Locking in natural gas prices at the wrong time can cost your business, or your customers, thousands of dollars overnight. Yet many pricing decisions are still made without a clear understanding of what actually moves the natural gas market. Supply constraints, weather-driven demand spikes, storage levels, and global events all collide to create volatility that punishes guesswork and rewards strategy. In this article, we break down the real supply-and-demand forces behind natural gas pricing, and how understanding them leads to smarter timing, lower risk, and better price outcomes.

Understanding Supply & Demand

Supply and demand from a purely economic perspective is the measurement of the amount of a commodity, product or service, relative to its buyer’s desire to purchase it in the market. Economists claim that when supply is high relative to demand, prices tend to fall, and vice versa. Here is a simple chart outlining the supply and demand curve and their impact on market prices:

In the natural gas sector, supply and demand are the main driving forces behind the price of the commodity. When natural gas production is high and is greater than the current demand for gas, then prices are usually low or falling. And, when natural gas is in high demand for any reason, if supply cannot keep up, then prices tend to rise. Next, let’s explore the factors that affect natural gas supply and demand.

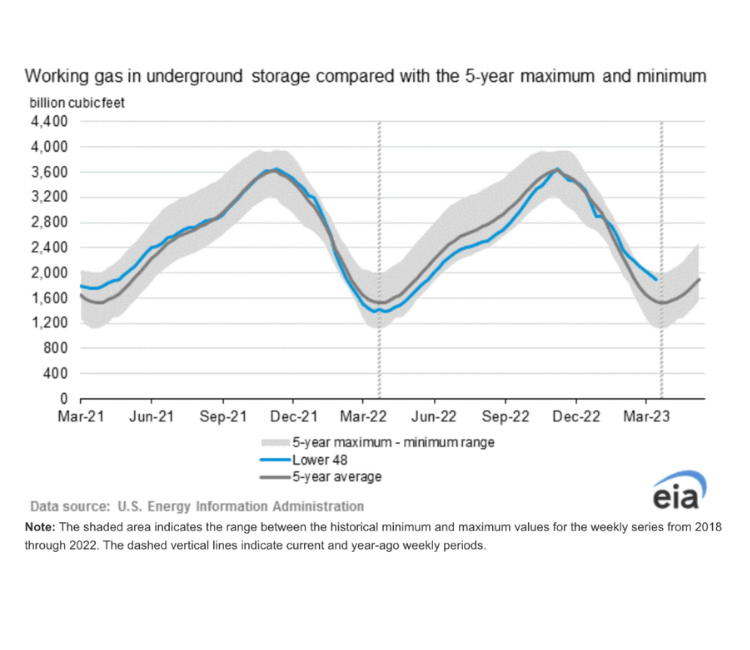

Natural gas supply and demand is largely driven by these market forces. Each week, when the natural gas storage report is published by the EIA, prices move. This report represents the total amount of natural gas supply available in the market. When supply is high, prices tend to fall, and vice versa. Some other factors affecting natural gas prices include power demand, drilling rig count, weather forecasts, and speculative outlook. We will dive deeper into these subjects below.

Factors That Affect Natural Gas Supply & Demand

There are many market forces at work in the natural gas sector. In this section, we will explore those factors affecting both supply and demand of natural gas. Let’s look at natural gas demand first.

Natural Gas Demand Drivers

To understand natural gas demand is to learn how gas is used in the physical market. When certain economic or political situations exist, they can create a higher demand for gas. Here are some of the top factors impacting natural gas demand:

- Weather (Largest short-term driver): Weather affects natural gas prices significantly. In fact, weather is the largest driver of short-term natural gas demand. When temperatures are cold, natural gas is in high demand to heat homes and businesses. On the flip side, when temperatures are very hot, natural gas is used to generate electricity for cooling.

- Economic Growth: Due to the price elasticity of natural gas, when the economy is booming and businesses are growing, this can place pressure on natural gas. Because natural gas is often used in many industrial processes and manufacturing, economic growth causes businesses to need more natural gas for their operations. In addition, close to half of all U.S. electricity production comes from natural gas, so when the economy is booming and businesses are using energy, natural gas becomes a critical element.

