In the complex world of electricity markets, various entities play critical roles in ensuring that power is generated, transmitted, and delivered efficiently to end-users. One such entity is the Load Serving Entity (LSE), also known as a retail electricity supplier or a utility company. LSEs act as an intermediary between the wholesale energy market and energy consumers. They are responsible for purchasing electricity from the wholesale market and ensuring it reaches businesses and households reliably. Understanding the role of LSEs is essential for anyone involved in the energy industry, as they significantly impact how electricity is priced, distributed, and regulated. In this article, we’ll dive into what a Load Serving Entity is, the different types of LSEs, how they operate within the electric grid, and how they influence the price of electricity.

What Is A Load Serving Entity (LSE)?

A Load Serving Entity (LSE) is an entity that has the right and responsibility to provide electrical power to end-users. These entities can be either regulated utilities or third-party electricity suppliers operating within a deregulated electricity market. The primary role of an LSE is to ensure that its customers have a consistent and reliable supply of electricity. This involves purchasing power from the hourly wholesale energy market and managing the distribution of that power through the electric grid to end-users.

LSEs are legally obligated to supply electricity to their customers, whether they are regulated utilities or retail electric suppliers. In many cases, LSEs also serve as demand aggregators, pooling the demand of their customers to negotiate better rates and manage energy procurement more effectively.

LSE entities procure, sell, and schedule electricity for delivery, acting in each aspect of the electricity supply chain.

The Different Types Of Load Serving Entities (LSEs)

LSEs can generally be classified into two main categories:

1.) Regulated Utilities

These are traditional utility companies that operate in regulated and deregulated energy markets. They are typically granted a monopoly over electricity supply within a specific geographic area and are regulated by federal, state, and local authorities. These utilities are responsible for all aspects of electricity delivery, from generation to transmission and distribution, and they often own the infrastructure used to deliver electricity to customers.

2.) Unregulated Competitive Retail Suppliers

In deregulated electricity markets, unregulated LSEs, also known as competitive retail suppliers, provide an alternative to traditional utilities. These entities compete for customers by offering various energy pricing structures and products. They do not own the transmission or distribution infrastructure but instead, purchase electricity from the wholesale market and deliver it to customers using the existing grid, often offering more flexible or cost-effective options.

How Do LSEs Operate Within An Electric Grid?

LSEs play a crucial role in the operation of the electric grid, ensuring that electricity is available to meet consumer demand at all times. Here’s how they operate within the grid:

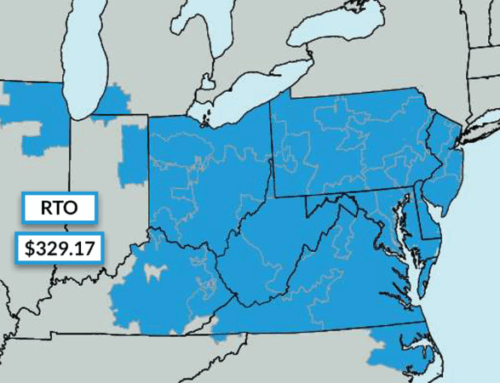

Becoming Members Of The Grid

LSEs must first become members of the regional transmission organization (RTO) or independent system operator (ISO) that manages the electric grid in their area. This membership allows them access to the wholesale energy market, where they can purchase electricity to meet their customers’ needs. Becoming a member involves meeting specific regulatory requirements, posting liquid collateral, and obtaining the necessary licenses to operate within the grid.

Responsibilities Of LSEs

LSEs are responsible for forecasting their customers’ electricity demand daily and purchasing enough power from the wholesale market to meet that demand. They must also comply with energy regulation standards, such as ensuring the reliability and security of the power supply. LSEs are also required to pay for the capacity necessary to ensure that there is enough electricity supply to meet peak demand, a cost that is often passed on to customers through electricity rates. Additionally, LSEs must pay for the transmission of electricity from power plants to local utilities for distribution. These costs are often passed through to end consumers in their total rate for electricity.

Wholesale Billing

Once an LSE has purchased electricity from the wholesale market, it is billed by the grid operator for the power it procured. This billing includes the cost of the electricity itself, as well as additional charges for transmission, capacity, and ancillary services. The LSE then bills its customers based on their usage, factoring in these wholesale costs along with any additional fees or margins.

