Electricity prices across the U.S. are rising at a pace many commercial and industrial energy consumers haven’t experienced before. What once felt like manageable, predictable increases are now showing up as sharp jumps in monthly bills, budget constraints, and unexpected exposure to market volatility. For many organizations, these higher costs are not the result of increased usage, but structural changes in the energy markets themselves.

The challenge isn’t just higher prices; it’s uncertainty and the lack of market knowledge to combat rising costs. Without a clear strategy, many customers are left wondering how to regain control.

In this article, we will outline why electricity costs are rising, why traditional energy procurement strategies no longer work, and how to implement a responsible approach to energy purchasing to manage risk and meet budgetary goals.

Why Electricity Prices Are Skyrocketing

At the core of today’s rising electricity costs is a fundamental imbalance between rapidly growing demand and constrained supply. One of the largest drivers is the explosive growth of data centers to support AI and cloud computing. This new demand is significantly increasing peak electricity across the country.

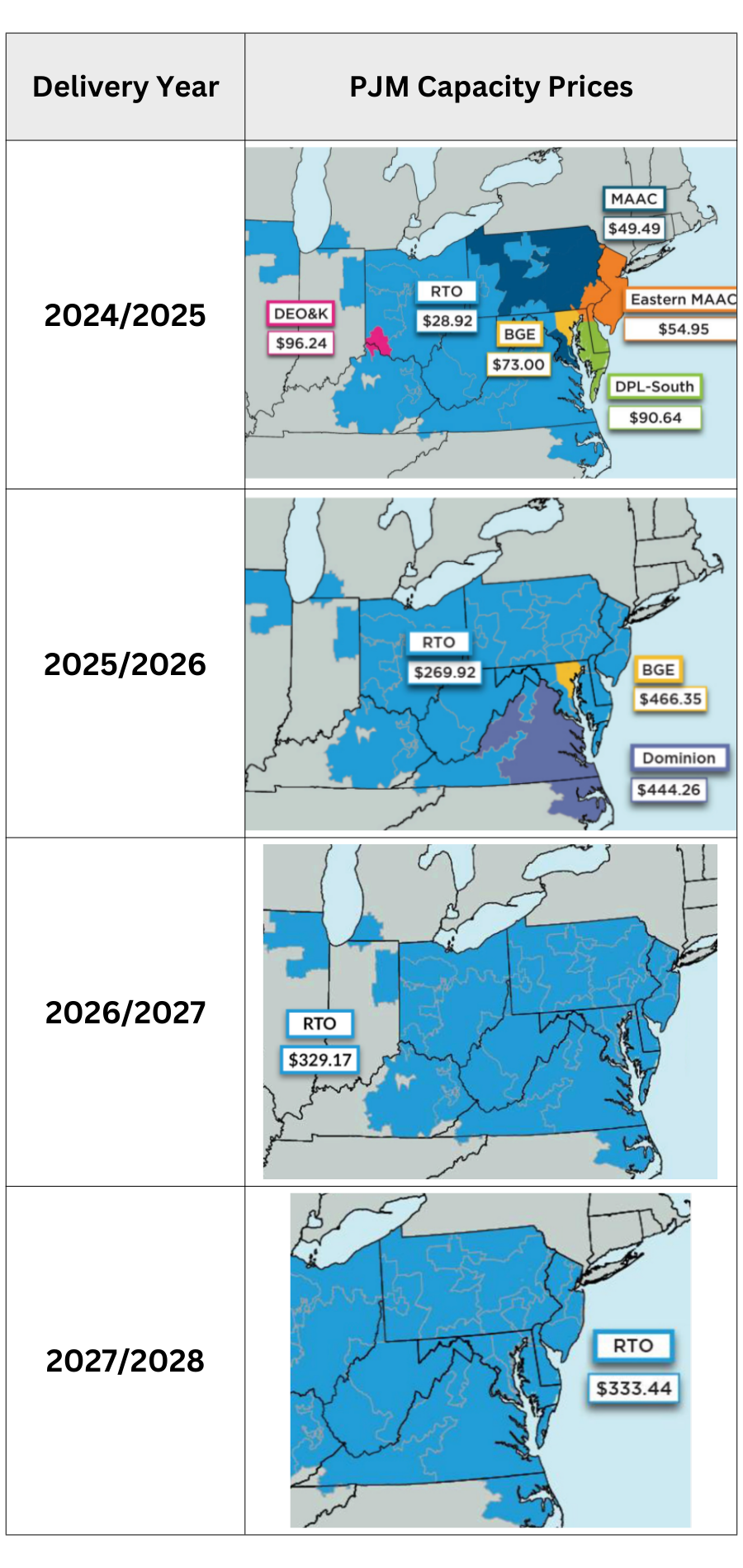

Regional markets like PJM and MISO illustrate this trend clearly. Capacity prices in PJM have reached historic highs due to load growth projections, generator retirements, and reliability concerns. MISO has seen similar cost pressure, with capacity prices surging as reserve margins tighten and new market rules better reflect scarcity risk. These capacity costs are ultimately passed through to end users in their retail electricity prices. And what’s worse, higher electricity supply prices are here for years to come.

Price Impact on Electricity

The chart below illustrates the significant increase in PJM capacity costs since 2024:

When prices spiked from 2024/2025 to 2025/2026, FERC instituted a PJM capacity price cap to protect consumers. All subsequent auctions hit this price cap, indicating that there is a dire need for new electricity generation.

Additional Impact on Natural Gas

At the same time, this demand growth is impacting natural gas markets. Even with natural gas storage levels remaining relatively high, natural gas prices have stayed elevated because gas-fired generation is increasingly relied upon to meet rising power demand. The result is a feedback loop of higher electricity demand, higher gas demand. Volatility is becoming a systemic problem for utilities, energy suppliers, and ratepayers.