- Alternative Fuel Costs: When the prices of alternative fuels, such as petroleum or coal, are on the rise, some are able to replace those fuel sources with natural gas. In an economy where many businesses are able to switch between fuel sources easily, the prices of these fuels become inversely correlated. If it is more expensive to operate your facility using petroleum, one might start using natural gas to save money. In turn, this creates more demand for natural gas. Renewable energy generation can also impact reliance on natural gas as a power source. Businesses installing on-site renewable generation rely less on the fossil-fuel-centric grid.

Natural Gas Supply Drivers

Natural gas supply, on the other hand, is the measure of the total amount of natural gas available for consumption. When supply is high, prices tend to drop, and when it is low, prices rise. Here are some of the top factors that affect natural gas supply:

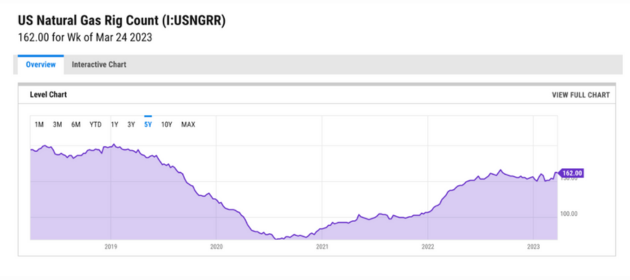

- Gas Production: When natural gas producers are drilling for gas, they are continually adding supply into the market. When production is low, for whatever reason, gas supply tends to drop.

- Net Imports: Another factor affecting the supply of gas in any market is the total net imports into the country or market. Some regions, and even countries, send gas to each other. When net imports are high, there is more supply in the given market.

- Oil Prices: When oil prices are high, oil production climbs. Since natural gas is a byproduct of oil drilling in many regions, the total supply of natural gas tends to increase when oil drilling is on the rise.

