The wholesale electricity market is where power is bought and sold in bulk, between generators, market operators, utilities, and retail energy providers, before it ever reaches homes and businesses. It’s a dynamic, competitive marketplace that plays a central role in determining the price and availability of electricity across the country. For energy brokers, large commercial users, and retail suppliers, understanding how the wholesale power market works isn’t just helpful, it’s essential. Knowing how prices are set, how power is traded, and who the key players are can unlock smarter energy strategies, better contracts, and bigger cost savings. In this guide, we’ll break down the wholesale electricity market in clear terms, so you can make more informed energy decisions for your business or clients.

What Is The Wholesale Electricity Market?

The wholesale electricity market is the backbone of the U.S. power system, enabling the buying and selling of electricity between large-scale generators and entities that resell power to end-users, such as utilities and retail energy suppliers. These markets are vital for maintaining grid reliability, managing supply and demand, and setting transparent price signals for electricity across different regions.

A Brief History Of Wholesale Electricity Markets In The U.S.

The foundation for today’s wholesale electricity markets was laid in the early 90s. In 1992, Congress passed the National Energy Policy Act, which opened the door to competition by creating the concept of Exempt Wholesale Generators (EWGs). These entities were allowed to sell power into the grid without being subject to traditional centralized utility regulations. A few years later, in 1996, the Federal Energy Regulatory Commission (FERC) issued Order 888, a landmark ruling that required utilities to provide non-discriminatory access to their transmission systems for all wholesale electricity market participants. Prior to this, generation and transmission were vertically integrated, with utility monopolies controlling both. FERC Order 888 marked a major shift by unbundling transmission from generation and allowing broader participation in energy markets. Around this time, several states began to explore energy deregulation at the retail level as well.

Key Players In The Wholesale Market

Several market stakeholders play critical roles in wholesale electricity markets:

- Power Generators: These companies operate generating facilities, such as nuclear, coal, natural gas, wind, solar, and more, that produce electricity. Generators are the first step of the wholesale electricity supply chain.

- Transmission Owners: These entities own and maintain the high-voltage transmission lines that carry electricity from power plants to substations and local utilities. While they do not typically buy or sell electricity, they play a central role in ensuring the safe and reliable transport of power across long distances. In many cases, they receive regulated returns on capital investments approved by FERC.

- RTOs/ISOs: These entities manage regional transmission systems, oversee energy, ancillary, and capacity market operations, and facilitate the buying and selling of energy at the wholesale level.

- Energy Traders: Both physical and financial traders participate in markets to hedge risk, manage asset portfolios, and speculate on price movements.

- Retail Energy Suppliers: In deregulated states, these companies buy power in the wholesale market and sell it to end-use customers through fixed, index, or hybrid contracts. Retail suppliers can also act as intermediaries between wholesale markets and utilities.

Here is a high-level overview of the electricity supply chain from the generation station to the end user:

Power Generation

Electricity is generated through coal, nuclear, natural gas, wind, solar and other generation sources. Generation owners are responsible for supply electricity into the transmission network and wholesale markets.

Transmission Grid

High-powered transmission lines (“the grid”) carry electricity from the power plant to the local utilities. ISOs and RTOs operate these transmission networks and markets to ensure a reliable power supply to end users.

Utilities & Suppliers

Utility companies and electric suppliers purchase power from the wholesale markets and resell it to end-users. Utilities maintain local distribution lines that ultimately deliver power to their end use customers.

Customers

Electricity is then delivered and purchased by end-users for use in factories, restaurants, and homes. Customers are typically billed by utilities regardless of whether they purchase power from a third party.

Physical vs. Financial Wholesale Markets

Wholesale energy markets can be thought of as two distinct markets when it comes to the buying and selling of power:

Physical Electricity Markets

The physical electricity markets involve the actual generation and transmission of electricity from generators to the grid. RTOs and ISOs in these markets are tasked with balancing real-time and day-ahead supply and demand, making markets through an auction-based model. Since electricity cannot be stored in bulk efficiently, these markets are instant and ever-volatile.

Financial Power Markets

Financial electricity markets include forward contracts, swaps, and futures contracts that allow participants to hedge against price volatility or speculate on future price movements, with or without involving physical delivery. Retail energy suppliers and their wholesale trading partners often engage in these markets in an effort to offer fixed pricing to customers outside of physical real-time or day-ahead hourly rates.

The Importance Of Wholesale Markets In Deregulated States

In deregulated energy markets, wholesale electricity trading is central to their operation. Retail energy suppliers rely on these markets to procure power competitively and offer customized pricing to commercial and industrial customers. Generating asset owners in these markets also benefit from the flexibility of various off-takers and price mechanisms. These dynamics allow generators to revenue stack through physical, financial, ancillary services, and capacity markets. The efficiency and transparency of wholesale markets are what make retail choice possible, allowing customers and suppliers to benefit from price competition and innovative energy solutions.