How This Impacts Your Commercial Electric Bill

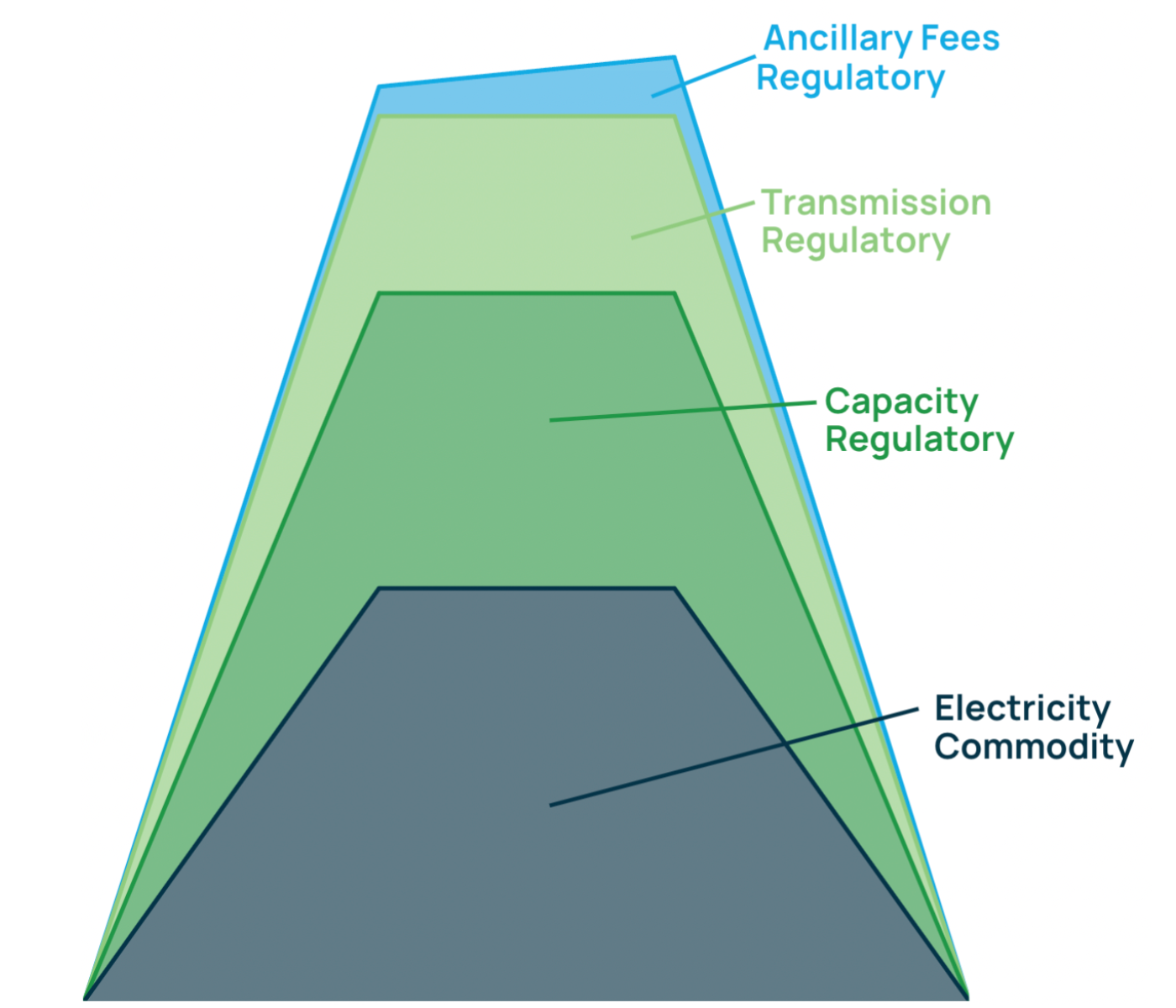

Capacity costs show up directly on your electricity bill. In capacity markets like PJM, NE-ISO, NYSIO, and MISO, capacity prices are determined through annual auctions designed to ensure enough generation is available to meet future peak demand. Those auction results set a capacity price, which is then applied to each customer based on their capacity tag, a measure of peak demand during system peak hours (in the summer months)

Capacity charges typically appear as a separate line item or are embedded within a fully-bundled fixed rate, and they are charged every month, even though the capacity obligation itself is set only once per year. This means a single high-usage hour during a system peak can influence electricity costs for an entire planning year. As capacity prices rise, the financial impact of that one hour becomes significantly larger.

Load Factor

One key metric that influences capacity cost is load factor, which is the ratio of a customer’s capacity tag (peak demand in the summer) to their total annual energy usage. A lower load factor indicates sharp usage spikes during peak hours, making a facility more expensive to serve and driving higher capacity charges and retail rates. A higher load factor reflects more consistent usage and typically results in lower effective capacity costs on a per-unit basis.

The rate chart below illustrates how capacity costs make up a portion of your total supply price:

Ways to Reduce Capacity Cost Obligations

There are practical ways to reduce capacity exposure during peak summer hours when capacity obligations are set.

- Load Curtailment: Customers can curtail load or shift load during forecasted peak events, moving energy-intensive processes to off-peak hours.

