Energy market volatility poses a significant challenge for commercial and industrial energy users, impacting budget stability and operational costs. As prices fluctuate due to geopolitical tensions, changes in supply and demand, energy regulatory policies, and other unpredictable factors, businesses find themselves at the mercy of a market that can shift dramatically and without warning. This volatility not only complicates financial planning and risk management but also affects long-term investment decisions and competitiveness. In this blog, we will explore the complexities of energy market volatility, its implications for commercial and industrial users, and how Diversegy implemented sophisticated strategies to mitigate these risks for one of its energy customers.

Energy Market Volatility: The Current State Of The Energy Market

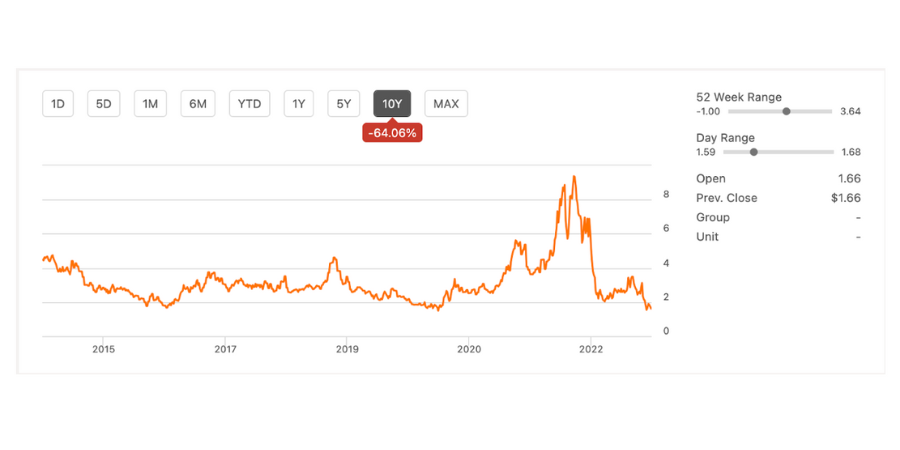

Although the energy market saw lots of volatility during and after the pandemic, with prices reaching 15-year highs, current energy prices are trading quite low. If we look at a 10-year price chart of U.S. natural gas NYMEX contracts, we will see that levels are trading today as low as they were in 2019:

Many energy market experts predict volatile energy price trends in 2024 with the uncertainty of the coming election, Russia-Ukraine escalating tensions, and the unknown impact of environmental energy policies on the market.

As a commercial or industrial energy consumer, this uncertainty can mean higher energy futures contract costs, expensive long-term fixed-rate energy contracts, and other energy industry challenges. In order to best navigate these volatile times, it’s best to consider hiring an energy broker and utilizing their expertise.

How Energy Price Volatility Impacts Customers

There are several ways that price volatility can impact energy customers. Let’s explore some of the common challenges we see facing our customers in today’s energy market landscape.

Effects On Budget Planning

For those businesses that require stable energy costs to be profitable, multi-year budget planning is a must. When energy markets are volatile, however, this can create quite a challenge. When locking into a longer-term energy supply contract, the business runs the risk of losing money if the market drops. On the other hand, less-expensive, shorter-term deals can leave them exposed to higher future prices. Learning how to navigate these uncertain waters is critical for success and for achieving energy cost goals.

Cost Of Goods Sold

Some manufacturers and producers rely on energy in the production of their products. Oftentimes, the electricity and/or natural gas used in the manufacturing process is recorded under the cost of goods sold and has a direct impact on the business’s total cost of production. When energy prices are volatile, increased manufacturing costs can lead to lower profit margins and can even cause bankruptcy in the most extreme cases.

Future Investment

Without budget certainty, investment into new businesses or existing business infrastructure can be troublesome. For example, if a plastics manufacturer is considering acquiring a competitor’s business, they will want to consider their profit and loss statements. Assuming certain energy costs will play a role in the valuation of the business. If energy costs suddenly spike after the acquisition, the producer could not be as profitable as he/she first predicted. This can lead to hesitancy when investing in the business.

Ways To Manage Volatile Energy Prices

Despite these challenges and setbacks, there are several ways to manage volatile energy markets to achieve price certainty for your business. Here are some recommendations directly from Diversegy’s energy management team.

1. Have An Energy Budget

Although it might seem obvious, our first recommendation is to have an energy budget. We find that many businesses are at the mercy of the market and simply paying current energy prices with no regard to budget. Even if you cannot achieve your budget goals, it’s best to start with a budget in mind and back into the numbers.

2. Calculate Your Target Prices

After you set a budget goal, determine the energy consumption in your business. Calculating business energy consumption might seem complicated, but most utility bills have charts that outline total monthly and annual energy consumption. When you know your energy usage, you can calculate the total price for energy you must pay in order to meet your budget. Remember when dissecting your energy bill that there are two parts of the bill: supply and delivery. Supply costs are determined by energy supplier or utility rates, while delivery costs are based on energy tariff schedules.

3. Pick A Plan

Determining the best-fit utility tariff for your business can be achieved by conducting a utility bill audit. The audit should outline the various rate schedules available and project the cost of each plan. Next, it’s time to start shopping for energy suppliers. When choosing an energy plan for your business, keep in mind the contract length, total price, and price components. Remember, there are fully bundled energy rate premiums and other hybrid energy plans that pass through certain charges. It’s best to consult the services of an energy brokerage firm when negotiating with energy suppliers.

4. Watch The Market

After you’ve enrolled in an energy plan, it’s time to start watching energy futures for price spreads so that you can renew your energy contract at a lower rate. Let’s face it, you do not want to simply wait until your contract expires to renew. If you do, you will pay whatever the market dictates. Staying ahead of the curve and locking in future prices when they are low is a great way to achieve your budgetary goals.

Diversegy Case Study

Through our diligent tracking of the energy futures market and detailed approach to helping our customers achieve their budget goals, we have been successful in navigating volatile energy markets. Here is a recent case study that allowed this particular customer to beat the market by over 40%:

Customer Overview

- Customer Type: Municipal Water Authority

- Annual Electricity Costs: $600,000

- Budgetary Goals: Reduce spend by 3% each year

Results:

- May 2016: Diversegy contracted an electricity supply contract beginning in January 2017 and ending in January 2020. The total price for the electricity contract is projected to result in an annual spend of $570,000

- February 2017: Three months into the customer’s new electricity contract, Diversegy’s team noticed that calendar years 2020 and 2021 were trading 10% lower than when the customer first contracted.

- March 2017: After negotiations with several retail energy suppliers, Diversegy contracted a new electricity supply contact beginning in January 2020 and ending in January 2022. This new contract resulted in an approximate budget reduction of 10% for the customer.

- August 2019: The Diversegy market team noticed that calendar year 2022 was trading significantly lower than when the customer last contracted. Diversegy contracted a new electricity supply contract beginning in January 2022 and ending in January 2024. This new contract allowed the customer to reduce their budget by approximately an additional 10%.

- Present Day: Due to the contract entered in August 2019, the customer is currently paying electricity prices that are close to 40% less than the current market, saving almost an additional $250,000 per year.

Need Help Navigating Volatile Energy Prices?

As evidenced by the case study above, our team’s approach to the energy market is unique and effective. Unlike other energy brokerage companies that simply renew contracts when they come due, our team actively monitors the futures market looking for price opportunities that save our customers money and help them to achieve their budget targets. Contact us today to learn more about our energy purchasing strategies.