Energy brokers act as intermediaries between retail energy suppliers and customers in deregulated energy states. There are typically two types of energy brokers: residential energy brokers and commercial energy brokers. In this article, we will discuss what commercial energy brokers do, how they are paid, and everything else you need to know about their careers. The same reasoning applies to residential energy brokers with the exception being the type of customer with whom they do business.

In this article, you will learn the following. Click on any of the highlighted links in the box below to skip to that section of the page:

In this article, you will learn:

Don’t have time to read? Take this article with you!

What Is An Energy Broker?

Energy brokers act as liaisons in deregulated energy markets between retail energy suppliers and end-users. In a deregulated electricity market or natural gas market, retail energy suppliers (“REP”) purchase energy from the wholesale market and resell it to customers in the retail market. The REP’s charges typically will appear on the customer’s local utility invoice and the customer will still pay their local utility when purchasing energy supply from a third-party provider or REP. When customers decide to purchase energy from a supplier, they will enter into a retail energy supply agreement with the REP outlining the terms of the commodity supply (price, length, etc).

How Energy Brokers Grew So Fast

When energy deregulation first began, REPs hired their own salaried salespeople to acquire commercial and residential customers. In many deregulated states, there were also processes in place for Retail Energy Brokers to become licensed in order to also participate in the deregulated energy markets. Brokers set up relationships with REPs and acted as commission-only sales organizations for the suppliers. As the markets matured and more brokers became established, many REPs decided it was easier to sub-contract their sales efforts to energy brokers instead of hiring salaried salespeople. As this transition occurred, the energy broker channel grew rapidly. Today there are over 600 licensed energy brokers throughout the U.S.

Energy Broker Sales Proposition

Since energy brokers are not allowed to purchase energy but are simply permitted to sell retail energy contracts to consumers, energy brokers bring value to their customers through service and supplier competition. Since there are many retail energy suppliers offering pricing in deregulated markets, it can be overwhelming for a customer to vet supplier offers and decide which offer is the best. These offers are based on energy market prices and typically are only valid for 24 hours. It is a daunting task to obtain quotes from 30+ suppliers and compare them on the exact same day. This is where energy brokers offer value to their customers. Since brokers have established relationships with supplier price desks, it is simple for them to quickly obtain price quotes and present them to their customers. Energy brokers are also able to help their customers negotiate with energy suppliers to find the lowest price for energy.

How Energy Broker Quotes Work

Typically, an energy broker will put together a supplier comparison chart for his customers. This chart will display price quotes from all energy suppliers in $/kWh (Kilowatt-Hours), outline the various contract terms, and also detail special contract provisions. These comparison charts make it easy for customers to quickly compare quotes side-by-side and do an apples-to-apples comparison. This saves the customer time and the headache of having to organize these requests for proposals. In these ways and many more, energy brokers offer value to their commercial customers. See more on why to use an energy broker below:

What Makes Diversegy Different?

Most energy brokers operate as independent sales agents with limited supplier access and no back-end support. Diversegy combines licensed brokerage with proprietary technology and institutional backing (Genie Energy, NYSE: GNE), delivering advantages that standalone brokers cannot match:

- 60+ Supplier Relationships: Access to national and regional suppliers across all deregulated markets

- Real-Time Pricing Platform: Matrix pricing tools that eliminate 24-hour quote delays

- Transparent Commission Model: Supplier-paid fees with no hidden markup layers

- Multi-Market Licensing: Direct licensing in all major deregulated states; no sub-broker limitations

- Advisory + Execution: Strategic procurement guidance plus contract management (not just transactional quotes)

This infrastructure allows Diversegy to negotiate rates typically 8-15% lower than standalone brokers while providing enterprise-grade support to businesses of all sizes.

What Do Energy Brokers Do?

Commercial energy brokers engage in procuring energy supply for their electricity and natural gas customers. Energy brokers have agreements with multiple Energy Suppliers and offer price quotes from many suppliers to their commercial customers. In addition to procuring energy supply, there are many other things energy brokers do to bring value to their customers:

Contract Language

Professional energy brokers understand the legal energy contract language in retail energy contracts they offer to their customers. Energy supply rates can get complex with many different product offerings and conditions. Energy brokers help their customers understand things like capacity charges, bandwidth clauses, transmission charges, Kilowatt-Hours (kWh), pass-through charges, and more. Without an energy broker in their corner, customers would be forced to understand the details of the energy supply agreement themselves.

