If you research the history of energy deregulation and wholesale energy markets, then you might learn about the common thread of the energy futures market. Although abstract for some, the futures market is where energy prices are bought and sold for consumption at a later date. And, wrapping your head around the concept of energy futures is very important to becoming a successful energy broker. This page outlines the ins and outs of electricity and natural gas futures, how they pertain to commercial energy customers, and what those prices represent in a retail energy contract.

What Are Energy Futures And How Do They Work?

In the world of commodity trading, particularly related to energy commodities like electricity and natural gas, traders have the option to take title to energy in the future at a certain price and delivery date. In other words, a trader could enter into a contract today to purchase natural gas at a pre-determined price six months into the future. These agreements between buyers and sellers in the wholesale energy market are also referred to as futures contracts.

In the retail energy market, energy brokers can also offer a derivative of a futures contract by offering their customers a fixed price that begins on a certain date in the future. Because all retail energy suppliers hedge their energy purchases in the wholesale market, this future-dated retail contract is simply a representation of the underlying futures contract trade in the wholesale market.

How Energy Futures Apply To The Energy Broker Market.

First things first, as an energy broker offering a fixed-rate energy contract to your customer, you must understand how the price of the contract is derived. Like any commodity or stock, electricity and natural gas have a futures market. That is, the future delivery of electricity or natural gas at a certain given time can be traded or agreed upon ahead of time.

We know that sounds confusing. Allow us to simplify things. Let’s say a producer of natural gas wants to gain some security knowing what his revenue might be for the next 12 months based on the total gas he is producing. That producer might enter into a futures contract with a buyer and agree that no matter the market price of gas for the next 12 months, he will sell it to the buyer at X price. That, in essence, is the basis of a futures contract. Here are a few key items you must know about energy futures to be a competent energy broker.

Types Of Energy Futures Contracts.

In the energy market, there are several different types of energy futures contracts including:

- electricity futures contracts

- natural gas futures contracts

- oil futures contracts

- petroleum futures contracts

As it relates to the deregulated retail energy market, we will only explore electricity and natural gas futures.

Electricity Futures Contracts

Electricity futures can trade up to ten years in the future, although most trading activity happens in the shorter term future (less than 12 months). These futures contracts are traded on the NYMEX and ICE exchanges and allow customers, electricity marketers, electricity traders, and electricity producers to hedge costs, predict revenue, and even speculate for profits. Electricity, unlike other energy commodities, cannot be stored efficiently so when electricity futures contracts expire, the power needs to be consumed or the contract needs to be liquidated for a profit or loss. Here are some of the typical scenarios where electricity futures contracts are used:

- Retail Electricity Suppliers: Power suppliers, or electricity marketers, purchase electricity futures contracts to secure long-term costs when supplying electricity to retail customers. This is particularly important when suppliers offer fixed-rate energy contracts to their customers.

- Electricity Traders: Energy traders use electricity futures contracts to speculate on market swings for trading profits. When a trader believes the price of electricity will be higher in the future, he might purchase a futures contract with the hopes of being able to sell it back to the market for a profit.

- Electricity Generators: Power plants might utilize energy futures contracts to ensure that they have a profitable income stream no matter what the price of the energy index market does. Generators can short-sell the market and profit when power prices decline. This can counteract any losses they might take from having to produce power at cheap prices.

Natural Gas Futures Contracts

Natural gas futures contracts mimic electricity futures to a certain degree. Like electricity, natural gas futures can be traded nearly a decade into the future, but are often more liquid in the shorter term future. Unlike electricity, natural gas can easily be stored, so there is an opportunity to buy and hold gas until prices move. Most energy companies buying and selling natural gas futures contracts, however, are doing so to hedge costs or create long-term price certainty. Here are some common uses for natural gas futures:

- Retail Electricity Suppliers: Natural gas suppliers utilize futures contracts to lock-in long term supply costs on behalf of their customers. When a supplier enters into a fixed-rate natural gas contract with a customer, futures contracts are purchased to ensure that the gas can be procured for a profit over the length of the agreement.

- Natural Gas Drillers: Another way gas futures are utilized is by natural gas exploration and drilling companies. Drilling for natural gas is an expensive endeavor and energy companies cannot afford to be subject to the ebbs and flows of the market as an income source. In fact, it can be difficult to get funding for natural gas exploration unless there is some sort of profit guarantee. Natural gas futures contracts can be used to ensure that the new gas supply will generate a healthy profit margin.

Key Energy Futures Concepts.

