As energy markets evolve, businesses must stay informed about changes that could significantly impact their operating expenses. One such development is the recent surge in PJM’s capacity prices for the 2025/2026 delivery year, which have skyrocketed to $269.97/MW-day from the current $50 levels. This dramatic increase is set to affect commercial customers and energy brokers alike.

In this blog, we’ll delve into what energy capacity charges are, how they’re calculated, and their implications for your electric rates. We’ll also explore traditional methods for lowering capacity costs, understand why these charges exist, and discuss how recent auction results and energy market dynamics have led to such a substantial price increase. Finally, we’ll offer strategies to combat rising capacity costs and explain how Diversegy can assist in navigating these challenges.

What Are Capacity Prices & How Are They Calculated?

Capacity charges are fees paid to the electric grid operator (in this case, PJM) to ensure that power plants remain operational and capable of meeting electricity demand, even during times when electricity prices are low and plants might not be profitable. These charges act like an insurance premium for grid stability, guaranteeing that there is enough electricity available to meet consumer demand at all times. Let’s explore how capacity rates are set, and how costs are calculated for consumers:

Electric Generators Set Rates Through Capacity Auctions On PJM: Here’s How It Works

The calculation of capacity charges involves several factors, including the availability of power plants, projected peak demand, and market rules established by regulatory bodies like the Federal Energy Regulatory Commission (FERC). PJM conducts annual capacity base auctions to determine the price of capacity for future delivery years, where power generators bid to provide the necessary capacity to meet projected demand. The auction clearing price, which reflects the cost of securing this electric capacity from generators, is then passed on to consumers as part of their overall electric rates. The auction process includes:

- Initial Resource Review: PJM assesses the available generation resources and their capacity to meet future demand.

- Bidding Process: Generators submit bids indicating the price at which they are willing to provide capacity.

- Auction Clearing: PJM evaluates the bids and determines the auction clearing price, which is the price at which enough capacity is secured to meet the projected demand.

- Price Announcement: The auction results are announced, setting the capacity prices for the specified delivery year.

How Capacity Costs Are Calculated For Ratepayers

Capacity costs for ratepayers are calculated based on their electric demand during the peak hours of the summer months. Each year in September, PJM retroactively reviews the five peak hours of electric demand over the summer (June, July, and August). They measure each consumer’s electric demand during these five peak hours, average those numbers, and set the consumer’s capacity tag. This capacity tag represents the consumer’s share of the peak demand on the grid.

The consumer then pays their capacity tag multiplied by the capacity rate set at the auction for the following capacity year (June 1 – May 31). For example, if a large New Jersey manufacturer has a capacity tag set at 1,000 MW, determined by the following peak hour demands:

- First peak hour: 1200 MW

- Second peak hour: 800 MW

- Third peak hour: 1100 MW

- Fourth peak hour: 900 MW

- Fifth peak hour: 1000 MW

The average demand for these peak hours is 1,000 MW, which becomes the manufacturer’s capacity tag. For the 2024/2025 capacity year, the capacity rate in New Jersey is $54.95/MW/day. Therefore, the total capacity costs for the manufacturer are:

- 1,000 MW × $54.95 × 365 days = $20,056

For the 2025/2026 capacity year, the new capacity rate is $269.92/MW/day. Thus, the new costs for the manufacturer with the same capacity tag are:

- 1,000 MW × $269.92 × 365 days = $98,512

This results in a total annual increase of: $78,456,050

Such a significant increase underscores the importance of understanding and managing capacity costs effectively.

How Does Capacity Show On My Electric Bill?

Capacity costs are typically embedded in the overall electric supply rate that consumers pay, whether they purchase electricity from an electric supplier or directly from the utility company. These costs can account for about 30% of the total electric supply charges, making them a significant component of your electric bill. The capacity charges ensure the reliability of the power supply, helping to prevent outages and maintain consistent energy availability.

For consumers paying fully-bundled fixed rates to suppliers, capacity costs are bundled into the total price for electricity, in addition to transmission and commodity costs. Some large users elect for hybrid energy products where capacity costs are unbundled from the total supply rate and billed as a separate line item.

What Are The Traditional Ways To Lower These Costs?

Businesses can adopt several strategies to lower energy capacity costs, including:

- Demand Response Programs: Participating in demand response programs allows businesses to reduce their electricity usage during peak times in exchange for financial incentives, thereby lowering capacity costs.

- Energy Efficiency Measures: Implementing energy efficiency measures, such as upgrading lighting and HVAC systems, can reduce overall energy consumption and peak demand, leading to lower capacity charges.

- Load Shifting: Shifting energy-intensive processes to off-peak hours can help reduce peak demand and associated capacity costs.

On-Site Generation: Utilizing on-site generation, such as solar panels or backup generators, can reduce reliance on the grid during peak periods, lowering capacity costs.

Why Do Capacity Costs Exist?

Capacity charges exist to ensure the reliability and stability of the electric grid. They provide financial incentives for power generators to remain operational and available to meet demand, even when market conditions are not favorable. Without these charges, there would be a higher risk of power shortages and outages during peak demand periods, which could disrupt businesses and affect the overall economy. The EROCT market in Texas, for example, does not have a capacity market, and during Winter Storm URI, they saw electricity prices rise from $40/MWh to $9,000/MWh. An efficient capacity market would have prevented this drastic price increase.