Retail vs. Wholesale Electricity Prices

Electricity prices at the retail level are fundamentally derived from wholesale market rates, but they include several layers of markup, fees, and risk premiums from suppliers. While wholesale electricity is priced based on real-time market dynamics, such as supply, demand, and congestion, retail electricity reflects a packaged product tailored for end-users.

Wholesale prices are set in regional electricity markets through an auction and clearing system and fluctuate hourly. Prices are determined by the marginal cost of the last generator dispatched in that hour to meet demand. Wholesale buyers, such as utilities and retail suppliers, purchase power at this rate.

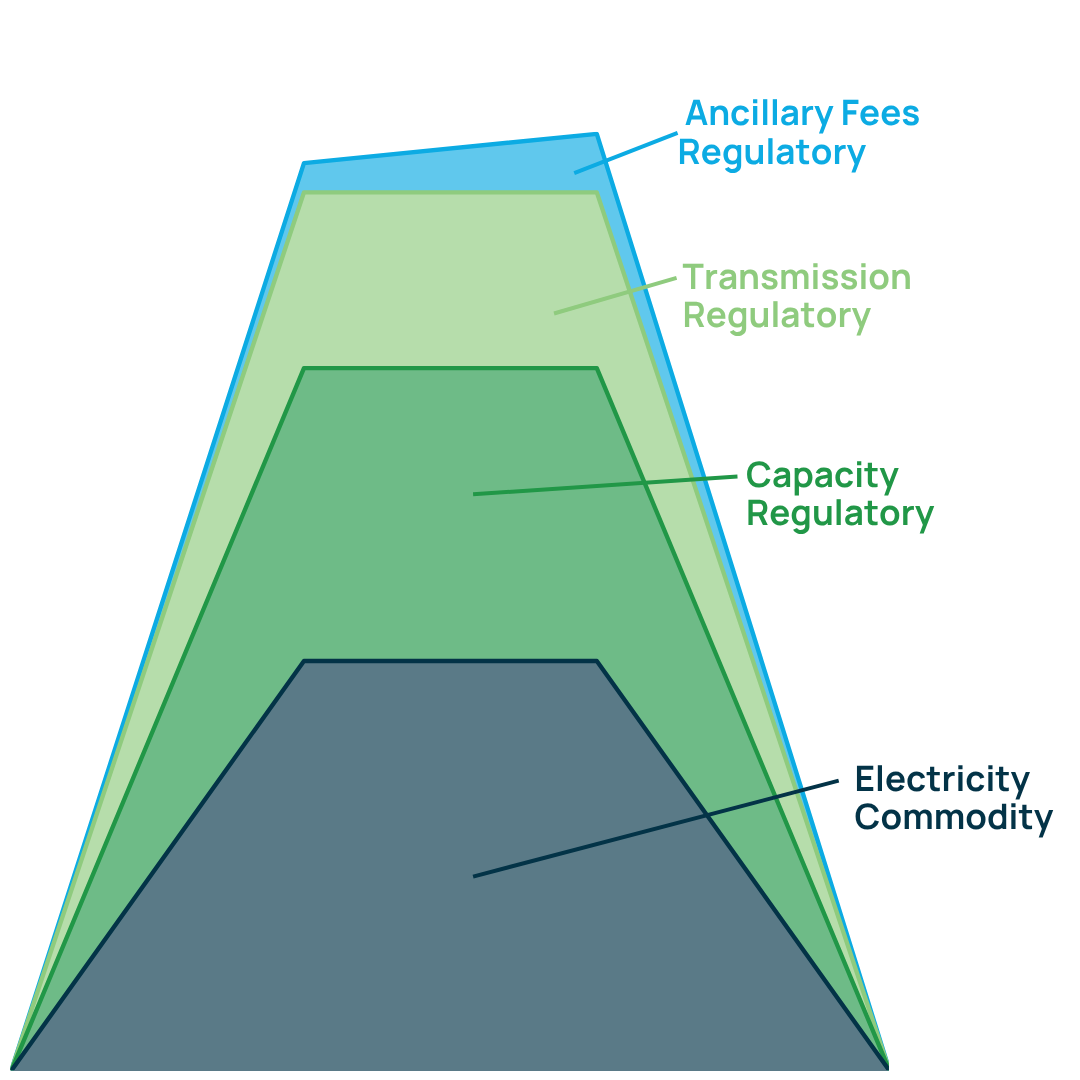

Retail prices are what end-users, like homes and businesses, actually pay. These rates incorporate:

- Wholesale energy costs (hourly or fixed)

- Transmission charges

- Capacity and ancillary service fees

- Risk premiums (to protect suppliers from volatility)

- Utility delivery fees

- Administrative and customer service fees

- Supplier profit margin

Example Retail Electricity Rate:

This chart above illustrates how the final price paid by a consumer is nearly double the raw wholesale cost, due to the layered structure of the retail market. Understanding this flow is essential for businesses looking to lower energy costs through direct wholesale access, strategic energy procurement, or energy consulting services.