We know that the concept of buying or selling something in the future might be difficult to understand. So in order to fully understand how energy futures work, it’s important to get a good comprehension of the basics.

Future Months Create Calendar Strips

When energy suppliers offer fixed-rate agreements to end-use customers, they too, are entering into futures contracts with producers on the wholesale market in order to guarantee their costs for the specific contract term. In the futures market, each calendar month has a specific price, and those prices are averaged to create calendar strips.

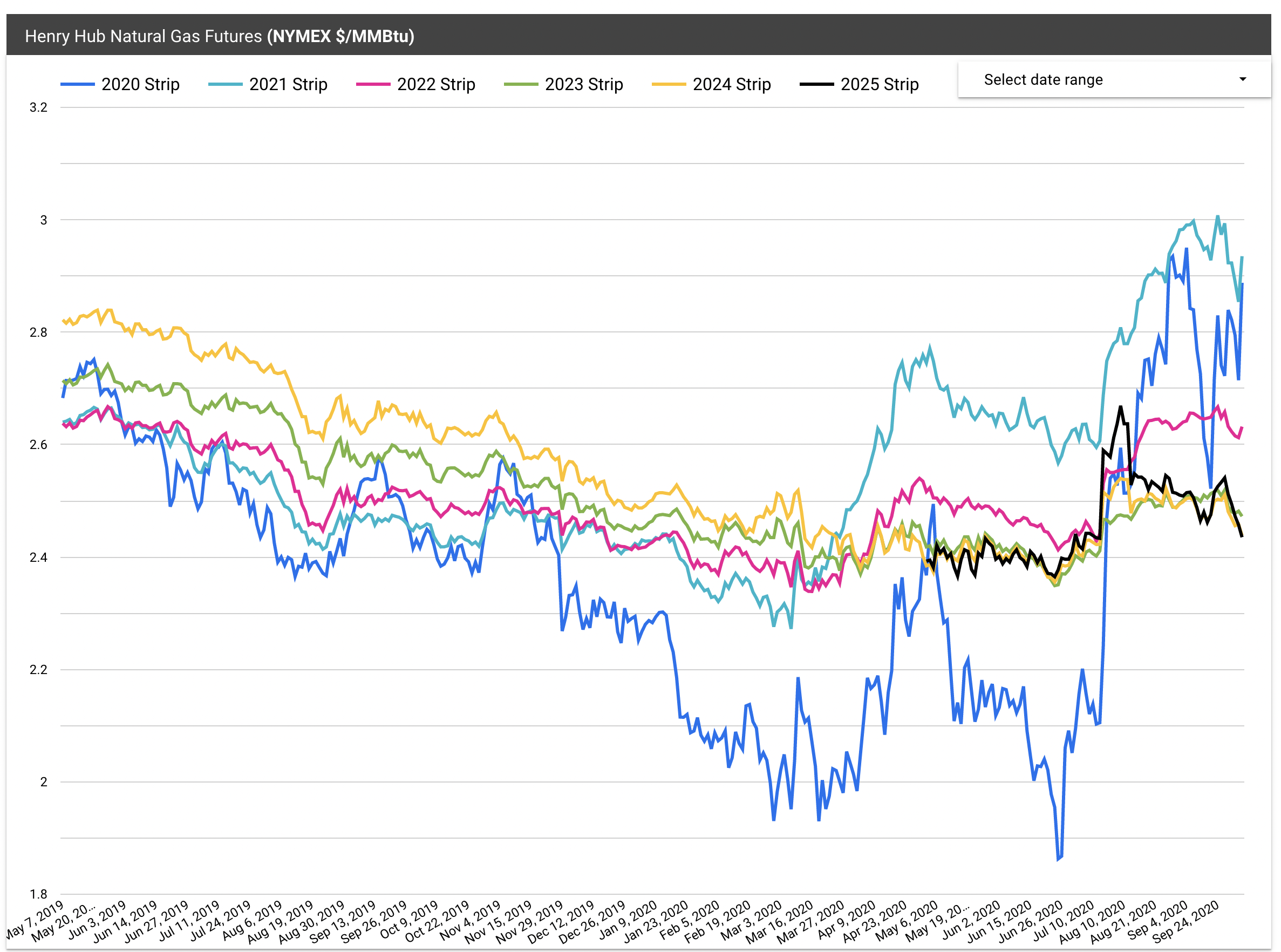

Typically, retail energy suppliers look to calendar strip prices when determining their costs for a fixed-rate retail contract. These strips move up and down each trading day with the movement of the underlying monthly contracts. Here is an example of the 2020-2025 NYMEX natural gas calendar strips. Note that these calendar strips reflect trading days May 7, 2019 through September 24, 2020.

