Whether you are an energy broker or energy trader, retail energy supplier, or simply involved in the retail or wholesale energy market, the concepts of backwardation and contango apply to you. Now, before we dive into these concepts, know these financial terms that apply to any futures market: energy futures, sugar futures, oil futures, gold futures, etc.

What Is Backwardation & Contango?

In order to fully understand the trading concepts of backwardation and contango, one must first grasp the concept of a futures contract. If we refer to our previous article about how energy futures contracts trade, we will remember that every calendar month going several years into the future has a price for energy that can be purchased today.

The purpose of a futures contract is to facilitate transactions between buyers and sellers. For example, a developer looking to build a power plant needs to have some sort of future guarantee of revenue at a certain price per megawatt hour in order to get financing from the bank. And on the flip side, a retail electricity supplier needs to be able to secure power at a certain price for the next three years in order to fulfill a fixed-rate energy contract with a customer.

The energy futures contract allows these two parties to enter into an agreement to buy and sell energy at a certain price for the next several years, no matter what the price of the market does.

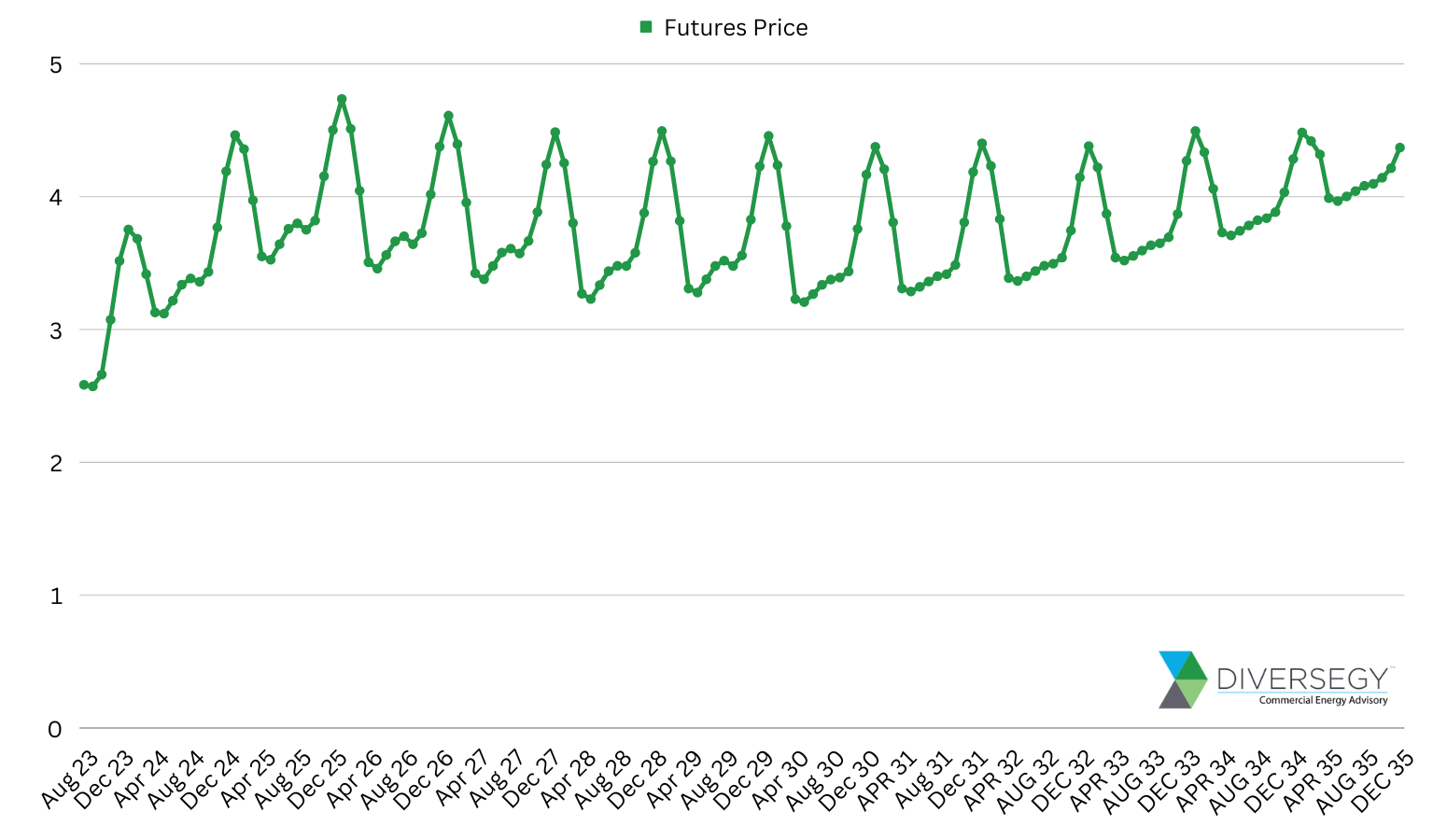

In order to visualize what a futures market might look like, let’s take a look at this natural gas futures chart below. This graph represents a forward curve that is comprised of several individual calendar month prices:

