Liquified Natural Gas (LNG) has become an integral part of the U.S. energy economy, making U.S. natural gas a globally traded commodity. As exports to foreign nations increase, domestic supply and demand dynamics are greatly impacted. In this article, we will explore the impact of LNG exports on pricing, infrastructure, and energy policy, with a specific focus on the global trade of LNG.

What Is Liquefied Natural Gas (LNG)?

Liquefying natural gas is a process where natural gas is cooled to -260°F to become liquid for storage and transport. The LNG process takes place at large LNG facilities where gas volumes are reduced by 600 times for ease of shipping. As the U.S. ramps up exports of LNG to Europe and other countries, it is doing so through the LNG process, shipping LNG gas in cryogenic tanks on ships internationally.

The Rise Of U.S. LNG Exports

The fracking boom in the Marcellus Shale region of the U.S. led to a surplus of domestic natural gas production. This helped the U.S. transition from an importer of energy to the top global exporter of LNG. In order to support this growth, new LNG expert terminals, such as Sabine Pass, were built to convert the gas to LNG and load it into tanks for shipping. This shift has turned U.S. gas into a globally traded resource, like crude oil, and has drastically impacted the market dynamics around natural gas.

Market Impacts Of LNG

LNG has had several direct and indirect impacts on the natural gas market, including supply and demand effects and geopolitical influences.

Natural Gas Prices

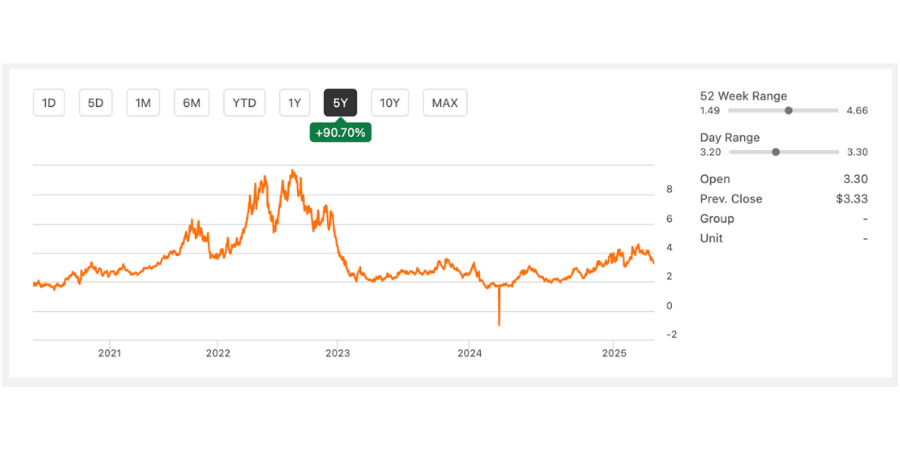

Natural gas prices are derived from physical supply and demand metrics in the market. When demand outweighs supply, prices rise, and when supply outweighs demand, prices fall. As LNG exports continue to grow, they are greatly impacting the demand for U.S. natural gas, causing withdrawals from natural gas storage reserves and generating a need for new production. In the last several years, the demand for LNG has directly increased natural gas prices as evidenced by the chart below:

Natural Gas Prices Chart

Global Influences

Geopolitical events, such as the Russia-Ukraine War, have placed more demand for U.S. LNG exports. Historically, European countries purchased natural gas from Russia. But with supply shortages coming as a result of the conflict, Europe has shifted its purchasing behavior towards U.S. LNG. This has further influenced the price of gas in the U.S. as this unanticipated demand continues to grow.

LNG Infrastructure Evolution

To keep pace with the growing demand for LNG, market players are investing in new infrastructure such as LNG terminals, LNG tankers, storage facilities, and new pipeline networks.

New pipeline infrastructure is needed to bring natural gas to LNG terminals so it can be cooled and transported. This requires significant capital investment, and many investors are also building complementary storage facilities to store excess gas that is waiting to be liquefied.