You might also take notice of the quick increase in the 2021 calendar strip in March 2020 (represented by the turquoise blue line). As the pandemic came into full swing, future prices drastically increased.

Understanding how to access this data and interpret it will make you a more effective energy broker. You will understand what drives supplier pricing, where it might be going, and how to take advantage of future market dips.

What Are Calendar Strips and Why Do They Matter?

A calendar strip is a series of energy futures contracts for consecutive months within a calendar year, commonly used to represent average prices for a fixed period of time. For example, if a supplier wants to quote a 12-month contract, they will look at each month’s futures price and calculate the average across all 12 months to create what’s known as a strip price.

This process allows suppliers to offer fixed-rate products based on the expected wholesale cost of electricity or natural gas. Here’s a simple example:

- If the January futures price is $3.00/MMBtu and February is $3.25/MMBtu, the strip average would be $3.125/MMBtu.

- Suppliers use this average to build contract offers for customers, often packaging pricing into 12, 24, or 36-month strips depending on the procurement strategy.

Understanding how calendar strips work is essential for brokers, as it gives them insight into how market expectations translate into the rates their customers see in supply contracts.

How Brokers Can Use Cal Strip Pricing In Client Conversations

Calendar strip pricing is a powerful tool for brokers looking to guide clients on market timing and contract decisions. By monitoring movements in the strip, brokers can alert clients when it’s a favorable time to lock in rates, especially if the average across months dips lower than historical norms or recent trends.

For example, if the 12-month strip shows a price decline due to mild weather forecasts or excess supply, it might be a strategic moment to offer clients a 12-month fixed deal. Brokers can frame these decisions around market data, making the value of timing more tangible for buyers.

Additionally, explaining the concept of forward visibility, how strip pricing reflects future cost expectations, can help clients feel more confident in long-term energy decisions. It allows brokers to shift the conversation from reactive budgeting to proactive strategy.

Peaks and Shoulders

Another key concept to understand is the market price trends around peak months and shoulder months. Energy marketing pricing, in the short term, is largely based on supply and demand. Because colder and warmer temperatures can create added demand for energy, summer and winter months typically have higher prices.

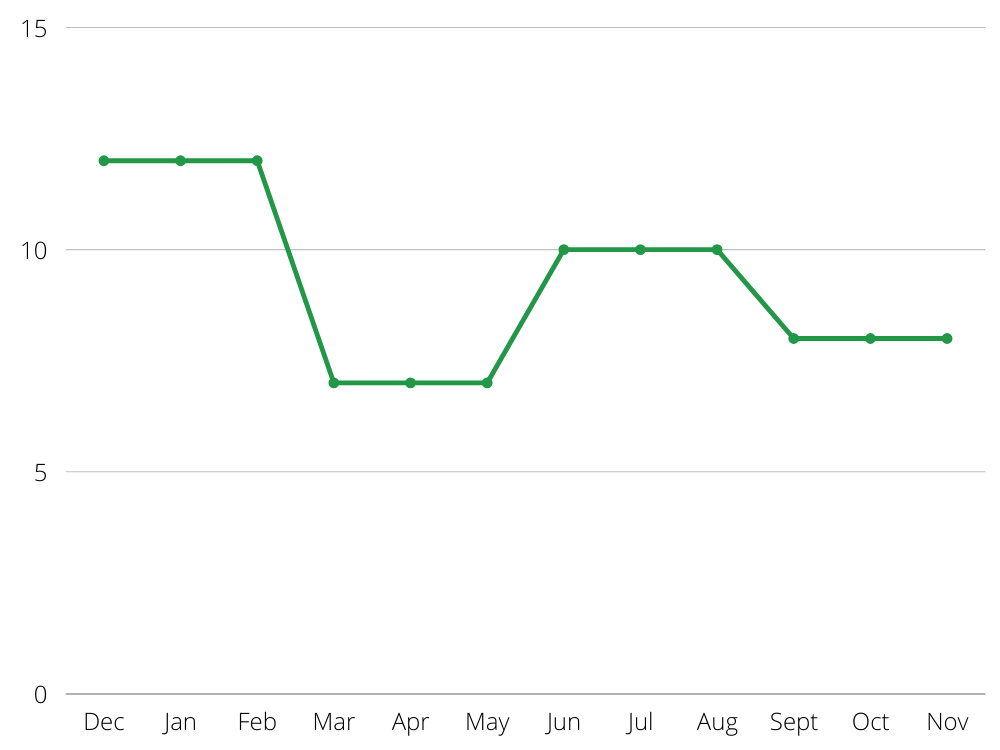

As evidenced by the chart below, energy futures typically trade at higher prices December – February and June – August. These seasons have higher anticipated demand and speculation in the market reflects this.

