Electricity transmission networks, also known as electricity grids, are complex systems that require constant attention to ensure that electric supply meets consumer demand every second of every day. If these two are not continually in balance, it can lead to grid blackouts and worse. In order to maintain this delicate balance of energy capacity, transmission operators implement something known as operating reserves. Operating reserves are essentially a safety net, or backup source of power, for the electricity network. These power reserves represent the extra power that is accounted for each day in case consumer demand outweighs the forecast. In this article, we will dive into what operating reserves are, the different types of operating reserves, their benefits, and why they’re critical for energy security and the stability of the U.S. electricity network.

What Are Operating Reserves?

In order to fully understand electricity operating reserves, one must first understand how supply and demand are continually balanced in the electricity grid. Each regional network transmission operator requires retail energy suppliers and utilities to submit a daily load forecast predicting customer demand. Through a series of equations, weighted with weather, grid operators are able to predict the total demand for the next day during each minute of the day. To meet that demand, the electric grid schedules certain electricity generators to go on line at different times. But, what happens when demand outweighs the forecast and there is not enough supply scheduled? Enter the operating reserve.

Operating reserves are additional electrical generating capacities that system operators can call upon on short notice to meet electricity demand if a generator fails, there’s a supply disruption, or demand is more than the forecast. These reserves are a critical component in the design of power systems, ensuring reliability and continuity of service. The capacity of the operating reserve is typically set to match the capacity of the largest generator in the system plus risk a margin for peak load. This practice ensures that the transmission network can withstand sudden losses of supply or sudden increases in electrical demand.

The Different Types Of Operating Reserves

These systems are categorized into several types of operating reserves, each serving a unique role in the wholesale energy market. Let’s explore the operating reserve types in more detail below.

Spinning Reserves

Spinning reserves are the additional energy capacity that can be made available by increasing the output of generators that are already online and producing electricity. Spinning reserves are typically the first resource called on when extra power is needed in the system as it is a matter of the generator ramping up energy production by turning up existing generating processes. Spinning reserves are a quick and reliable source of backup power.

Non-Spinning Reserves

Non-spinning, also known as supplemental reserves, are electrical generators that aren’t currently connected to the electric grid but can be activated on short notice. These can could include fast-start natural gas turbine generators or other sources of generation. In addition, non-spinning reserves can include power that is moved from other interconnected grid systems, known as the wheeling of power from one grid to another. Often times, non-spinning reserves can be expensive to turn on, so they are the second option after the spinning reserve.

Replacement Reserve

Replacement reserves in the power system are longer-term solutions, involving electricity generators that take longer to ramp up. These generators can be started within thirty to sixty minutes to replace the initial rapid response reserves. Replacement reserves are essential for restoring the balance of the power system, ensuring the network can return to a state of normalcy. This is the last step when there is an imbalance of supply and demand to get the power grid back to equilibrium.

Benefits Of Having A Reserve Power System

The presence of a robust operating reserve system offers many benefits, including enhanced grid reliability, energy security, improved readiness for unexpected events, and the ability to maintain electric service to customers during equipment failures or sudden demand spikes. Furthermore, operating reserves contribute to the overall stability of the electricity market, promoting stable and reliable energy prices. Let’s explore more about how power reserves operate in the retail energy markets below.

How Operating Reserves Affect Retail Energy Pricing

Operating reserves play a critical role in stabilizing wholesale and retail energy prices. Since the price of electricity in most markets is set on an hourly basis, if a portion of the electric grid were to go down for a sustained period of time, it could cause prices to skyrocket. Remember, these prices are predicated upon supply and demand in real time. So, the operating reserve serves its purpose to keep the grid running and prices predictable.

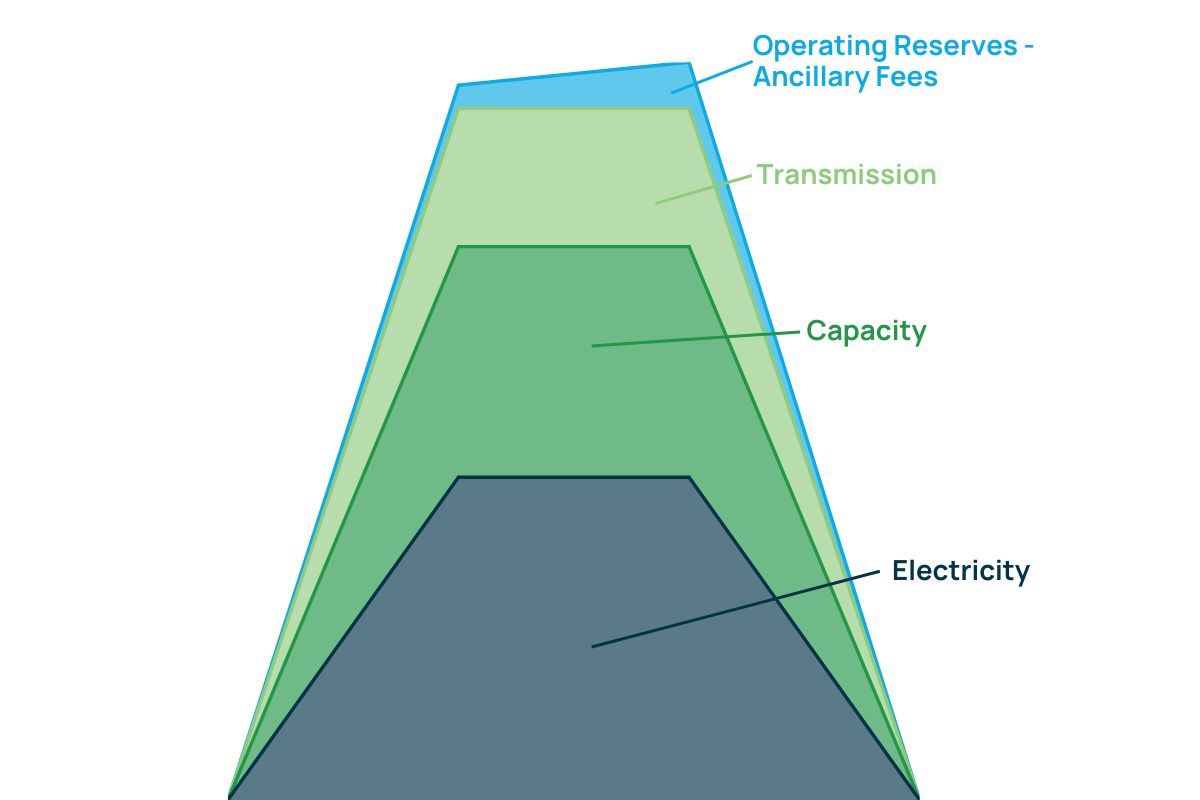

In order to pay for operating reserves, energy customers contribute a portion of their electricity rates to these power systems. Oftentimes, the payment for these fees is unknown to the end user as the costs are bundled together in a final retail price for electricity. For larger energy consumers on wholesale supply products, however, they will see these charges represented as ancillary fees in their electricity statements. These charges represent a small percentage of the total electricity rate and are sometimes referred to as reliability must run (RMR) in certain markets. Take a look at the breakdown of the total retail electricity rate below to see how operating reserves are paid for:

Want To Learn More About The Electric Grid And How It Applies To Your Energy Pricing?

Our team of retail and wholesale energy market experts can help you to better understand operating reserves, ancillary fees, and how those costs apply to your business. In fact, entering into certain types of energy contracts can help you to pay less for these costs and save money in the long run. Want to chat with an energy expert today? Contact us now!