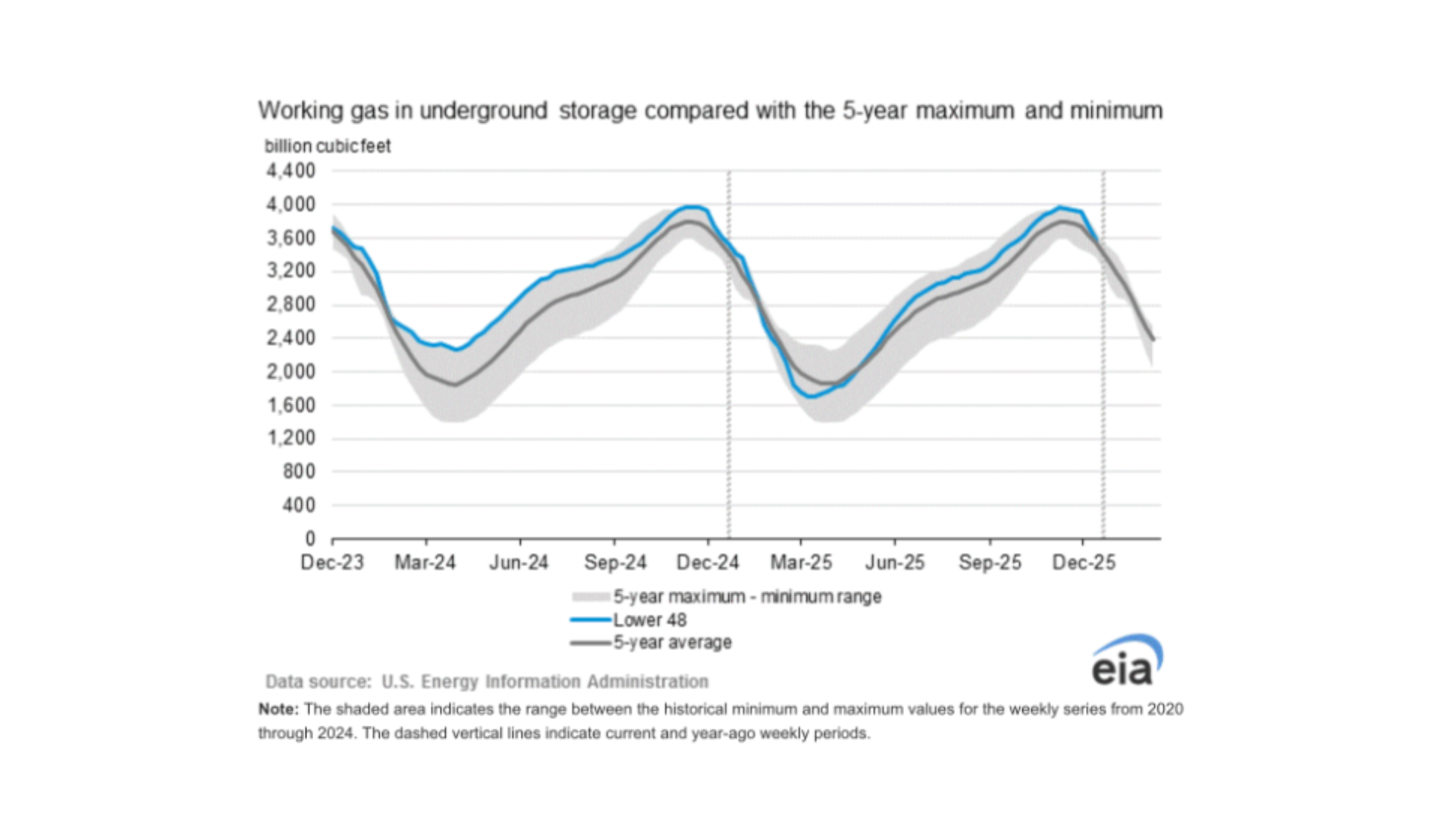

- Storage: Finally, the total amount of storage of natural gas is a big factor affecting supply figures. April 1 through October 31 is considered “injection season” in the natural gas market when natural gas is stored for higher-demand Winter months. These storage figures are reported weekly, and the total amount of storage affects natural gas prices. Here is an example of a natural gas storage chart reported on by the EIA:

Europe And Natural Gas Supply & Demand

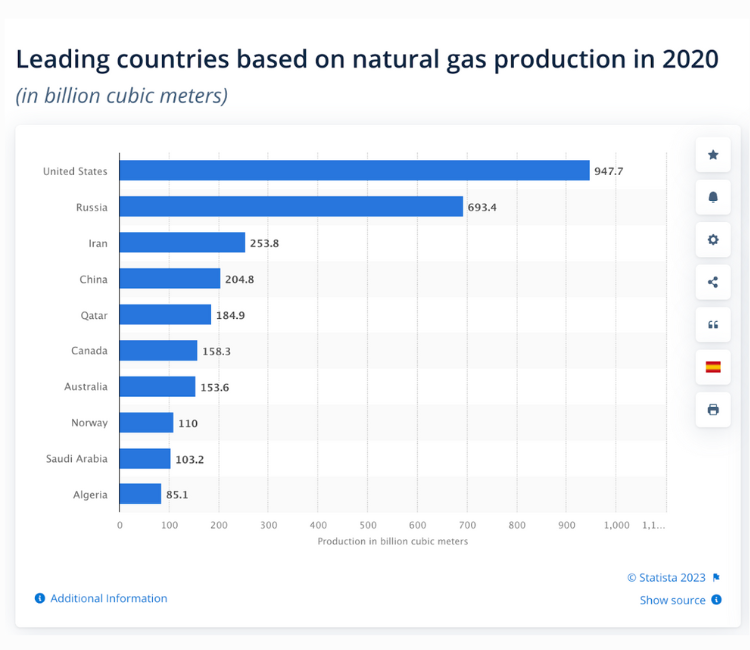

Since most European countries do not produce natural gas, they rely on other countries like Russia and the United States for natural gas imports. As we have seen recently with the Russia-Ukraine War, this can create lots of stress on the European energy economy. Since natural gas supplies from Russia were interrupted, energy prices in Europe soared (remember, when supply is low prices rise). This even forced European lawmakers to enact a European gas cap so that consumers did not have to pay extraordinarily high prices in the Winter.

Because European nations are at risk of not having enough natural gas supply, the United States has been exporting gas to Europe in its liquid form (liquified natural gas or LNG). The added European demand is another factor affecting U.S. natural gas demand and even caused U.S. prices to rise over the Winter.

