Electricity Costs Are Spiking: Here’s How Large Energy Consumers Are Responding

Electricity prices are rising faster than many large energy consumers have ever experienced, driven by structural changes in power and capacity markets. For organizations with significant electricity spend, the challenge is no longer just securing a competitive rate, but managing long-term price risk and budget uncertainty. This guide explains how large energy buyers are responding with structured hedging strategies to control costs, reduce price exposure, and stabilize energy budgets.

Battery Energy Storage Systems (BESS): Smarter Commercial Energy Management

Battery Energy Storage Systems (BESS) are rapidly becoming a cornerstone of smarter commercial energy management as businesses face rising electricity costs, demand charges, and grid volatility. From peak shaving and backup power to demand response and wholesale market participation, BESS allows commercial and industrial facilities to actively control energy costs while improving resilience and flexibility.

Energy Procurement for Multi-Site Businesses

Managing energy procurement across multiple locations introduces complexity that goes far beyond price. Different utilities, tariffs, contract terms, and regulatory rules can quickly turn energy into an administrative and financial burden. Without a centralized strategy, multi-site businesses often face misaligned contracts, missed market opportunities, and unnecessary exposure to risk. This guide explains how centralized energy procurement helps multi-site organizations streamline contracts, reduce costs, and manage market volatility with a structured, portfolio-level approach.

Commercial Energy Storage Systems

Commercial energy storage systems are becoming a game changer, offering new possibilities for efficiency and sustainability. This article delves into the cutting-edge advancements in commercial energy storage, examining how they are revolutionizing the way businesses store and manage power.

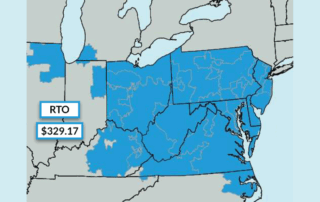

PJM 2026/27 Base Residual Auction Results: Record Capacity Prices in PJM

On July 22, 2025, PJM Interconnection released the results of its 2026/2027 Base Residual Auction (BRA), clearing at a record-high FERC-imposed cap of $329.17 per megawatt-day. This 22% increase from the previous year signifies escalating demand and tightening capacity across PJM's 13-state region, leading to continued elevated electricity prices for industrial and commercial energy users.

How Are Commercial Electricity Rates Determined?

Commercial electricity rates are influenced by a complex interplay of generation, transmission, and capacity costs, alongside local market dynamics. Understanding these key factors and how they are calculated is essential for businesses seeking to manage and reduce their electricity expenses.