The deregulated energy markets are quite complex, and seasonal energy pricing makes shopping for energy even more difficult. With supply and demand driving volatility in the market, it’s important to understand seasonal patterns that ultimately affect the price that you pay.

In this article, we will discuss the factors affecting energy prices, timing strategies to secure the lowest rates, different rate structures offered by retail energy suppliers and more. Stay tuned to uncover proven strategies to pay less for energy at your business or organization.

Factors That Impact Energy Pricing

There are several factors that affect the electricity and natural gas markets in the United States. Unlike the stock and bond markets, commodities have a physical component and are greatly influenced by real-world conditions. Let’s explore some of these influences in more detail.

Supply & Demand

Supply and demand are the primary driving factors in the short-term index energy markets. When supply outweighs demand, prices fall, and when demand outweighs supply, prices rise.

Some of the external factors influencing supply and demand include weather patterns, fuel availability, and consumer usage cycles. In the Winter, for example, when heating demand from consumers is high, if there is not enough supply available in the market to meet demand, prices skyrocket.

Fuel Types

In order to understand the full impact of supply and demand dynamics, we need to look at the various fuel types in the market. In the U.S. electricity generation sources are comprised of both fossil fuels and renewable energy production. Almost 60% of electricity in the country comes from natural gas, so when gas prices are high, electricity prices follow. Natural gas prices are solely driven by supply and demand dynamics in the market. Each week, the EIA published a natural gas storage report to indicate the total amount of available working natural gas in the market. When storage levels are low and demand is high, gas prices tend to rise.

On the other hand, renewable energy generation is somewhat consistent. Once a wind turbine or solar field is constructed, the unit cost to produce electricity remains somewhat stable. However, due to the intermittent nature of these generating sources, they are not readily available (i.e. the sun is not shining or the wind is not blowing).

Market Conditions

Global geopolitical events, such as the Russia-Ukraine conflict, can have a worldwide impact on energy prices. At the start of this conflict, European gas prices skyrocketed causing the EU to put in place a gas price cap. Because Europe relies heavily on Russian gas, the war disrupted supply. Furthermore, the U.S. began exporting liquified natural gas (LNG) to Europe in order to fill the supply gap. This placed additional pressure on U.S. natural gas causing prices to spike. In the power markets, regulatory changes such as the recent spike in PJM capacity prices also impact markets and drive up prices for consumers.

Utility Tariffs

When dissecting the anatomy of a utility bill, utility delivery charges can compound energy prices for consumers. These charges are driven directly by utility tariffs, which allow utilities to recoup capital investments in infrastructure (gas pipelines and local utility lines). When investment increases, so do tariffs, causing a net impact on ratepayers.

How Seasonal Trends Impact Energy Prices

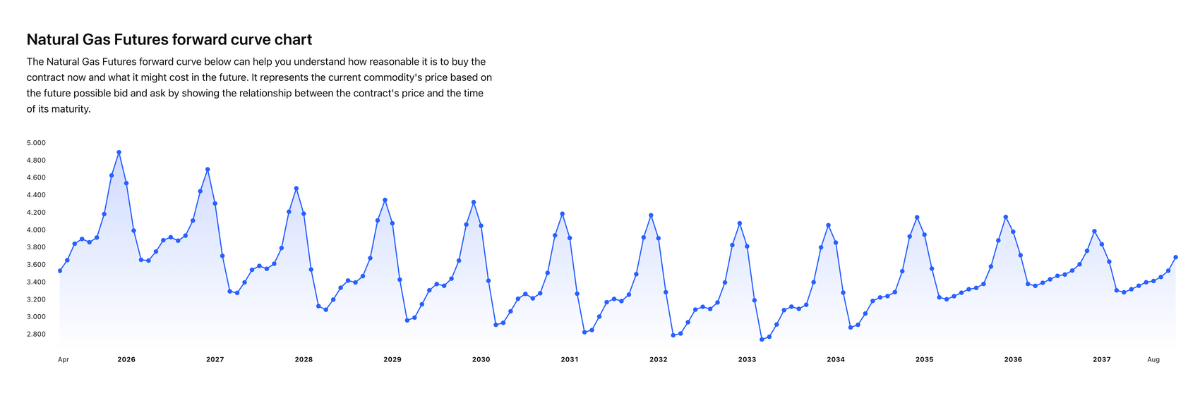

Seasonal energy pricing is the variation in electricity and natural gas rates based on the time of year. If you look at the natural gas forward curve chart below fromTrading View, you will notice that prices are always cyclical. They always rise in the Winter, and fall during the rest of the calendar year.

