In the complex retail and wholesale energy markets, natural gas storage plays a pivotal role in balancing supply and demand in the market. As natural gas consumption fluctuates seasonally and unpredictably, the ability to store surplus gas during low-demand periods and withdraw it during peak demand is crucial for energy price stability. However, the capacity constraints of storage facilities and natural gas pipelines can significantly influence market prices, often leading to market volatility. And because much power generation in the U.S. is predicated on natural gas, electricity prices are also impacted by this dynamic.

This article delves into the complexities of natural gas storage in the United States, exploring how storage can impact market dynamics, price stability, and the broader energy landscape. By understanding these market dynamics, energy consumers can better navigate purchasing decisions for both electricity and natural gas.

The Different Types Of Natural Gas Storage

Natural gas storage is essential for balancing supply and demand in the energy markets. There are different Seasons for storing natural gas, based on periods of high demand and low demand. First, let’s explore how natural gas is stored. There are several types of gas storage facilities, each with its unique characteristics and advantages.

Underground Storage

- Depleted Gas Reservoirs: These are the most common form of natural gas storage. As natural gas is drilled and extracted from the ground, large reservoirs are left empty. These facilities utilize exhausted gas fields that have been converted for storage purposes. They take advantage of the existing geological formations, offering substantial capacity and established infrastructure. This type of storage is very cost-effective and quite popular among natural gas storage companies and producers.

- Aquifers: Aquifers are underground rock formations that contain water, and can be repurposed for natural gas storage. Aquifers make great storage facilities for natural gas provided they are well-sealed and have suitable geological properties. While they offer large storage capacities, the initial setup costs can be high due to the need for extensive geological studies and modifications to the physical structure.

- Salt Caverns: Old salt caverns exist from underground salt formations and are often used to store natural gas. Salt caverns offer high deliverability rates, meaning gas can be injected and withdrawn quickly. However, they generally have smaller storage volumes compared to depleted reservoirs and aquifers. The unique properties of salt, which can self-seal under pressure, make these caverns an ideal choice for high-frequency injection and withdrawal cycles.

Above-Ground LNG Storage:

In LNG (Liquefied Natural Gas) storage facilities, natural gas is cooled and stored as a liquid at very low temperatures (-260°F; -162°C). This process significantly reduces the volume of the gas, making it more efficient for both storage and transportation over long distances. LNG storage is particularly useful for meeting peak demand periods and providing supply to regions without extensive natural gas pipeline infrastructure.

Injection And Withdrawal: Natural Gas Storage Seasons

The natural gas storage cycle is marked by distinct phases of injection and withdrawal seasons, each corresponding to seasonal variations in demand. These two seasons are critical for maintaining a stable and reliable supply of natural gas throughout the year, ensuring that consumption needs are met regardless of fluctuating demand conditions. Let’s explore the different natural gas storage seasons in more detail below.

Injection Season

Injection season is marked by off-peak seasons of spring and summer when natural gas demand is lower, running from April 1 through October 31 of each calendar year. During this period, surplus natural gas is injected into storage facilities or converted into LNG. This process involves compressing the gas and pumping it into underground storage sites, such as depleted reservoirs, aquifers, and salt caverns, or storing it in large LNG tanks. The aim is to accumulate sufficient gas reserves to meet the higher demand anticipated during the colder months. Sometimes natural gas market participants can take advantage of lower prices during this period to purchase and store gas, reselling it later at higher prices.

Withdrawal Season

Withdrawal season occurs during the fall and winter months when natural gas demand peaks, running from November 1 to March 31. During this time, demand typically increases primarily due to rising heating needs. When demand is high, stored gas is withdrawn from storage facilities to supplement the ongoing supply from production fields. The withdrawal process involves reducing the pressure within the storage facility, allowing the gas to flow back into the pipeline system and be delivered to utilities and consumers. This phase is crucial for preventing supply shortages and managing price volatility during periods of high demand.

Seasonal Dynamics, Capacity Constraints, And Market Impact

The cyclical nature of natural gas injection and withdrawal significantly influences natural gas market dynamics, with storage capacity constraints adding another layer of complexity. During the injection phase, the accumulation of gas in storage can lead to a temporary surplus, often stabilizing or reducing prices. However, the extent to which prices are affected depends on the available storage capacity. If storage facilities are nearing their capacity limits, the ability to inject additional gas is constrained, which can prevent prices from dropping as much as they might otherwise.

Conversely, during the withdrawal phase, the reliance on stored gas to meet peak demand can tighten supply and potentially drive up prices. Capacity constraints become particularly evident during extreme weather conditions or unexpected demand spikes. If storage levels are insufficient due to limited capacity, the market may experience sharper price increases as supply struggles to keep up with demand. Market participants closely monitor storage levels and capacity constraints as critical indicators of future price trends and supply security.