- Peak Shaving: Customers can utilize on-site generation or energy storage to reduce grid demand during peak periods. Even small operational adjustments during critical hours can materially reduce capacity tags and deliver savings that last for years.

- Demand Response: Customers can participate in demand response programs by turning off certain motors during peak events, and even earn revenue for doing so.

Why Traditional Procurement Practices Aren’t Working

For years, many businesses managed energy costs by procuring electricity once every one, two, or three years, often locking in 100% of their volume at a single point in time. When prices were low and stable, this approach worked. It was simple, predictable, and effective.

Today, that same strategy exposes customers to significant risk. Prices are now materially higher than they were just a few years ago, and locking all volume at once means fully committing to whatever the market happens to be offering at that moment. This “all-in” timing approach amplifies volatility rather than managing it.

Historically, advanced hedging strategies were reserved for the largest energy buyers with in-house trading desks and dedicated risk teams. Mid-sized and even large commercial customers rarely had access to these tools. That dynamic has changed. In today’s market, complex hedging is essential, and it’s now accessible through specialized energy advisors like Diversegy.

Solution: Structured Electricity Hedging Strategies

Leading energy consumers are responding by shifting from reactive procurement to planned, forward-looking hedging strategies. Instead of asking “When does our contract expire?”, they are asking “What should our energy costs look like over the next several years?”

This approach starts with budget planning and price targets. Customers define acceptable price ranges, monitor forward markets, and act deliberately when pricing aligns with their objectives, removing emotion from the decision-making process.