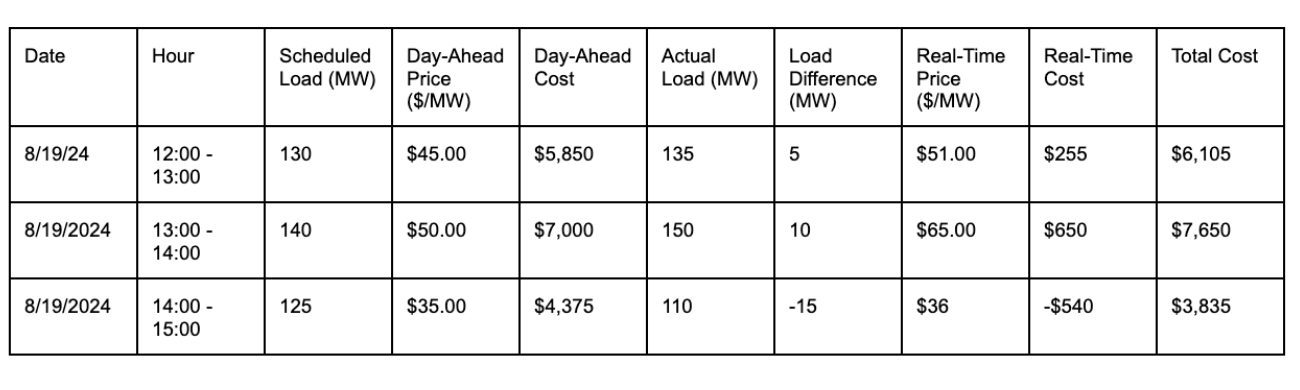

In most electric grids, there are two types of hourly markets: the day-ahead market and the real-time market. Each day, an LSE (Load Serving Entity) must predict the total hourly electricity usage of all its customers and schedule (purchase) that amount of power in the day-ahead market. On the following day, if the actual usage exceeds what was forecasted, the LSE needs to buy the extra electricity at the real-time market price, which can vary each hour. Conversely, if the LSE bought more power than was needed for any given hour, it must sell the excess back to the market at the real-time price. The LSE’s monthly bill from the grid operator will show a line item for each hour of the period, reflecting these transactions.

It might look something like this:

How Do LSEs Impact The Energy Market And Customers?

The role of LSEs in the energy industry is significant, as they directly impact the pricing, reliability, and availability of electricity for consumers. Here’s how they influence the market and customers:

Hedging To Manage Costs:

To protect themselves from volatile wholesale energy prices, LSEs often engage in hedging strategies. Hedging involves securing fixed-price contracts using financial instruments that lock in electricity prices over a specific period. This approach helps LSEs manage the cost of electricity procurement and provides customers with more predictable pricing. These active transactions create a very liquid wholesale electricity trading market.

Retail Products Offered By LSEs:

LSEs offer a variety of retail electricity products to their customers. These can include fully-bundled fixed-rate plans, where customers pay a consistent price per kilowatt-hour (kWh) regardless of market fluctuations, and variable-rate plans, where prices can change based on market conditions. Other options may include time-of-use plans, where prices vary depending on the time of day or season. LSEs can also use their access to wholesale prices to offer pass-through products and block + index energy contracts.

Wholesale Sleeve Products For Large Customers

For large energy consumers, LSEs may offer wholesale sleeve products. These products allow customers to use the LSE’s license and access to the wholesale grid to purchase electricity at wholesale rates, often with a small fee for the service. This arrangement provides large customers with the benefits of wholesale pricing without the need to become a direct participant in the wholesale energy market themselves. There is also no risk for the LSE as the consumer assumes all financial obligations.

Interested In Learning More?

Load Serving Entities (LSEs) are vital players in the electricity markets, acting as the bridge between the wholesale energy market and end-users. Whether regulated utilities or competitive retail suppliers, LSEs ensure that electricity is available and reliably delivered to businesses and households.

At Diversegy, we are committed to helping businesses navigate the complexities of the energy market. Whether you need assistance in understanding your electricity supply options, managing costs, or participating in an LSE sleeve deal, our team of experts is here to help. Contact us today to learn how we can help your business achieve greater energy cost savings.