At a Glance:

Whether you are a seasoned energy broker sales professional or new to the industry, understanding how to read the driving market fundaments behind electricity and natural gas prices is critical to your success. Energy market knowledge can be a significant differentiating factor when growing your business and book of energy customers since finding the right products for your customers is key. In this article, you will learn how to read market trends and make suggestions to customers in order to generate more sales.

In this article, you will learn:

Market Fundamentals That Drive Energy Prices.

In order to effectively use market intelligence to make recommendations to your customers, you must first understand the major fundamentals that affect energy prices. Considering the fact that the majority of U.S. power is generated with natural gas, the two commodities are closely correlated. When natural gas prices go up, electricity prices go up, and vice versa. With that said, you can simply watch the fundamentals of the natural gas markets in order to understand both commodities. Here are the top 6 fundamentals to watch in order to accurately predict the direction of natural gas prices…

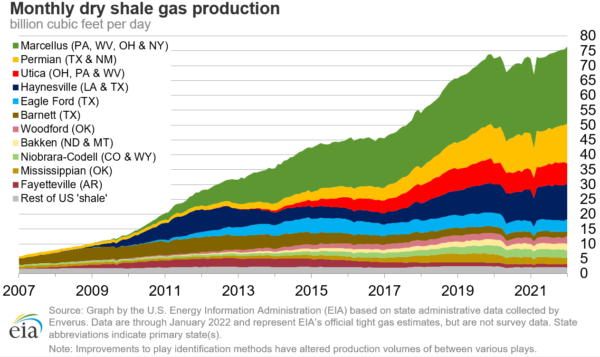

Natural Gas Production

Since natural gas is primarily driven by supply and demand, the first major factor affecting the markets is total natural gas production. In 2010, when large amounts of natural gas were found in the Marcellus Shale area, the U.S. markets enjoyed a decade of low natural gas prices. The excess supply introduced to the market helped depress prices. The chart below from the EIA, shows total natural gas production by region for the last fifteen years.

Natural Gas Storage

Natural gas markets have two seasons: injection season and withdrawal season. Since the majority of natural gas consumption is used in the winter months for heating, natural gas is stored the rest of the year so there is enough supply for the winter. April 1 to October 31 is known as injection season when natural gas is pumped into underground storage facilities, and November 1 to March 31 is know as withdrawal season when most natural gas consumption takes place.

Each week, the total amount of natural gas working storage is reported by the EIA. These storage figures have a direct impact on gas prices. When storage is low, traders believe there is not sufficient supply in the market, and prices rise. On the other hand, when storage is high, there is plenty of supply, and prices usually decline. In the chart below, released on Thursday, March 10, 2022, you will notice that working storage is well below the five-year average and close to the five-year minimum. Natural gas prices have recently increased drastically.

DIVERSEGY PRO TIP: Reading the weekly natural gas storage report from the EIA is a great way to stay informed on week-to-week price changes. The weekly natural gas report can be found by clicking this link.

Natural Gas Import-Export Balance

Another primary factor contributing to total natural gas supply figures is the balance between imports and exports to and from the U.S. Over the last decade, the U.S. became the world’s largest producer and exporter of natural gas. In fact, dry natural gas is often liquified and transported via ship to Europe and Asia where natural gas supplies are relatively non-existent. Increased demand from foreign nations on U.S. natural gas contributes to overall demand and strain on domestic supply.

IN THE NEWS: The current Russia-Ukraine conflict could put a heavy strain on U.S. natural gas exports. Europe gets most of its energy from Russia and will most likely rely more on the U.S. if Russian supply dries out as a result of the war. See more here on the energy impacts of the Russia-Ukraine conflict.

Domestic Economic Growth

When the economy is growing, natural gas and electricity are in heavy demand. Many commercial businesses rely on natural gas, and most certainly electricity, in their day-to-day operations. When new businesses are opening, there is an increased demand for energy. This can cause prices to rise in the short term depending on how much supply is available in the market.

Moreover, many industrial facilities rely on natural gas and electricity in their manufacturing process. When the economy is booming and consumer demand is high for products, there is a great strain on energy supply when producing those goods. A growing economy could also cause energy prices to rise.