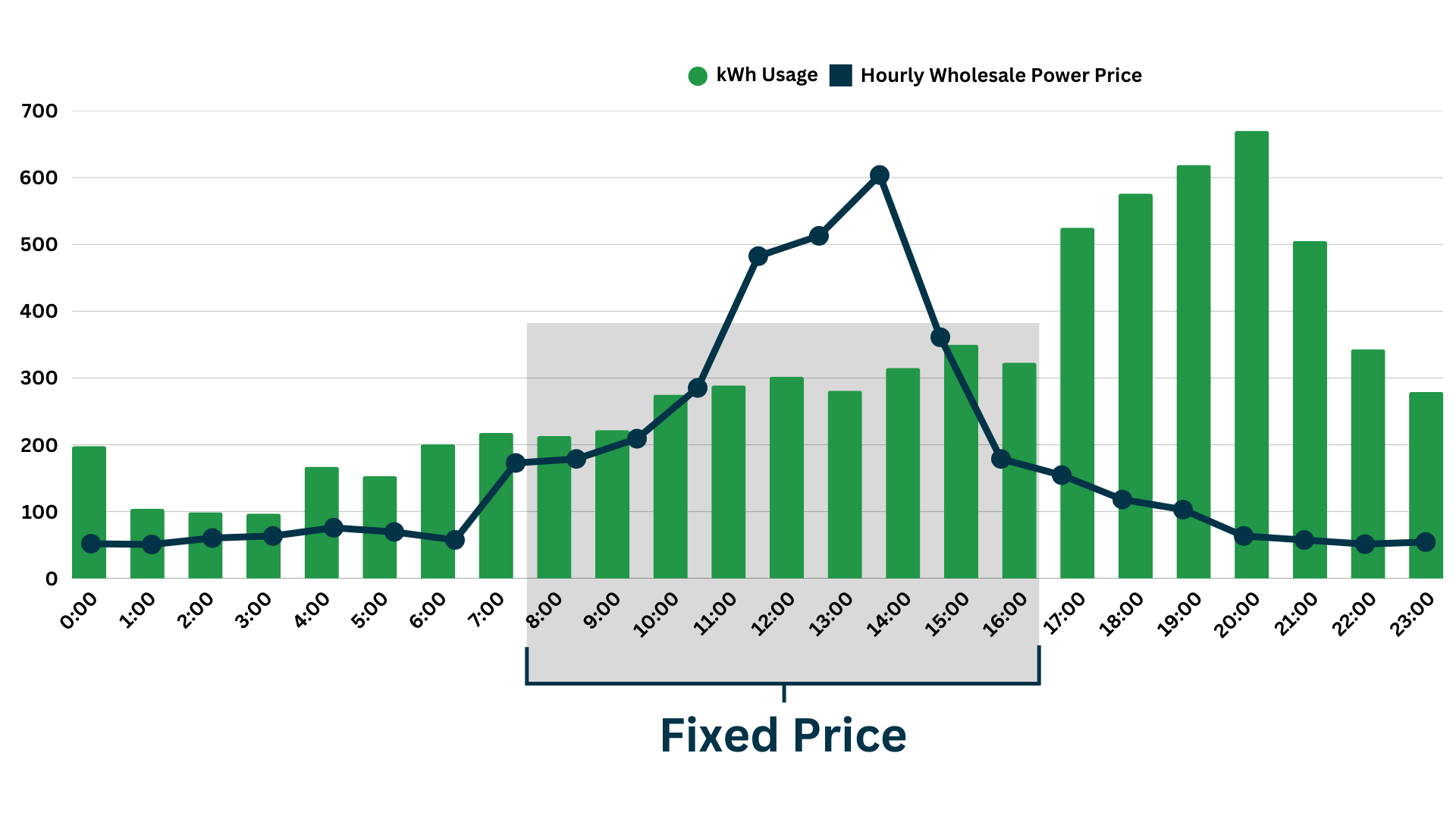

Rather than fixing all volume at once, many customers are layering hedges over time, gradually locking in portions of their load. This dollar-cost-averaging approach reduces timing risk and smooths price exposure to volatile markets. For customers with off-peak or flexible usage profiles, hybrid structures like block-and-index products offer an additional layer of sophistication, allowing portions of usage to be fixed while leaving the remainder indexed to capture market opportunities. This balanced approach blends savings potential with disciplined risk management.