The chart above, compiled by Diversegy’s team of energy market analysts, shows the natural futures settlement price on July 7th, 2023 for each calendar month’s contract starting in August 2023 and ending in December 2035 (data from CME Group). Here’s what to know when viewing this chart:

- The data points on the chart represent a snapshot of all futures prices on the trading date: 7/7/2023

- Each calendar month across the X-axis represents a separate futures contract at a different price (e.g. April 2024 is different than April 2029)

- The line, or the forward curve, shows the futures market trend for all months between August 2023 and December 2035

Contango and Backwardation are terms used to describe this forward curve. This is what each term means in itself:

- Contango: When future prices on the forward curve are higher in the future than they are in the present.

- Backwardation: When futures prices on the forward curve are lower than prices in the present time.

Now, let’s explore the concepts of Contango and Backwardation as they relate to this example of natural gas futures contracts.

Markets In Contango

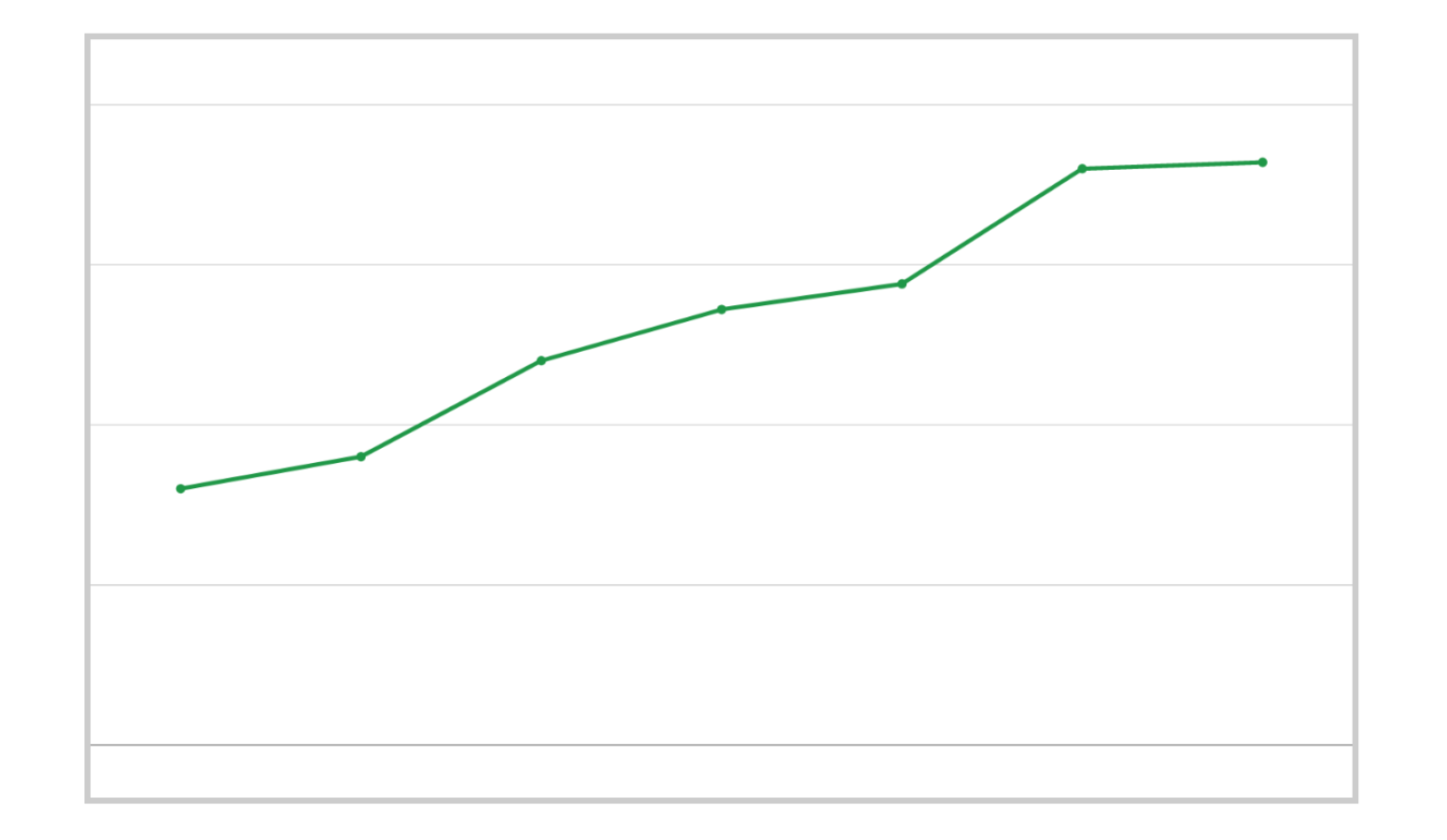

Commodity markets are said to be in contango when futures prices are higher than prices today, also referred to as the spot price. Markets in contango are considered to be bullish as market participants are anticipating prices to rise over time.

There are several reasons why a market might be in contango including future uncertainty about price, speculation about a shortage of supply in the future, speculation about an increase in demand in the future, global events such as war (e.g. the Russia-Ukraine impact on energy prices), and other factors.

A contango market looks like this:

Markets In Backwardation

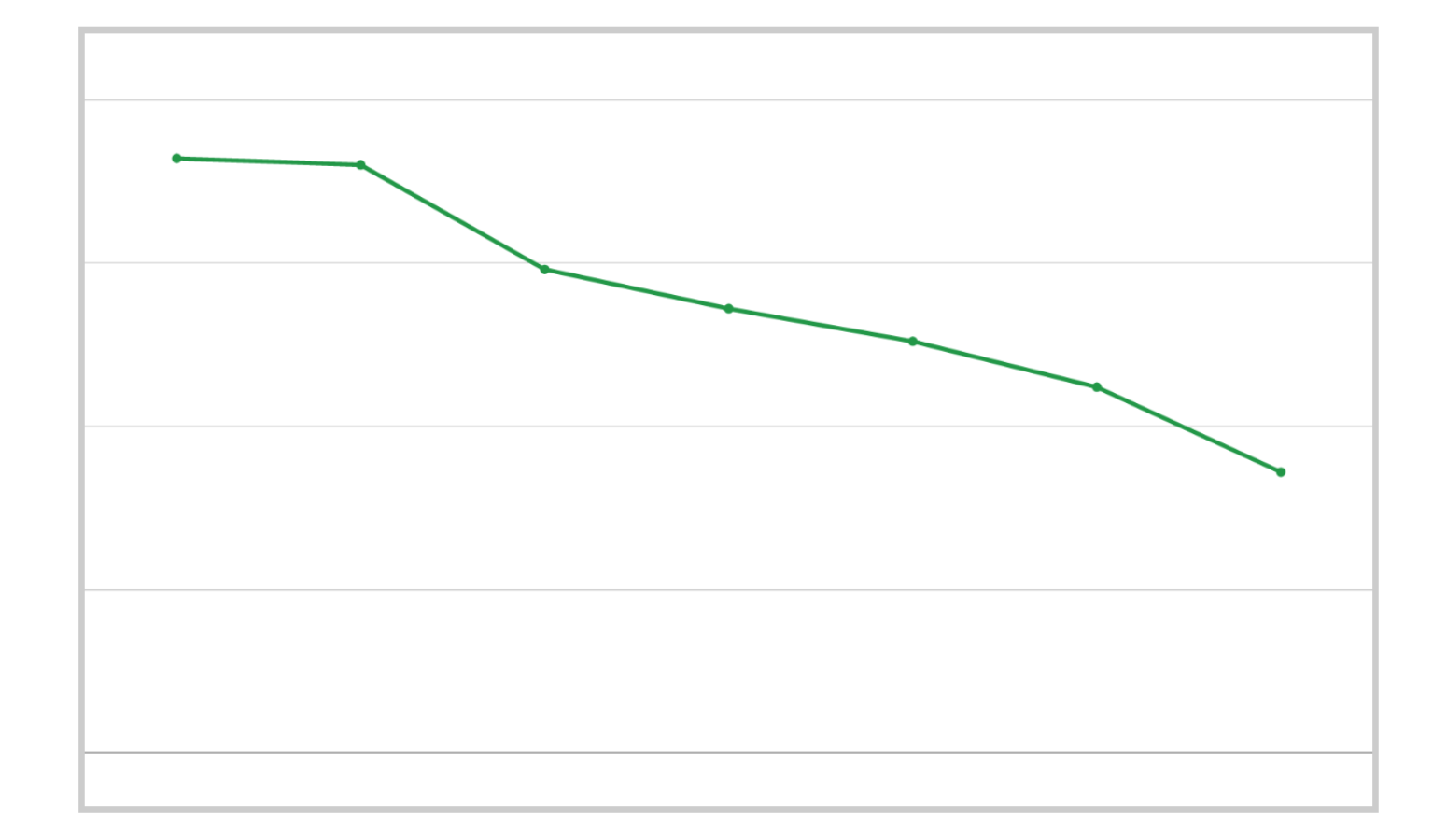

On the flip side, commodity markets are said to be in backwardation when futures prices are lower than spot prices today. Backwarded markets are considered to be bearish as all market participants are speculating that prices will drop in the future.

Markets in backwardation can be beneficial for consumers as they can secure lower rates for energy long term.

There are several reasons why a market might be in backwardation including future speculation that there will be an abundant amount of supply, relative to demand.

A market in backwardation looks like this:

How Contango & Backwardation Affect Energy Supply Prices

Now, let’s explore the practicality of markets in contango or backwardation and what they mean to retail energy suppliers and customers in deregulated energy markets that are trying to develop cost-effective energy strategies for their businesses.

Contango Means Lower Short-Term Energy Contracts

Since energy suppliers need to purchase a strip of futures contracts to offer a fixed-rate quote to a customer, the price of the quote is an average of the underlying futures contracts. For example:

- Energy Contract Fixed Term: 12 months

- Contract Period: January 2024 – December 2024

- Contract Cost: $0.08 / kWh

The contract cost is equal to the average of all electricity futures contracts for the contract period (Jan 2024 – Dec 2024). In the above example, the average cost of all highlighted calendar month contracts is 8¢, so the total electricity supply rate would reflect this.

When a market is in Contango, the future prices for months in 2025 are higher, ultimately driving up the total cost of a two-year deal:

- Energy Contract Fixed Term: 24 months

- Contract Period: January 2024 – December 2025

- Contract Cost: $0.09 / kWh

Since the average of all 2025 calendar months’ futures contracts are 10¢, then when they are average with the 2024 prices, a two year deal becomes more expensive.

The bottom line is that when markets are in contango, shorter-term energy contracts are less expensive than longer-term contracts.

Contango Means Lower Long-Term Energy Contracts