Seasoned energy brokers know how to structure retail energy supply contracts to take advantage of lower-priced shoulder months. In fact, you might even notice in supplier matrix pricing that contracts ending in May or November have lower rates. The reason for this is that those contracts are capturing one more shoulder period and have a lower net cost to the supplier. Here are some tips for utilizing shoulder months to sell lower-cost energy to your customers.

Pro Tips

- Sell sweet spot terms that have more shoulder period than peak periods

- Lock-in peak period prices that typically have high volatility, and float shoulder periods (see more on block + index pricing here)

Understanding Seasonal Price Risk

Seasonal price risk plays a major role in the energy futures market. Peak demand months, typically July and August in the summer, and January and February in the winter, often experience significant price increases due to widespread use of heating and cooling systems. These seasonal shifts create volatility in the market, where supply constraints can drive prices sharply upward in a short amount of time.

Extreme weather events like Winter Storm Uri in 2021 highlight just how severe these spikes can be. During that period, natural gas and electricity prices surged across Texas and the ERCOT region due to frozen infrastructure and soaring demand. For energy brokers, understanding these seasonal risks is essential. It allows them to guide clients in making smarter procurement decisions, avoiding exposure during high-risk months, and building more resilient energy strategies.

Strategic Contract Timing Using Shoulder Months

Shoulder months, typically found in the spring (April–May) and fall (October–November), are periods of lower energy demand, and therefore offer more price stability. Because weather is milder during these times, heating and cooling needs are minimal, and the market tends to be less volatile.

For brokers, this presents a tactical opportunity to structure energy supply contracts to start or end during shoulder months to capture lower blended rates. This timing strategy can reduce overall energy costs, particularly when paired with market dips or favorable strip pricing. For example, a 17-month contract running from November to April may only include two peak months (January and February), with the remainder falling in shoulder periods, resulting in a more cost-effective procurement plan.

Less Volatility Out The Curve

To fully understand the difference between energy spot prices, energy future prices, and what affects the two, one must understand the make-up of the futures curve.

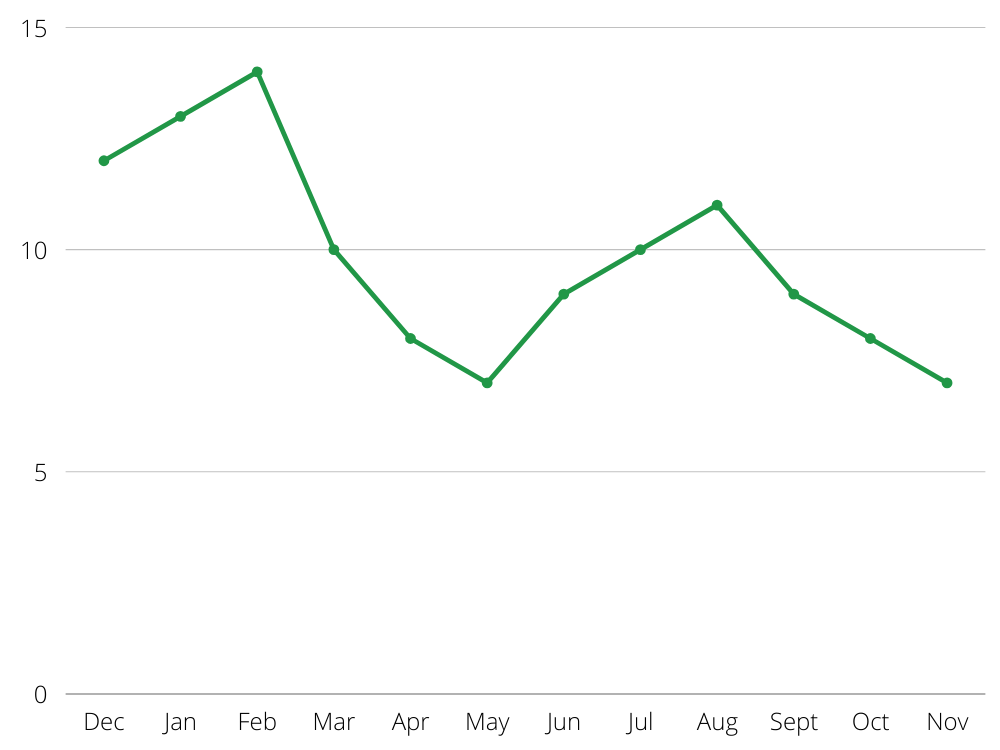

Since each future calendar month has an individual price, when you align them together, you get a futures curve. It might look something like this:

The first month of the futures curve is the most recent month, or “front month”. When you hear about natural gas or oil prices on CNBC, they are referencing the front-month contract. This contract is heavily impacted by market fundamentals, such as supply and demand.