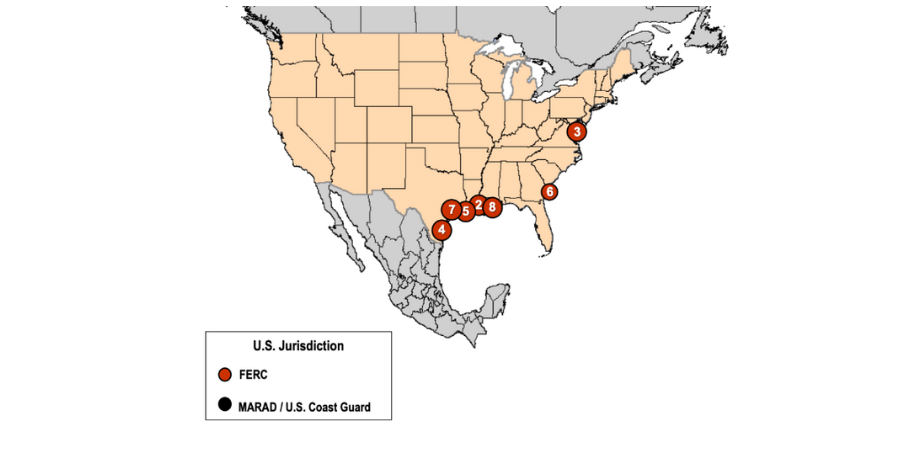

Many LNG port terminals are also under construction and are typically located near existing pipeline infrastructure and ports. These facilities need access to stable gas supply and must also be able to load tankers onto ships for international transport. Many of the LNG terminals today are located on the coastline of the Gulf States. The map below, from the Department of Energy, shows active U.S. LNG terminals:

Map of Active U.S. LNG Terminals

LNG’s Role In The Energy Transition

LNG is playing a key role in the global energy transition, acting as a bridge fuel between dirty fossil fuels and renewable energy. Let’s explore how LNG is shaping the energy landscape of the future.

Bridge Fuel

LNG is acting as a bridge fuel in many emerging energy economies. For example, oil-driven power plants in South America and Caribbean countries are quickly being replaced by gas-fired power plants. Because these countries do not have access to natural gas infrastructure, LNG is being shipped to these facilities as a method of power generation.

RNG

The role of Renewable Natural Gas (RNG) is also playing an important role in this transition. Renewable Natural Gas (RNG) can be used in the LNG process to create a cleaner form of LNG, contributing to global decarbonization efforts.

Climate Concerns

LNG is not without environmental concerns, however. Critics often point to methane leakage during production, transport, and regasification. Additionally, when evaluating the full lifecycle emissions of LNG, questions arise over its long-term compatibility with net-zero targets.

LNG Policy Considerations

LNG energy policy in the United States has been a heated debate. Many climate activists are against this process, arguing that is furthers our reliance on fossil fuels. Proponents, on the other hand, debate that LNG is a great way to replace dirty power generation from coal and oil. Some of the important policies shaping the LNG industry include:

Global Methane Pledge

This pledge, signed by over 150 countries, includes efforts to reduce emissions from LNG production and limit our dependence on fossil fuels.

Asia Energy Security

Japan, South Korea, and China have mandates in place to secure enough LNG supply for energy security reasons. These countries are also committed to exploring alternative methods, such as hydrogen-ready LNG, to further their commitment to green energy.

President Trump’s Executive Order

In January 2025, President Trump signed Executive Order 14154, “Unleashing American Energy”, to reverse the temporary pause on LNG export applications authorized by the Biden Administration. This order will further the demand for LNG in the U.S.

Want To Learn More?

Now more than ever, understanding the impact of LNG on U.S. energy markets is essential for commercial and industrial customers. Whether you’re evaluating your current gas supply structure, exploring long-term contracts, or seeking natural gas hedging strategies, aligning your energy strategy with market dynamics can unlock significant value. At Diversegy, our team of natural gas market experts has decades of experience helping our clients find low-cost gas for their operations. Contact us today to learn more about how LNG exports could impact prices for your business.