The EIA’s Weekly Natural Gas Storage Report

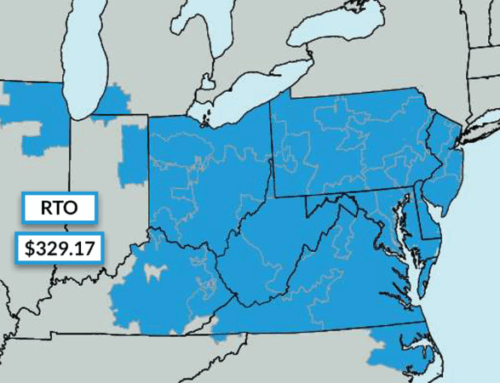

The U.S. Energy Information Administration (EIA) releases a highly anticipated weekly natural gas storage report each Thursday morning, which provides critical insights into the current levels of natural gas held in underground storage facilities across the U.S. This report offers detailed data on the amount of natural gas injected or withdrawn during the previous week, segmented by different regions.

The EIA collects this data through a comprehensive survey of storage operators, who report their inventory levels and changes on a weekly basis. This information is critical for market participants, policymakers, and energy analysts as it helps them gauge gas supply adequacy, anticipate price movements, and make informed decisions regarding energy trading.

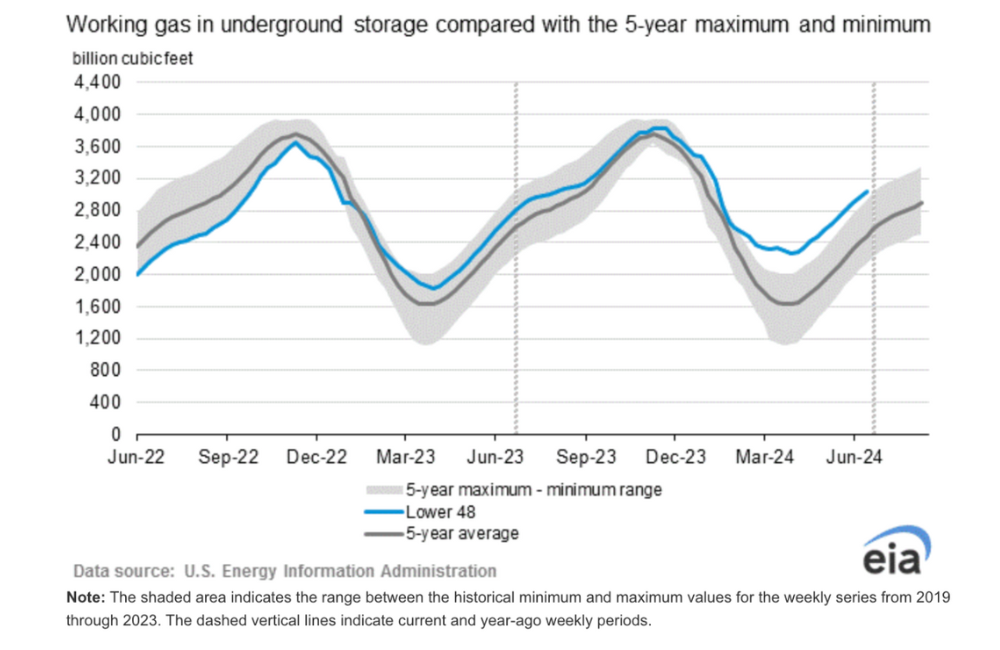

Here is a look at the historical EIA report for the past two years:

Gas Storage Impact On Energy Customers

The natural gas storage report can greatly impact retail energy prices for energy customers. In fact, in certain parts of the United States, nearly 70% of power generation comes from natural gas, so electricity rates also fluctuate according to the price of gas. Typically, when natural gas storage levels are high, prices are low, and consumers enjoy opportunities to execute favorable energy supply contracts. Conversely, when natural gas storage levels are low, prices can rise, negatively impacting energy consumers.

Natural gas storage levels significantly impact spot market prices, but have little effect on futures prices, especially far out the futures curve. So, a negative natural gas storage report might affect short-term energy prices, but could have no impact on longer-term price quotes. It’s best to consult with an experienced energy broker that can navigate you through the complex world of energy pricing and help you choose the best energy supply plan for your business.

Need Help Navigating Gas Prices?

In summary, natural gas storage is a critical component of the energy markets, wholesale and retail energy prices, and overall economic trends. Whether you are a large user of natural gas, a natural gas broker, or simply interested in the natural gas markets, our team can help. We have over 100 years of combined experience analyzing natural gas storage trends and their impact on prices. Contact us today to learn more about the supply and demand dynamics that drive energy prices in the U.S.