Overall, capacity charges help maintain a balance between supply and demand, ensuring that there is always enough electricity available to meet consumer needs.

The Recent Results For The 2025/2026 PJM Auction

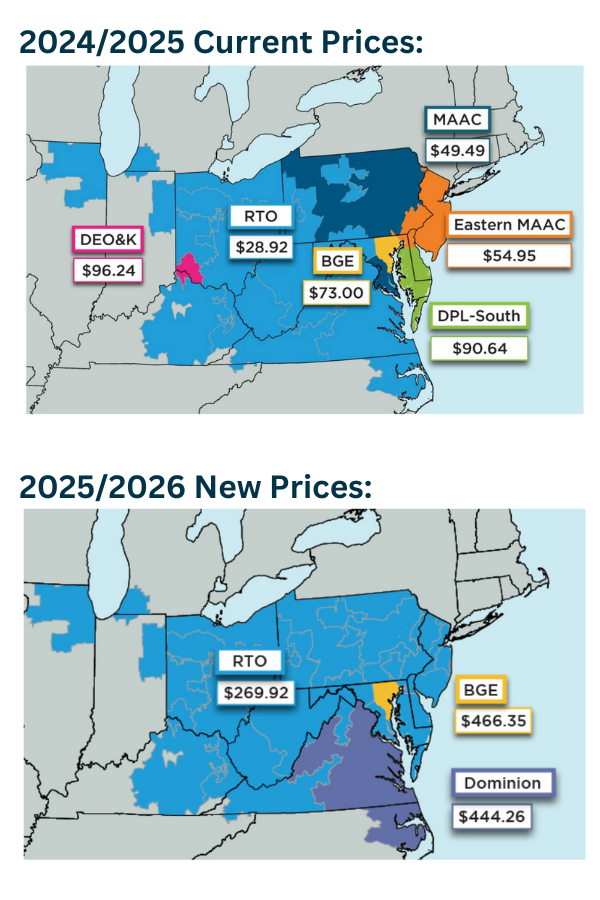

The recent capacity auction for the 2025/2026 delivery year resulted in record-high prices of $269.97/MW-day for much of the PJM footprint, compared to much lower prices for the 2024/2025 auction (see graphic below). This significant increase was driven by a combination of tighter supply, higher demand, and new market rules approved by FERC. The highest prices were seen in the BGE and Dominion Zones, which are transmission capacity constrained, leading to prices of $466.35/MW-day and $444.26/MW-day, respectively.

Why The Sudden Increase In Capacity Costs On PJM?

Several factors contributed to the sharp increase in capacity prices:

- Power Plant Retirements: The retirement of several power plants reduced the available capacity by approximately 6,600 MW compared to the previous auction.

- Increased Demand: The projected peak demand for electricity increased from 150,640 MW to 153,883 MW.

- Market Rule Changes: FERC-approved market reforms, including improved reliability risk modeling for extreme weather and capacity accreditation that more accurately values each resource’s contribution to reliability, played a role in the higher prices.

What This Means For Ratepayers

For commercial customers and ratepayers, the increase in capacity prices means higher electricity bills starting in June 2025. The average commercial customer can expect their electric bill to increase by an additional 2-4¢ per kWh, potentially leading to a 20-30% rise in overall energy costs. This significant jump will impact operating expenses and may necessitate budget adjustments and cost-saving measures.

Other Ways To Combat Capacity Costs

To combat rising capacity prices, businesses can explore several strategies:

- Invest in Solar Energy: Installing a commercial solar system can help offset electric demand and reduce capacity obligations. Solar power generation directly lowers the amount of electricity drawn from the grid, mitigating the impact of higher capacity costs.

- Power Purchase Agreements (PPAs): Entering into PPAs with solar providers can secure lower electricity rates, potentially up to 50% cheaper than future grid rates.

- Battery Storage Systems: Coupling solar installations with battery storage systems can help businesses avoid capacity costs altogether by relying on stored energy during peak demand periods.

How Diversegy Can Help

Diversegy specializes in helping businesses navigate complex energy markets and manage their utility costs. Our team of experts can conduct comprehensive utility audits to identify areas for cost savings and efficiency improvements. By analyzing your energy usage and capacity obligations, we can recommend tailored solutions to mitigate the impact of rising capacity prices.

Our services include:

- Utility Bill Audits: Identifying billing errors and discrepancies to ensure you are not overpaying for utilities.

- Energy Procurement: Securing competitive energy rates and contracts to optimize your energy expenses.

- Commercial Solar Solutions: Assisting with the installation of solar systems and negotiating PPAs to lower your electricity costs.

- Energy Efficiency Consulting: Advising on energy-saving measures and upgrades to reduce consumption and peak demand.

Need Help Navigating This Current Market Change?

The recent surge in PJM’s capacity prices for the 2025/2026 delivery year presents a significant challenge for commercial customers and energy brokers. Understanding capacity charges and exploring strategies to mitigate their impact is crucial for managing operating expenses and maintaining financial stability.

At Diversegy, we are committed to helping businesses navigate these challenges and optimize their energy costs. Contact us today to learn how we can assist you in securing a more stable and cost-effective energy future. Let our expertise guide you through the complexities of capacity charges and energy management, ensuring your business remains resilient in the face of rising costs.