Natural gas futures play a key role in commercial energy retail pricing, especially in deregulated markets where suppliers offer several different fixed price options. The prices set in these markets directly influence the rates offered by suppliers. Futures markets are driven by speculative trading, hedging, and overall market outlook. For energy buyers, understanding these market forces is essential to managing cost risk and timing supply contracts effectively. In this article, we’ll break down how speculation in natural gas futures works, how it impacts price trends, and what brokers and large energy users can do to turn that knowledge into a competitive advantage.

What Are Natural Gas Futures?

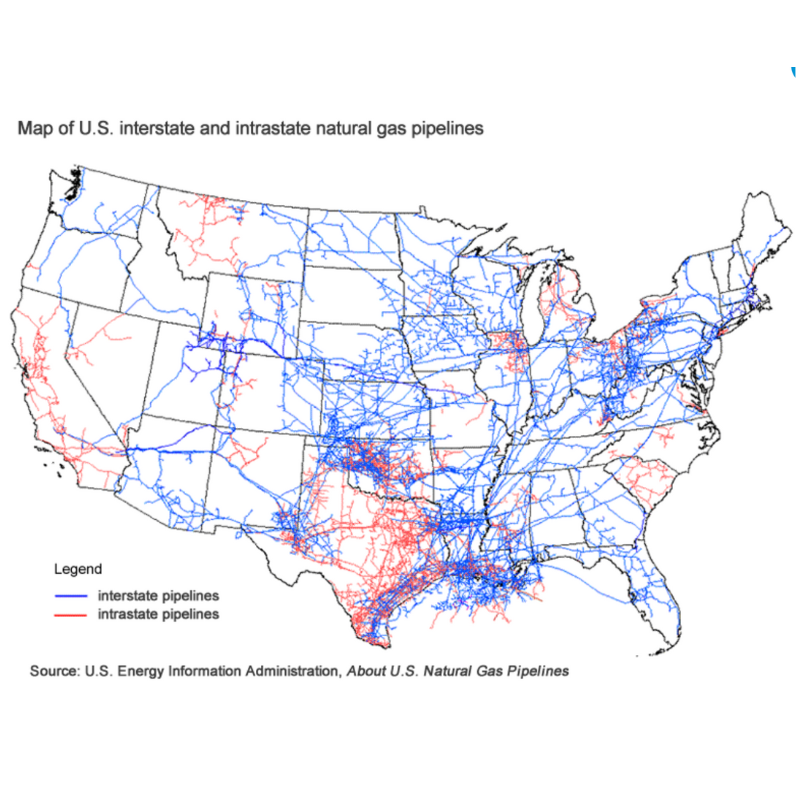

Natural gas futures are financial contracts that trade on the NYMEX exchange and are tied to natural gas prices delivered at the Henry Hub. The Henry Hub, located in Louisiana, is the most liquid physical trading and natural gas delivery point in the U.S. as evidenced by the pipeline map below:

Standard natural gas futures contracts trade in lots of 10,000 MMBtu and contain monthly expiration dates when gas needs to be physically delivered. For example, a December 2025 natural gas futures contract expires in the last remaining days of November 2025. If a holder of a December 2025 contract does not sell the contract on a financial exchange by the expiration date, he or she will need to take physical possession of the underlying gas commodity.

Natural gas futures contracts can be utilized for price hedging or speculation. Hedgers, such as retail natural gas suppliers, can utilize futures contracts to secure wholesale pricing for a specific term. If a supplier agrees to sell gas at $5.00/MMBtu to an industrial plant for the 2026 calendar year, the supplier can purchase a strip of 12 natural gas futures contracts (January – December) in order to hedge against future market volatility.

Natural gas speculators use futures contracts to earn income from price differentials. A gas trader who has a view that prices will rise by the following Winter might go long (or buy) a January 2026 contract at the current value. If the trader’s view is correct and gas prices increase before the contract’s expiration date, he or she can liquidate the contract for a profit. On the other hand, if prices move in the opposite direction, the trader will lose or owe money.

The Role Of Speculation In Natural Gas Markets

Speculators in natural gas futures markets create liquidity by making frequent trades. This constant trading volume allows physical hedgers to purchase and sell contracts without having to find counterparties or assume price risk. This interaction between hedgers and speculators helps to determine fair market prices in the years to come. For example, speculators might look to sell large quantities of gas futures with a view that the future is bearish. Hedgers, on the other hand, cannot afford to take on spot price volatility and purchase these futures contracts. If the market price does indeed fall by these contract expirations, speculators are looking to buy, while hedgers are forced to sell. This dichotomy creates an ideal trading place for all market participants.