When you move further “out the curve”; however, those monthly contracts are less affected by short-term market fundamentals. In fact, when you look several years out the curve, futures prices have very little volatility when compared to the front-month contract.

Energy brokers can take advantage of this market phenomenon by future-dating retail supply contracts for their customers. Just because current market prices are high does not mean that there isn’t an opportunity further out the curve to save your customers on their energy costs.

What Is the Futures Curve?

The futures curve is a line graph that plots the market price of energy contracts over a series of future delivery dates, typically organized by month or quarter. It offers a visual snapshot of how the market expects prices to evolve in the coming months or years. On this curve, the “front-month” refers to the nearest-term contract (e.g., the next calendar month), while the “outer curve” refers to contracts set 12 or more months into the future.

For energy brokers, the futures curve is a powerful tool. It reveals patterns of volatility, market sentiment, and expectations for seasonal spikes. A steep upward curve may suggest bullish pricing due to anticipated constraints, while a flat or downward-sloping curve could indicate lower expected demand or ample supply. Brokers can use this data to time contracts and educate clients on future cost trajectories.

Why Long-Term Futures Are More Stable

Long-term futures contracts, those set for delivery 12 months or more out, tend to be more stable than near-term options. That’s because they are less exposed to immediate risks such as sudden weather events, short-term fuel shortages, or geopolitical disruptions. As a result, prices in the outer curve typically move more gradually, offering a smoother pricing path for longer-term planning.

This stability presents a major advantage for brokers recommending fixed-rate energy plans. When clients are concerned about budget predictability, a long-term contract can lock in a rate and eliminate short-term surprises. The trade-off, of course, is that while these plans reduce risk, they also limit the potential for savings if the market declines unexpectedly. Still, for many commercial clients, the consistency of a well-structured, long-term contract outweighs the chance of speculative gains.

How Can I Utilize Future-Dated Contracts As An Energy Broker?

Future-dated retail energy supply contracts are a powerful tool for energy brokers. There are many times when the futures market tends to be trading lower than the spot market. These are great times to notify your customers about market opportunities so they can lock in lower prices for future energy supply. Some sophisticated energy brokers help their clients develop annual budgetary goals. Utilizing future-dated contracts is an outstanding way of helping your customers achieve budget goals. When futures prices are trading within a certain range, your customers can execute retail supply contracts to secure those rates for the future.

How to Turn Futures Insights Into Actionable Procurement Advice

Energy futures aren’t a crystal ball, but they are a powerful forecasting tool when interpreted correctly. For brokers, the key is to view the futures curve as a directional signal that helps anticipate trends, rather than a precise prediction. By consistently monitoring market indicators, like NYMEX natural gas settlements or PJM forward strip pricing, brokers can identify windows of opportunity to time contracts more effectively.

For example, if futures data suggests a dip in the 12-month strip or seasonal softening during a shoulder month, it may be a strong cue to advise clients to renew early or extend a current deal. This level of proactive engagement builds trust and positions the broker as a strategic advisor rather than a transactional middleman. A simple outreach like, “Based on the current futures curve, now may be an ideal time to lock in your next contract,” can drive timely decisions and deliver real client value.

Can Customers Get Out Of A Future-Dated Energy Contract?

Usually not. The only reason a customer might want to leave an energy contract early, or before it begins for that matter, would be if the market prices were even lower than the price of the contract. Otherwise, if prices were higher, the customer benefits by honoring whatever contract might be in place at a lower rate. Should the customer attempt to leave a supply contract early or before it begins, retail suppliers will typically charge the customer an early termination fee that can be equal to or greater than the cost for them to liquidate the contract in the open market. When market prices are lower than the value of the contract, the supplier incurs a loss when selling the energy back to the market. That loss is then passed to the customer in the form of an early termination fee.

Want to learn more about how you can utilize energy futures data to become a better energy broker?

Our team of energy market experts has a good handle on energy futures products and the different types of energy futures contracts traded in the market. In fact, we utilize this information daily in order to make better recommendations to our customers. Contact us today to learn more about how energy futures can help you to control your energy costs.