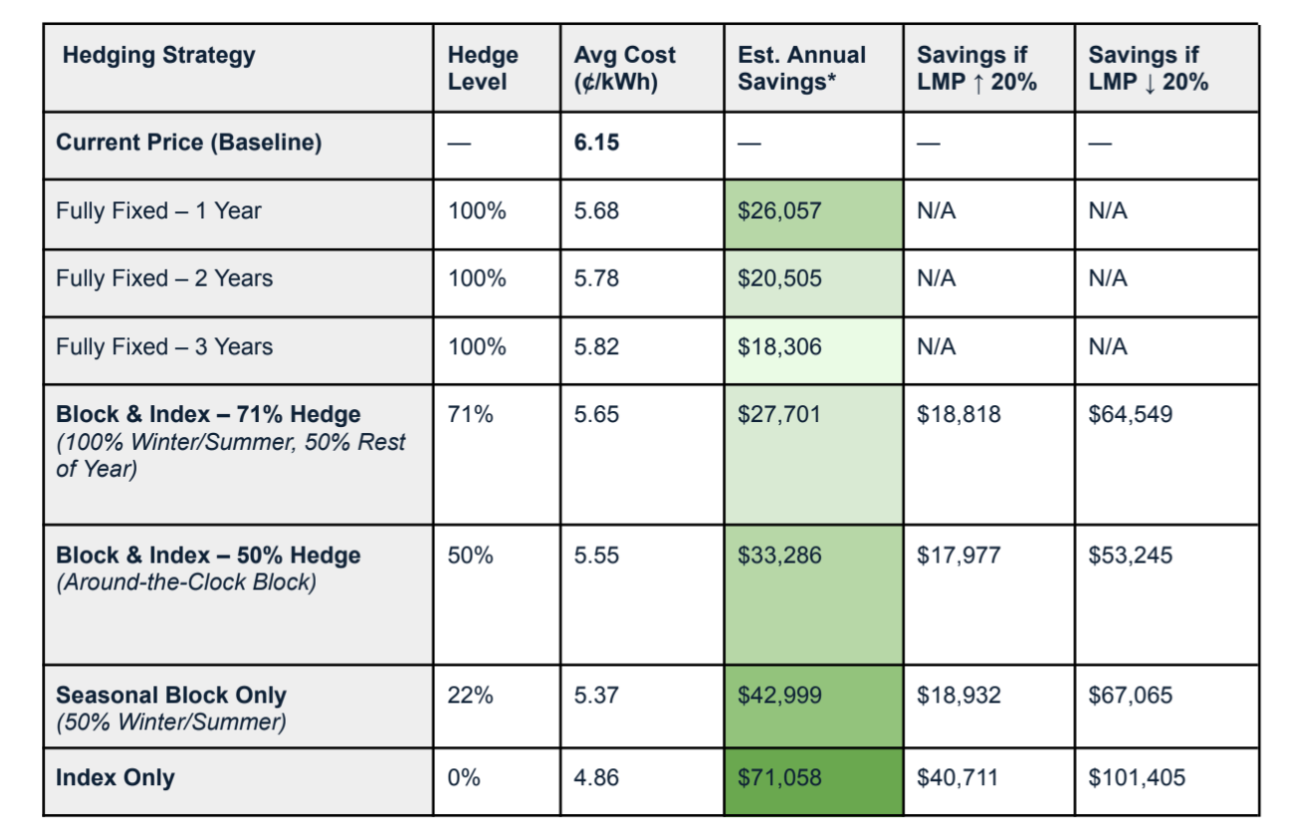

Here’s an example of a block + index hedging strategy in practice:

How Diversegy Executes on These Strategies

Diversegy specializes in bringing institutional-grade energy hedging strategies to commercial and industrial customers through a disciplined, transparent process.

Step 1: Historical Load Analysis

Diversegy begins by analyzing a client’s historical hourly usage and matching it against historical market prices. This allows clients to see how different hedge structures would have performed under real market conditions. By modeling fixed, layered, indexed, and hybrid strategies, clients gain clarity on downside risk, upside potential, and budget exposure. A sample analysis might look something like this:

Step 2: Execution

Once a strategy is defined, Diversegy actively monitors forward energy markets and identifies opportunities to execute layered hedges when prices trade within target ranges. This process is continuous, not reactive. Importantly, clients do not need to wait until their existing contracts expire. Even customers under contract for the next two or three years can begin executing future hedges today. The more time available, the more opportunities exist to manage risk responsibly and methodically.

Step 3: Ongoing Market Monitoring

Most importantly, the strategy is ongoing and evaluated regularly. If prices begin to trend lower, we might adapt the strategy by developing new price targets. Furthermore, once the fixed position is fully hedged, we begin to plan future years to help you achieve budget savings year-over-year.

Take Control of Energy Price Volatility

Electricity costs are rising, and the forces behind them are not temporary. But, higher prices do not have to mean higher risk. The organizations navigating this environment most successfully are those that have moved beyond traditional procurement and adopted structured, forward-looking hedging strategies.

Diversegy helps commercial and industrial energy consumers by combining deep market expertise, advanced analytics, and disciplined execution. In a market defined by volatility, strategy matters more than ever. If your organization is feeling the impact of rising electricity costs, now is the time to rethink how you manage energy risk.

Contact us today for a free evaluation.