Furthermore, natural gas producers utilize the liquid gas futures markets in order to obtain financing for their capital-intensive projects. A gas producer’s costs might be $3.00/MMBtu and need to sell gas from a well at $3.50 in order to turn a fair profit. This producer can utilize futures contracts to lock in that price, no matter where the market moves. In this scenario, the producer might sell (or short) a series of futures contracts at $3.50. By the time of delivery, if the price moves to $3.00, the producer earns a $0.50 profit on the futures trade, while selling the physical gas at cost ($3.00). The producer has hedged its price risk. On the flip side, if the market moves to $4.00, the producer loses $0.50 on the futures short; however, it earns $1.00 on the physical delivery – in essence, locking in its $0.50 margin.

Speculative traders allow these types of trades to happen as natural gas futures are a zero-sum market. Where there is a seller, there must be a buyer. When the producer looks to sell at $3.50, the speculator might buy, thinking there is plenty of upside potential.

Types of Speculative Strategies in Gas Futures Trading

Directional Trading

Directional trading involves taking a long position (buying futures) when expecting prices to rise, or a short position (selling futures) when anticipating a decline.

Bullish speculation can push short-term prices higher as more traders buy into the market. When speculative buying surges, the near-term months may rally faster than the rest of the strip, distorting price curves. On the flip side, when there is a drastic amount of shorting, prices could also fall in a similar fashion.

Spread Trading

Spread trading means buying one futures contract while simultaneously selling another, or vice versa. This allows the trader to profit from the change in price differential rather than the absolute price of a single contract.

In natural gas markets, a winter-summer spread often widens when cold weather forecasts boost expected winter demand. To execute this trade, traders buy winter contracts and sell summer contracts, and benefit when the spread between each contract widens.

Volatility-Based Strategies

Some traders speculate not on the direction of prices, but on the magnitude of price swings. These strategies, often using options to create price collars, generate profits when the market experiences large movements, regardless of whether prices rise or fall.

Sudden weather shifts, extreme cold snaps, hurricanes, or surprise storage reports can trigger sharp price spikes or drops, creating opportunities for volatility-focused traders.

Arbitrage

Arbitrage exploits price discrepancies between related markets. In natural gas, this can include basis arbitrage, or the trading of differences between Henry Hub futures and local gas hub prices.

While arbitrage can narrow regional spreads and align prices across locations, it also creates quick bursts of trading activity when discrepancies appear between regions. For example, a physical gas trader might purchase gas in West Texas at one price, transport it to a different state, and sell it at a higher price. Traders can also accomplish something similar by purchasing transport rights along pipelines that suddenly have increased demand flow.

Market Implications

While speculative strategies add liquidity and price discovery to the gas futures market, they can also amplify short-term volatility. Directional trades may drive temporary price surges or drops, spreads can shift seasonal price relationships, and volatility-based plays can intensify reactions to news or weather events. Even arbitrage, though often stabilizing in the long run, can spark rapid trading activity in the short term. For market participants, understanding these speculative forces is essential for managing risk, interpreting price signals, and planning procurement or hedging strategies effectively.

How Speculation Impacts The Futures Curve

The futures curve is a visual plot showing natural gas prices for delivery in upcoming months and years. It’s a snapshot of how the market values gas at different points in time, often shaped by supply and demand expectations. This curve is significantly influenced by speculative trading.

When speculative buying increases, particularly in contracts further out, the curve can steepen, pushing future prices higher relative to near-term prices. Conversely, heavy speculative selling can flatten the curve or even invert it, with near-term prices exceeding those further out. The relationship between contract months is also described in terms of contango and backwardation:

- Contango occurs when future prices are higher than spot prices.

- Backwardation happens when future prices are lower than spot prices.

If traders bet heavily on a colder-than-average Winter, Winter contract months may surge in price, creating a market in contango. This makes fixed rates for winter delivery more expensive for buyers locking in today. For energy procurement teams, understanding how speculation shapes the curve is key to timing purchases strategically.

Why Gas Futures Matter For Brokers And End Users

For energy brokers and large gas users, understanding natural gas futures market dynamics is a competitive advantage when it comes to securing costs. Gas futures play a central role in shaping retail energy prices, and knowing how to interpret them can help optimize timing for locking in fixed-rate contracts.

By monitoring shifts in the futures curve, brokers and consumers can anticipate how wholesale price movements may filter into the retail market in the weeks or months ahead. A steepening curve might signal rising long-term costs, while a flattening curve could indicate a more stable pricing environment.

In most regions of the U.S., power prices are closely correlated to natural gas futures, meaning that expertise in gas markets can help gain insights into electricity price movements.

Need Help Understanding Natural Gas Futures?

Natural gas futures markets are a critical component of the U.S. energy markets, shaping both retail electricity and natural gas prices. Energy brokers and consumers that have a handle on how gas futures trade, what affects price trends, and how to interpret this data to make decisions are ahead of the game. At Diversegy, our team of energy market experts has decades of experience modeling gas futures to help our large energy clients make better decisions about procuring energy supply. Contact our team today for a free natural gas market outlook report.