Natural Gas Forward Curve Chart

While the total price for natural gas can shift up or down based on external factors, it always follows a seasonal trend as evidenced above. This ultimately affects utility rates during these Winter months, and further drives deregulated market prices offered by suppliers.

When Are Electricity Rates Lower?

In order to understand when electricity rates are lower, we need to evaluate both the futures and index electricity markets.

Index Electricity Market

The index, or spot, electricity market is the price of electricity on a daily, or hourly, basis. Prices in these markets typically follow seasonal trends based on demand. The Winter and Summer months are known as peak seasons when demand is high from heating and cooling. The Spring and Fall months, on the other hand, are known as shoulder seasons, which are typically periods of low energy demand (and prices). Please note that unexpected impacts on demand or supply and disrupt these trends, causing prices to fall in peak periods or rise in shoulder months.

Electricity Futures Market

The futures market differs from the spot market in that futures allow buyers and sellers to transact at prices based on future delivery dates. Ultimately, the futures price must meet the spot price; however, these prices are often driven based on speculative outlook on the market. If traders believe that supply will outperform demand next year, and they act accordingly, then futures prices can trade lower than spot prices. This phenomenon is known as market backwardation. On the other hand, when there is uncertainty in the market or lots of buying of futures contracts, future prices can be higher than spot prices. This is known as contango.

Are Electricity Rates Higher In Summer Or Winter?

Electricity rates are typically higher in the Summer than in the Winter. In most regional electricity markets, the peak of consumer load happens during the Summer months, driving up demand and prices. Summer demand is driven primarily by AC usage. Winter demand, the the other hand, is driven by heating, which ultimately affects the price of natural gas. In regions heavily reliant on natural gas electricity generation, this can also impact electricity prices.

What’s The Best Time Of Year To Lock In Energy Rates?

If you’re looking for the best time of year to lock in energy rates, you need to consider the cyclical nature of the energy forward curve. This curve differs for electricity and natural gas. Let’s look at both markets in more detail.

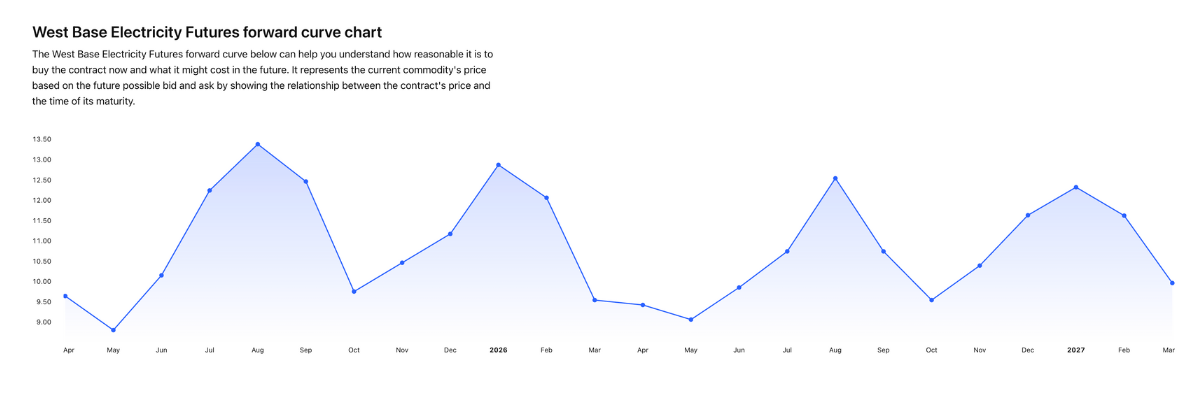

Electricity Forward Curve

The electricity forward curve spikes in the Winter and Summer months (peak periods) and falls in the Spring and Fall months (shoulder periods). In order to get the best price for a fixed electricity contract, you should look at locking in a term that contains more shoulder periods than peak periods. For example, a contract beginning in March 2025 and ending in May 2026 contains three shoulder periods (March 2025 – May 2025, Sept 2025 – Nov 2025, March 2026 – May 2026) and two peak periods (June 2025 – Aug 2025, Dec 2025 – Feb 2026). This price term (14 months) will almost certainly be lower than a 12-month contract, which will contain two shoulder periods and two peak periods. The chart below from TradingView illustrates the power forward curve:

