption patterns. Longer summer days may slightly reduce lighting needs but increase cooling loads, while darker winter months often mean heavier heating and lighting use. Regional climate factors add another layer of complexity. Humidity, for example, can significantly increase cooling demand in southern states, while in northern regions it can bring cloud cover and lower solar generation.

How Weather Disrupts Supply

While demand surges during extreme weather can stress the electric grid, supply-side disruptions often magnify the problem. Renewable generation is highly weather-dependent. Shifts in wind speed can cause sudden fluctuations in wind power generation. Furthermore, cloudy but hot summer days reduce solar generation while at the same time increasing consumer demand. This intermittency makes forecasting and balancing renewable generation a constant challenge for grid operators.

Fossil fuel supply chains are equally vulnerable to weather. Prolonged freezes can halt natural gas production at wellheads, freeze pipelines, and restrict coal deliveries. In coastal regions, hurricanes can force shutdowns of offshore oil platforms, damage refineries, and interrupt LNG shipping routes. Even moderate storms can down power lines or damage substations, forcing utilities into emergency repairs and load-shedding measures. These disruptions can also tighten supply across regional interconnections, raising prices far beyond the immediate impact zone.

Real-World Examples Of Weather’s Energy Market Impact

Winter Storm Uri in 2021 is perhaps the most striking recent example of extreme weather impacting energy prices. When freezing temperatures swept across Texas and much of the central U.S., natural gas production froze, wind turbines slowed, and coal plants struggled to operate. The result was widespread blackouts, record-setting wholesale power prices (~$9,000 per MWh), and unprecedented financial fallout for market participants.

California’s recurring summer heatwaves offer another similar case study. Prolonged high temperatures push air conditioning use to record levels, testing grid capacity. When demand peaks outpace available generation supply, the state has resorted to rolling blackouts, sending wholesale prices soaring.

In the Gulf of Mexico, hurricanes regularly disrupt oil and gas production, both offshore and onshore. The temporary loss of refining and transport capability can cause short-term fuel shortages and significant price spikes.

Market-Level Consequences

Weather-related disruptions often translate into price volatility across electricity and natural gas markets. When supply and demand shift rapidly, wholesale prices can move sharply within hours, and shorter-term forward prices may adjust in anticipation of upcoming weather risks. Because natural gas often fuels electricity generation, spikes in gas prices during cold snaps or heatwaves can drive parallel surges in wholesale power prices.

For energy traders, weather is a core data input in modeling future price movement, and forward curves often shift days or weeks ahead of a forecasted event. For brokers and consumers, this means that extreme weather can affect the cost of future contracts as markets price in risk.

Mitigation Strategies

The unpredictability of weather makes proactive planning essential. There are several strategies being utilized by large energy consumers and brokers alike.

Advanced Weather Forecasting

Utilizing real-time market monitoring tools, brokers and energy managers can anticipate demand surges and supply constraints before they hit. Pairing these insights with flexible procurement strategies, such as layered hedging or off-peak index contracts, can reduce exposure to peak pricing.

Load Shifting

Load shifting and peak shaving are valuable tools for businesses to reduce demand during grid stress events. For those participating in demand response programs, this can often mean earning incentive payments in the process. Encouraging participation in time-of-use rates or peak-shaving strategies can help smooth out demand curves and protect against the high-priced periods.

Energy Storage

Storage also plays a critical role in weather resilience. Using battery storage to keep operations stable during grid disruptions can be vital for critical facilities such as data centers and hospitals. Most importantly, brokers can help clients prepare seasonal energy procurement strategies that outline specific actions for high-risk weather periods. These plans can include backup generation, storage integration, or simply a plan to ensure they respond quickly and strategically when market conditions shift.

Need Help Navigating The Weather?

Weather will always be a variable in energy markets, but its influence is growing as extreme events become more frequent and impactful. For commercial energy buyers and brokers, the challenge is not to eliminate weather risk, but to understand it, plan for it, and respond with strategies that protect budgets. At Diversegy, we partner with our clients to navigate this complex landscape, helping them anticipate weather-related challenges, seize market price opportunities, and maintain stability in an increasingly unpredictable market. Contact us today to start planning your energy strategy.