While most commercial customers elect fixed rates, some larger users of energy take advantage of index electricity pricing that moves up and down with the energy market. Energy index prices can be a great way to take advantage of market downturns or off-peak periods when energy prices are low. This article outlines everything you need to know about energy index contracts and price structures.

What Are Energy Index Rates?

Unlike fixed-rate prices that do not change for a pre-defined period of time, energy index rates float up and down with the electricity and/or natural gas markets. There are different types of hybrid retail energy contracts that include index rates as part of their terms and conditions. Let’s explore the various types of retail agreements available to commercial customers and how index pricing works.

Block + Index

A block + index retail energy supply contract allows a customer to lock in, or block, certain percentages or volumes of their energy load while floating the remainder of the load on the index market. Block + index products are great for businesses looking to eliminate market price risk during certain periods of time, while taking advantage of open market index prices.

Fixed-Adder

A fixed-adder product allows a customer to float their energy rates on the open market. A fixed-adder product is 100% variable as the rate goes up and down with energy prices. An energy supplier will offer a fixed-adder to a customer by selling them the market price plus their fixed margin. These products are often purchased by facilities that pass through the cost of energy to their customers. For example, an oil refinery using electricity to process petroleum typically purchases a straight index product since the cost of electricity is added to the total price of petroleum.

Straight Index

A straight index electricity product follows the hourly consumption profile of the customer. In other words, the customer pays the index rate for electricity each hour multiplied by the total number of kilowatts used in that hour. Unlike a fixed-adder product that is typically based on the monthly average cost of the wholesale energy market, a straight index product is calculated each hour in real-time.

Benefits Of Index Pricing

There are many reasons why a business or organization might choose to enroll in an index-based energy plan or some sort of hybrid rate.

Off-Peak Usage: If you are using lots of energy during off-peak hours, then you might be able to save money by enrolling in an index rate during those times. Energy prices are typically lower during off-peak periods when consumer demand is low.

Cost Of Goods: When your utility expenses are directly related to your cost of goods, or your cost to produce a product, then an index rate tied to the market could be a good option for you. If your industry typically passes down the cost of energy to your customers, then a volatile energy market does not have an effect on your bottom line.

Flexibility: Index-based contracts also offer flexibility to energy users. Signing up for a fixed rate bounds you to the terms of your contract, while an index product allows you to float the market and potentially lock-in when prices are more favorable.

How Index Pricing Is Calculated

There are different ways to calculate energy index rates based on the commodity, energy contract type, and energy supplier. Typically, natural gas index rates are calculated one way, while electricity index rates are calculated using a different method. Let’s explore both commodities below:

Natural Gas

The price of a natural gas futures contract moves up and down with the ebbs and flows of the natural gas market. And, natural gas futures contracts have a certain delivery date or expiration date when the contract needs to be liquidated on the financial exchange. Here is typically how natural gas futures contracts trade:

- The February 2023 contract expires on 1/27/2023

- The March 2023 contract expires on 2/24/2023

- The April 2023 contract expires on 3/29/2023

These expiration dates are the last trading day of that month’s futures contract, so when an energy supplier is purchasing natural gas on the index market to supply a customer, the price of that contract is usually determined by the price of wholesale natural gas on the last trading day of the month or the contract expiration date. Let’s explore this example in more detail:

- A supplier selling a natural gas index rate to a customer

- The agreement between the supplier and customer is to calculate the total index price using the following formula:

- (price of natural gas futures contract on last trading day) + ($0.50)

- The price of the February 2023 contract on its expiration date of 1/27/2023 is $3.397/DTh

- The total index price of the retail supply contract for February 2023 is $3.897/DTh, or $3.397 + $0.50

Electricity

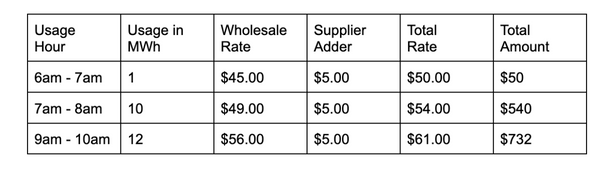

Electricity index pricing is a totally different animal. Since electricity cannot be stored like natural gas, the calculation of the index rate happens in real-time. Electricity prices in the wholesale market trade on hourly intervals, and when a customer elects to sign up for an index electricity rate, they are billed accordingly. Let’s look at an example of how electricity index prices are calculated:

- Supplier agrees to sell customer electricity using the following formula: (hourly wholesale rate + $5/MWh)

Want To Learn More About Index Rates?

In conclusion, index energy pricing can be a great tool for certain businesses based on their usage patterns. Index rates can be beneficial for businesses with off-peak usage, those that want more flexibility, or those that can pass through the cost of energy to their customers. If you are looking to learn more about energy markets, index products, or hybrid energy contract structures, contact our team of energy professionals today.