The Global Natural Gas Market

While natural gas is used in many industrial processes, to produce electricity, and to heat homes, many countries do not have the resources to produce natural gas on their own. In fact, the United States is the world’s leading producer of natural gas followed by Russia. Many countries in South America, Asia, and Europe rely on Russian or American natural gas imports to survive. Check out the chart below outlining the top natural gas producers by country:

The Impact On The U.S. Market

Today, much of the world is turning to the United States for natural gas supply, which is having an impact on U.S. gas demand. Over the past several years, this added stress on U.S. gas caused prices to rise significantly. See the price chart below outlining the price of natural gas over the last 5 years:

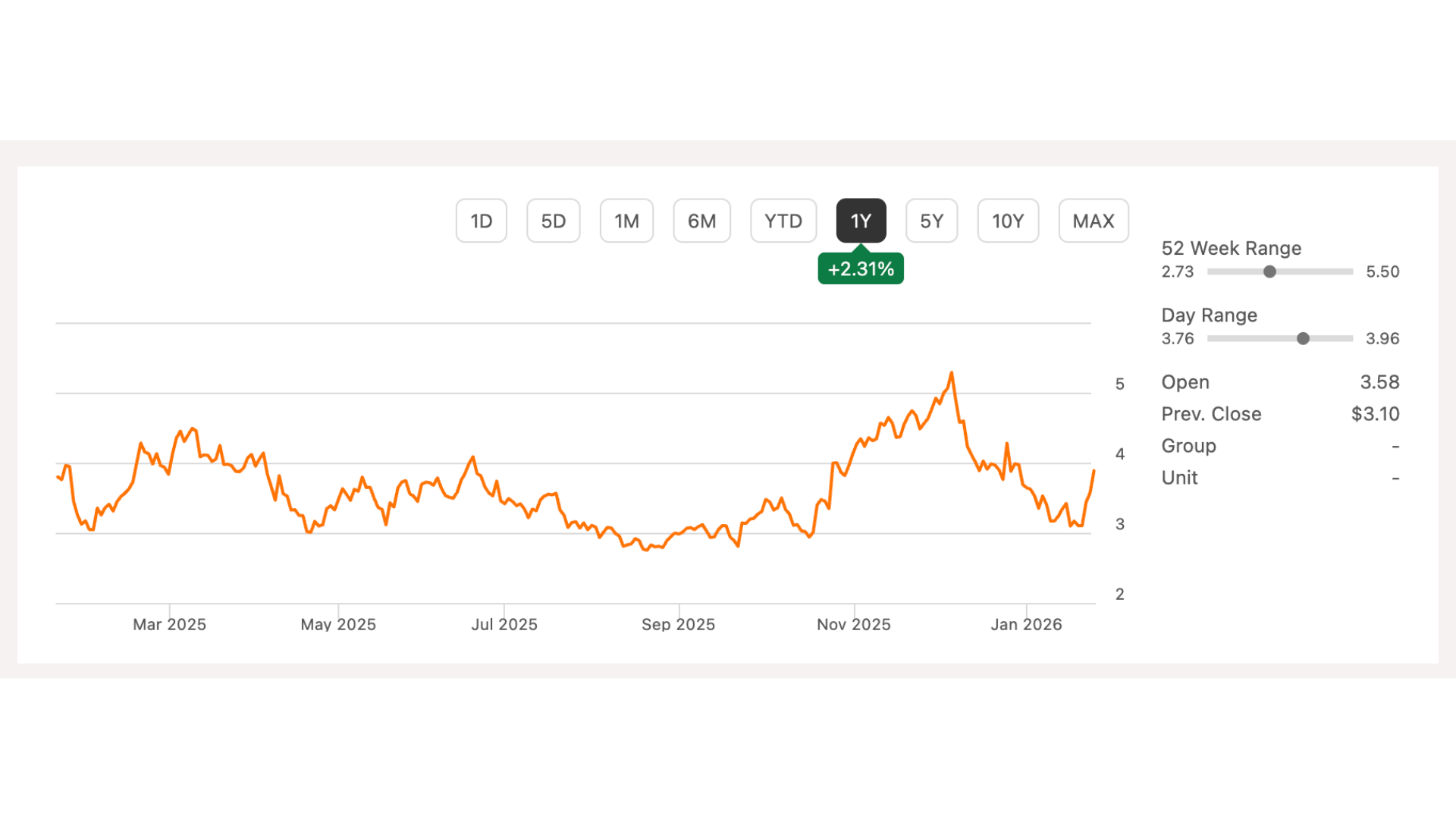

As you can see from the chart above, most of 2021 and all of 2022 saw drastic increases in natural gas prices. This was due to a number of factors including low supply levels and increased demand from Europe.

