Our commercial natural gas customers often ask us why natural gas prices in their regions differ from the NYMEX prices advertised in the financial news. To fully understand how natural gas is priced throughout the United States, you need to grasp the physical natural gas market, the cost of transporting gas to different regions of the country, and how natural gas prices are determined. This article outlines everything you need to know about the natural gas market and pricing.

The Physical Natural Gas Market

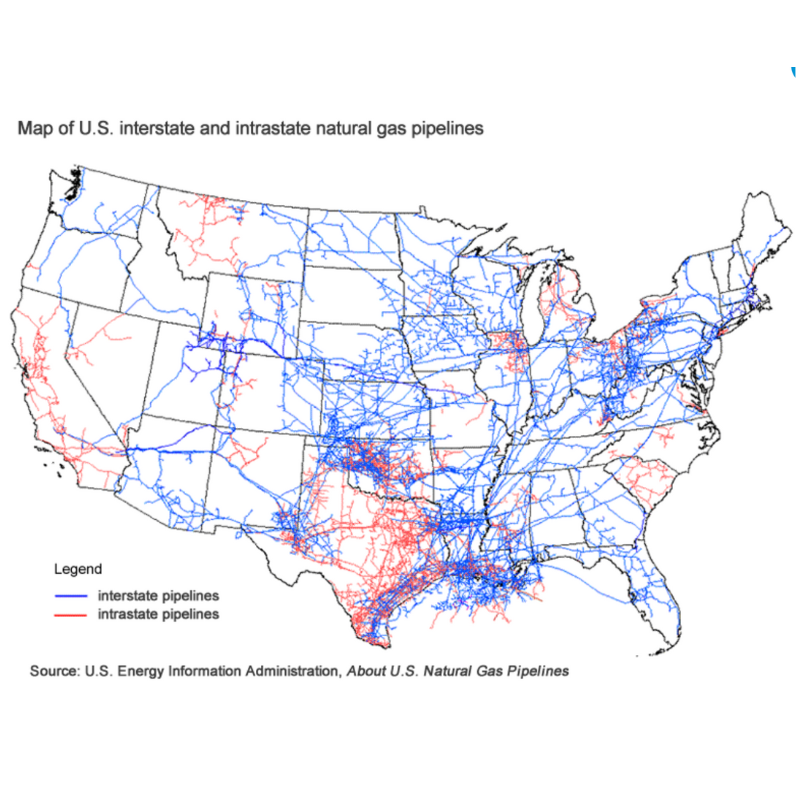

Unlike other financial products, such as stocks and bonds, natural gas prices are tied to a physical market where gas is being purchased and consumed. Natural gas is used to heat homes, power industrial processes, and even generate electricity. The demand for natural gas is met by transporting gas through interstate and intrastate pipelines to locations of high demand. In the United States, the natural gas pipeline network is vast and interconnected. See the natural gas pipeline map below:

In order to move gas across any of these pipelines, pipeline operators charge transportation fees. So, if a gas producer in the Marcellus Shale region of western Pennsylvania is looking to ship gas to New York City, a toll must be paid to use the appropriate pipeline. This creates price discrepancies between locations along the pipeline. We will explore this concept in more detail below when we discuss natural gas basis cost.

Understanding the NYMEX

The NYMEX, or New York Mercantile Exchange, is an exchange where natural gas futures contracts are regularly traded. Prior to this formal, organized market, producers and consumers of natural gas were forced to make private deals to buy and sell gas. The NYMEX standardized these contracts, allowing market participants to easily transact using a third-party exchange.

NYMEX-traded natural gas contracts are financial derivatives that are based on the underlying price of the physical natural gas commodity. If you notice in the pipeline map above, many major pipelines converge in Louisiana. In fact, the Henry Hub pipeline in Erath, Louisiana is the most liquid trading location for natural gas in the United States. Since 1990, the NYMEX has been using Henry Hub as the delivery point for its natural gas contracts. In other words, the price of a NYMEX natural gas contract is the price to take delivery of gas at the Sabine-owned Henry Hub pipeline in Louisiana.

NYMEX contracts are the standard natural gas prices that are often advertised on CNBC and other financial news networks. Since the Henry Hub has so much natural gas trading activity, this is the standard price for natural gas throughout the United States.

What About Natural Gas Basis?

Remember that we previously discussed pipeline transportation costs to move natural gas from one location to another. Well, these costs are often predicated on supply and demand in the delivery region.

Let’s assume that a late Winter storm hits New England in late March, while southern states are experiencing mild Spring weather. Heating demand in Massachusetts and New Hampshire spikes as people turn up their furnaces to brace for the snowy conditions. Since many gas producers and marketers will be scrambling to send gas to New England, the pipelines will be crowded and in demand. This will cause the cost of delivering natural gas to New England states to skyrocket.

If we assume that natural gas at the Henry Hub for that particular month is priced at $3.00/MMBtu and the cost to transport gas to New England shoots to $2.50/MMBtu, then the price of gas in New England will be $5.50/MMBtu – even though the NYMEX contract is trading at $3.00.

This difference in prices between locations is known as natural gas basis cost. Natural gas basis is always benchmarked against the Henry Hub, or NYMEX contract price. In fact, natural gas delivered on the Henry Hub pipeline is said to have zero basis, as it trades almost identically to the NYMEX contract.

it is correlated to the unique supply and demand of each market along the major pipelines. So, the next time you are wondering why your natural gas price quotes are different from the NYMEX contract price, you have natural gas basis to blame.

Looking For A Natural Gas Price Quote?

Diversegy’s team of natural gas market experts understands natural gas basis costs and what makes them trend. If you are looking to lower your natural gas costs and want to shop for a lower price, contact our team of experts today. We can help you understand your natural gas usage cost profile and help you shop for natural gas for your business.