Now, the opposite of the above example is true when markets are in backwardation. Because a backwarded market means that future prices are trading lower than spot prices, a longer-term energy contract is less expensive than a shorter-term contract.

Backwardation is ideal for end-users, retail energy suppliers, and other energy companies that are looking to secure costs for a long period of time. During backwardation, these companies can benefit from signing multi-year, fixed-rate energy contracts.

Using the same example as before, let’s assume that the average price of all 2025 futures contracts was 7¢ instead of 10¢. This would bring the price of a 24 month contract down to 7.5¢, the average of 2023 (8¢) and 2024 (7¢).

How Does The Futures Curve Affect Fuel Buyers

In the energy sector, there are many market participants buying energy futures. Some of these participants, such as power plants and natural gas producers, are long the market, meaning they benefit when prices rise. Other participants, such as retail energy suppliers and customers, are short the market, meaning the benefit when prices fall.

Each energy market player has a different incentive and benefits accordingly when commodity markets are backwarded or in contango.

If you are an energy producer, then you might be hesitant to sell your supply in a backwarded market. After all, you most likely have a fixed cost to generate power or gas and benefit when prices are high.

If you are a fuel purchaser, on the other hand, you might be hesitant to purchase when markets are in contango as lower prices in the future are better for you.

No matter your position in the energy market, it is important to understand these concepts thoroughly so you know how to best navigate volatile energy markets.

Do You Need Assistance Navigating Energy Futures?

Not only does our team of retail energy market professionals have decades of experience advising customers on buying energy futures contracts, but through our family of energy companies, we have access to wholesale energy market traders, hedgers, and analysts whose job is to watch contango and backwarded market trends daily. If you need help deciding what to do for your business or for your commercial energy customers, schedule an appointment today with one of our energy market specialists.