Impact On Retail Energy Price Decisions

For sophisticated energy buyers, utilizing market price data is essential to developing an effective energy procurement strategy. Since energy prices can be hedged years into the future, a good energy broker can help you monitor future prices for ideal hedging opportunities. For example, when natural gas futures contracts are trading low, a customer might elect to hedge some or all of their gas (or power) volume in response to market signals. This allows the customer to effectively create a fixed position through multiple market entries.

Thankfully, the United States has an abundant supply of natural gas resources and production is nearing all-time highs again. Although the amount of active natural gas drilling rigs in the U.S. reduced greatly during the pandemic, today production has ramped up significantly. Here is a chart showing current U.S. active natural gas production rigs:

2026 Natural Gas Price Forecast

2025 has been a historic year for natural gas, with much volatility hitting the market due to power demand from AI. As evidenced by the chart below, prices hit a low of $2.64/MMBtu in August and then skyrocketed to over $5.00/MMBtu a few short months later.

What is surprising to most market experts is that natural gas storage supply was at an all-time high during most of this volatile period:

Most natural gas professionals agree that the elevated prices are a direct result of power demand for natural gas. With the boom of AI, data centers have put a great deal of stress on the electric grid. In fact, in many RTO/ISO regions around the country, prices have soared as a result of this unforeseen load growth. Specifically, capacity prices on the PJM network spiked over 500% in many areas. This constant need for power is keeping natural gas in high demand, and causing great volatility in the market.

Key factors influencing the 2026 outlook for natural gas:

- Power Demand: If natural gas-fueled power plants continue to be utilized to meet the grid’s desperate need of power generation, this will continue to create volatility in gas prices. Traditional fundamental economics do not apply to the current market conditions.

- On-Site Generation: Many large power consumers are turning to on-site natural gas generators to help supplement their power needs. The growth of natural gas generators is creating new demand and keeping prices elevated.

- Rapid LNG Exports: The export market for liquified natural gas (LNG) is the largest it’s been in history. As foreign countries continue to rely on U.S. LNG and new exporting facilities come online, this will add significant volumes of gas demand. LNG export volumes are forecast to rise substantially in 2026.

- Natural Gas Infrastructure: Pipeline and midstream expansions are needed to support higher flows from production sites to export terminals and major demand centers. Constrained infrastructure from permitting delays will support higher prices and sustained demand signals in 2026.

Natural Gas Risk Management for Businesses

In an effort to manage risk, many commercial and industrial energy users are turning to experts like energy brokers and consultants. There are several key advantages to hiring an energy broker to help you with your natural gas procurement strategy, including:

Strategy Analysis

First and foremost, it is critical to understand your natural gas load, when volumes are the highest, and to consider different hedging strategies to manage risk and reduce costs. An energy broker can help you evaluate your historical gas consumption and run financial models to demonstrate how various hedging strategies might perform.

Hedging Fulfillment

Once a strategy is confirmed, executing on the strategy is the bulk of the work. One must monitor natural gas futures prices daily to determine when markets are trading within your target range. When signals arise, it’s prudent to hedge some or all of your volume until you achieve your fully fixed position. It’s important to note that many customers believe executing a gas hedge while under contract is not achievable. Contrary to popular belief, the earlier you begin monitoring futures markets for hedging opportunities, the better chance you have of achieving optimal price targets.

Strategy Monitoring

One of the most common questions is: What happens if market prices do not align with my goals? Strategies must be monitored and adjusted in real time based on market conditions and trends. If it’s believed that target prices cannot be achieved, it might be necessary to adjust budget goals or product structure. It’s best to consult with a true professional who can manage your natural gas hedging strategy in real time.

Frequently Asked Questions

Looking For An Expert To Help You Navigate The Natural Gas Markets?

Our team of energy professionals has over 100 years of combined experience in the retail and wholesale energy markets. Not only do we have a deep understanding of the fundamental factors affecting price, but we also have access to real-time data to produce accurate forecasts. Whether you are looking for advice for your business, or you are an energy broker trying to advise your clients, we can help. Contact us today to learn more.