Natural Gas Forward Curve

The natural gas forward curve follows a different pattern, spiking only in the Winter months. When locking into a fixed natural gas price, it’s advantageous to have your contract term contain more off-peak periods than peak periods. For example, a 21-month fixed natural gas contract starting in March 2025 will almost certainly be lower than a 12-month contract. The 21-month contract allows you to capture 18 off-peak months and 3 on-peak months, while the 12-month contract contains 8 off-peak months and 3 on-peak months. Now, much of this pricing is driven by futures contract pricing. If futures are in contango and trading higher than spot prices, you still might elect for a shorter-term deal. It’s best to seek the counsel of a seasoned energy broker to guide you through your price options and to explain market conditions so you can make an educated decision.

Finding The Best Energy Deal

Finding the best energy deal for your business can be challenging as volatile market conditions and contract price structure ultimately determine your total cost. Here are some tips when shopping for energy.

Use A Broker

Choosing a commercial energy broker to negotiate the purchase of energy on your behalf can be quite favorable. Brokers understand market trends and supplier pricing. They can help you evaluate your energy load, calculate business energy consumption, and match you with the best plan based on your specific needs and budgetary considerations.

Watch The Market

Using data analytics tools to watch the energy markets for strike prices is another great way to time the market. For example, you might have an energy contract that lasts another 12 months; however, in order to pay less for energy in the future, it’s important to back into the numbers to determine the target price you must hit in order to meet your future budget goals. Hiring an energy broker can be a strategic move as brokers have access to market data and price signal tools to alert you when futures prices are trading at or below your target price.

Avoid Teaser Rates

Today, there are many energy supplier offers available to consumers online. Unfortunately, many of these rates appear to be attractive but are designed to be short-term teaser rates. These companies attempt to bait companies into switching to these plans with a goal of charging a higher price after the contract expires. It’s best to evaluate the differences between shopping for energy online vs. using an energy broker and to weigh the benefits and drawbacks of doing it yourself. A seasoned energy broker understands the pitfalls to avoid and common problems with energy suppliers.

Types Of Price Structures To Consider

When contracting with a retail energy provider, there are many different price options available. You must evaluate the benefits of these various price structures based on your budget goals and risk tolerance. Here are some common energy plans offered in deregulated energy states.

Fixed Rates

Fixed rates allow consumers to lock in energy prices for an extended period of time. Suppliers utilize futures markets to secure energy supply for consumers at a predetermined price. These rate plans are best suited for businesses looking for budget certainty; however, they assume the risk of the market dropping during their contract term and ultimately paying a premium for the fixed rate.

Variable Rates

Variable energy rates, on the other hand, follow the energy index market. These prices fluctuate monthly, or hourly, based on the actual price of energy. Many larger users elect to float some or all of their energy on the index market as these products do not come with the same risk premiums associated with fixed-rate contracts. Consumers on variable plans assume the risk of the market, but can roll these rate plans into fixed contracts at any time.

Hybrid Plans

Hybrid energy contracts, such as block + index rate plans, allow consumers the best of both worlds. In these price structures, some energy can be fixed in the forward market, while other volumes can be purchased on the spot. These contracts allow for greater flexibility and give larger users the ability to carefully plan their energy strategy. Some businesses utilize hybrid plans to protect themselves from volatile periods with fixed pricing and take advantage of lower, index prices during off-peak periods.

Switching Plans To Leverage Better Pricing

If you’re interested in taking advantage of better energy pricing for your business, you need to learn how to switch energy suppliers. Oftentimes, you can leverage the fact that you are a new customer in order to negotiate more favorable terms. It’s important, however, to understand energy contract language and to avoid unfavorable contract terms, such as auto-renewal clauses, energy pass-through adjustments for transmission and capacity rate increases, and egregious early termination fees.

Need Help Shopping For Energy?

Understanding seasonal energy pricing is essential for businesses looking to reduce energy costs and improve budget certainty. By tracking when prices are typically lower, energy buyers can strategically lock in rates before seasonal demand drives prices higher. Taking a proactive approach to energy procurement not only protects against market volatility but can also result in significant long-term savings. Working with a trusted energy advisor ensures that your business navigates these seasonal patterns effectively and avoids costly missteps.

At Diversegy, our team has over 100 years of combined experience advising our commercial and industrial energy customers on the market, contract terms, and the best times to buy energy. Contact us today to explore your seasonal energy pricing strategy.