ISOs & RTOs

Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs) are nonprofit entities responsible for coordinating, controlling, and monitoring intra-state and inter-state electricity grids. Their primary mandate is to ensure the reliable delivery of electricity across vast geographic areas while also maintaining fair, transparent, and competitive wholesale power markets. ISOs and RTOs operate the grid independently of utilities and generation companies, providing equal access to the transmission system and helping to manage congestion, dispatch generation, and balance real-time supply and demand. Some examples of Major ISOs and RTOs include:

- PJM Interconnection: Covers 13 states in the Mid-Atlantic and parts of the Midwest.

- ERCOT: Manages most of the electric grid in Texas and operates as an ISO but with unique regulatory independence.

- CAISO: Oversees California’s grid and is a leader in integrating renewable energy sources.

Energy Markets In ISO/RTO Systems

Wholesale electricity markets operated by ISOs and RTOs include two major markets: Day-Ahead and Real-Time.

In the Day-Ahead Markets (DAM), participants submit bids to buy and sell electricity for delivery the next day. Prices are locked in 24 hours in advance, allowing for better planning and price certainty. These markets operate in 24-hour increments, and prices are driven by forecasted demand and available generation for each hour.

The Real-Time Markets (RTM), on the other hand, balance supply and demand on a five-minute to hourly basis, based on actual grid conditions. Prices can fluctuate significantly, especially during peak demand or unforeseen outages.

RTOs and ISOs oversee both of these energy markets in an effort to ensure demand is always met. What is not used in the DAM is sold in the RTM. If not enough power is scheduled in the DAM, it is then procured in the RTM. This dual-pricing system allows peaker plants to get additional compensation for meeting demand spikes in real-time, and ensures a fair wholesale market for all participants.

What Is Locational Marginal Pricing (LMP)?

Locational Marginal Pricing (LMP) is the pricing mechanism used by most RTOs and ISOs to determine the cost of delivering electricity to specific locations, or “nodes”, on the grid. It reflects the true cost of delivering the next megawatt of electricity, factoring in real-time supply and demand as well as grid limitations. The LMP typically represents the DAM price at each node. Here is an example of our an LMP is calculated:

- LMP = Energy Price + Congestion Cost + Line Losses

- Energy Price: The base cost to generate electricity.

- Congestion: Added cost when transmission lines are constrained and higher-cost power must be used locally.

- Losses: Power is lost as it travels through transmission lines, increasing delivery costs over longer distances.

Example: If the base energy price is $50/MWh:

- Node A (near low-cost generator): LMP = $50/MWh

- Node B (congested area far from generation): LMP = $90/MWh (includes $30 in congestion and $10 in losses)

This pricing structure ensures that market signals are location-specific, incentivizing investment in generation and transmission where it’s needed most.

Capacity & Ancillary Services

Capacity markets and ancillary services are additional markets operated by RTs and ISOs to ensure long-term grid reliability. Unlike energy markets, which focus on immediate electricity generation, capacity and ancillary markets secure commitments to have resources available when needed.

- Capacity Auctions: Ensure that enough generation is available to meet future peak demand. Generators and even large end-users participate to receive payments for maintaining availability during future system peaks.

- Ancillary Services: Include frequency regulation, spinning reserves, and voltage control services that support grid stability and help maintain the balance between supply and demand on a second-to-second basis.

Understanding and participating in these markets (either directly or through a retail supplier) can unlock new revenue streams, hedge risk, and reduce energy costs, especially for those with flexible load, storage assets, or on-site generation.

Today, battery storage energy systems (BESS) are playing critical roles at the wholesale energy market level in supporting ancillary services and capacity markets. Since these resources can quickly respond to market signals by accepting energy or discharging, they can flexibly meet grid needs in real-time, and are paid handsomely for doing so.

How To Buy Wholesale Electricity

Can a business buy electricity directly from the grid?

If you are a large consumer of power and you are interested in buying wholesale electricity for your business or organization, you have two options.

Retail Supplier Products

Although not a true wholesale product, many retail suppliers have programs in place that allow large customers to utilize their licenses in order to gain access to the wholesale electricity markets. Some suppliers offer hybrid energy products too, such as block + index, power products that mimic wholesale prices.

Register As A Load Serving Entity

The only true way to purchase wholesale electricity as an end user is to register as a load-serving entity with the electric grid. Becoming an LSE is the same process that retail electricity suppliers go through in order to access the wholesale markets. Consumers that become LSEs are, in essence, becoming electric suppliers in order to supply themselves.

This is a large undertaking and requires a lot of financial investment and energy market knowledge. However, some of the largest consumers of power in the country are LSEs and are able to pay wholesale for electricity.

Why Understanding The Wholesale Power Market Matters

Understanding how the wholesale energy market operates gives large energy users a strategic edge when it comes to energy procurement, cost control, and long-term risk management. By learning how prices are set, who the key players are, and how power is bought and sold, businesses can better align their purchasing strategy with market conditions.

At Diversegy, we help commercial and industrial clients take advantage of wholesale energy market insights, without having to navigate the complexity alone. Whether you’re exploring a hybrid procurement approach, interested in direct market access, or simply want better pricing, our team can guide you every step of the way. Contact us today to discover how we can support your business with smarter energy solutions.