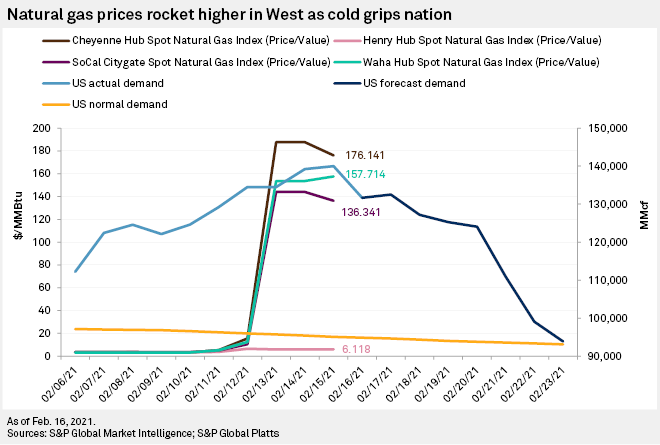

Weather

In the short term, weather is the primary factor that drives demand for gas and electricity. When the weather is cold, people use more natural gas to heat their homes. Furthermore, in the middle of the summer when temperatures are high, electric demand for air conditioning peaks. Below is a chart illustrating the relationship between weather and natural gas prices. In February 2021, Winter Storm Uri brought record cold temps to Texas. The chart below shows the drastic spike in gas prices as the storm descended:

Alternative Fuels

Last but not least, are alternative fuels. Since certain industries, such as manufacturing, industrial and power generation, can switch between fuel sources such as natural gas, coal, and petroleum, when the price of those alternative fuels becomes less expensive they have the option to halt their use of natural gas. On the flip side, when those fuels are high or natural gas prices are low, these facilities turn to natural gas.

DIVERSEGY PRO TIP: After evaluating all of the market-driving factors below, it is best to consider the price of alternative fuels when making conclusions about the future direction of the market. For example, if natural gas production is high, storage is high, weather is mild, and the price of coal is high, it is right to assume that most facilities will rely on nat. gas as a generating fuel. This may or may not drive price considering the amount of supply in the market.

Communicating With Customers.

Communicating facts about the energy markets can be complex and confusing to customers who are not energy industry experts. In fact, it is important to keep in mind that energy is just one line-item expense for most businesses and not always at the forefront of their minds. Always try to keep the information you are presenting short, simple, and to the point. Remember, your energy market knowledge is most likely far advanced when compared to what your customers know and understand.

For example, if you are indicating to a customer that energy prices might be on the rise due to the Russia-Ukraine conflict, you might want to highlight a few bullet points to support your opinion:

- Europe relies on Russia for oil and gas

- Russian energy supply could drop due to the war

- Europe may turn to the U.S. for natural gas

- U.S. exports to Europe will increase demand and prices domestically

Remember, customers, want to know “what’s in it for them”. Some energy professionals make the mistake of going down the technical rabbit hole of trying to explain how fuels are interconnected, or how to read gas inventory levels. It is always best to keep it simple, explain how the facts you are presenting could impact the customer, and the decisions they can make to mitigate risk.

Using Your Energy Market Knowledge To Make Sales.

Understanding the fundamental and technical aspects that drive energy market prices is one thing, knowing how to use that data to earn more income is another. The top energy brokers in the country are able to use their energy market knowledge to help their customers make insightful decisions. Below are some examples of how to use market intelligence to grow your energy broker business:

In A Bear Energy Market

When you see that certain factors are in play that might support a decline in energy prices, this can present a great opportunity for you and your customers. End-use customers are always “short the market” and benefit from lower prices. Here are some tips for motivating customers to execute energy supply contracts in a bear market:

- Present the Data: showing your customers where market prices are trading relative to a longer time frame is a great way to show them the opportunity to lock in a low rate.

- Support Your Argument: In a simple way explain the market factors that support your argument for low prices.

- Discuss Opposing Positions: It is also important to explain the benefits and disadvantages to your customer if your outlook on the market is wrong. This allows your customer to have all the facts before making a decision.

In A Bull Energy Market

When energy prices are rising, there is also a great opportunity to use this data to help better educate your customers. Your long-term outlook on the market will be a critical point to discuss with your customers as rising prices could just be temporary. Here are some things to keep in mind during Bull Markets:

- Short Term vs. Long Term: Try to determine if the increase in prices will sustain for a long time frame or if they are a short-term effect. Customers can outwait shorter runs and might want to consider locking in before a long-term price increase.

- Timing: Did prices just start to rise or have they been rising for months? This can help you and your customers decide when the best time to execute a supply contract and the duration of that agreement.

- Futures: Are future prices trading higher than spot prices or lower? When future prices are trading higher than spot prices, the market is said to be in contango; and, when futures are trading lower than spot prices, the market is said to be in backwardation. When markets are in backwardation, there might be an opportunity for your customer to lock in a price for a future-dated contract.