Supplier Vetting

All retail energy suppliers are not made equal. Some energy suppliers are very large, publicly-traded companies that own energy generation stations and have billions of dollars in revenue. Other suppliers are five employees in an office above an old mechanics shop (no kidding!). Helping their customers understand the prowess of the supplier and deciphering whether the supplier has the financial wherewithal to honor a fixed-price agreement is a true value energy brokers deliver. Customers get enticed by very low fixed-rate offerings by “fly-by-night” energy suppliers and are later disappointed when the supplier passes through other costs on their electric bill. Energy brokers can help their customers choose reputable suppliers and avoid energy scams.

Customer Service

Another thing energy brokers do on a regular basis is to offer customer service to their commercial customers. Utility issues and problems with energy suppliers are rare, but when they occur, the energy broker is available to help guide the customer through the problem. Whether it is a billing error or a billing question, energy brokers can help rectify the situation due to their direct lines of communication with energy suppliers.

See more on why to use an energy broker below.

How Do Energy Brokers Make Money?

Energy brokers earn a commission from retail energy suppliers for the total energy consumed by their customers over the length of a contract. Unlike energy consultants who charge a fee directly to the customer, energy brokers build energy broker fees into the total rate for energy that appears on the customer’s invoice. See more on Energy Brokers vs. Energy Consultants below).

In fact, energy broker licensing allows brokers to add margin to a retail energy supplier’s rate and earn a commission when the customer pays its bill. Since suppliers need to employ salaried salespeople to deal with direct customers, they add margin to their rates to cover the salesperson’s costs. Typically, energy brokers are able to obtain lower rates from suppliers than customers can directly, so the added broker fee or margin is many times not passed on to the customer. Here is an example of how energy brokers make money:

$0.060/kWh

The Energy Supplier has a total cost to purchase electricity or natural gas from the wholesale market. These costs move daily with the energy markets and differ based on the energy supply product offered.

+$0.005/kWh

The Energy Broker then adds a broker fee or margin to the retail energy supplier’s rate for electricity or natural gas. Suppliers allow brokers the discretion to choose their fee, but many times they are capped from adding too much margin.

$0.065/kWh

The Customer then pays the final price, which equals The Supplier Rate + The Broker Fee. The total price for electricity or natural gas is displayed on the customer’s utility invoice, and the customer is unaware of the broker fee.

In the example above, the energy broker added a total broker fee of $0.005/kWh to the supplier rate of $0.060/kWh, giving the customer a total energy price of $0.065/kWh. In this example, the supplier would pay the broker its fee of $0.005/kWh for every Kilowatt-Hour (kWh) of electricity the customer uses for the length of the retail energy supply contract. Many times, these commissions are paid monthly as the customer uses energy, and sometimes, the supplier will advance these commissions to the broker depending on their relationship. Here is what a typical commission statement might look like:

| Month | Electricity Usage (kWh) | Broker Fee ($/kWh) | Broker Commissions ($) |

|---|---|---|---|

| JAN | 24,000 | $0.005 | $120 |

| FEB | 27,000 | $0.005 | $135 |

| MAR | 12,000 | $0.005 | $60 |

| APR | 13,000 | $0.005 | $65 |

| MAY | 17,000 | $0.005 | $85 |

| JUN | 21,000 | $0.005 | $105 |

| JUL | 30,000 | $0.005 | $150 |

| AUG | 25,000 | $0.005 | $125 |

| SEPT | 16,000 | $0.005 | $80 |

| OCT | 15,000 | $0.005 | $75 |

| NOV | 20,000 | $0.005 | $100 |

| DEC | 21,000 | $0.005 | $105 |

Energy Brokers vs. Energy Consultants.

In the retail energy sector, there are many different companies and players: energy brokers, energy traders, energy consultants, and more. Further downstream, energy brokers and energy consultants deal directly with end-use customers to help them procure energy supply for their businesses. The main difference between an energy broker and an energy consultant has to do with how he is compensated. Energy brokers are compensated by energy suppliers by adding broker fees into retail energy rates. Energy consultants, on the other hand, are compensated by their clients for offering guidance and advice. Energy consultants, many times, also get involved in other areas of the energy industry. In addition to helping their customers with energy supply, consultants will advise on things like demand response, LED lighting, renewable solutions, wholesale products, and more.

What About Licensing For Energy Consultants?

Energy brokers are required to obtain licenses in certain deregulated states in order to add margin to retail energy prices. Energy consultants, on the other hand, are never required to get licensed as they collect fees directly from their customers. Unlicensed energy consultants are not allowed to add margin to retail supplier rates.

The Diversegy Hybrid Model

Diversegy operates as both licensed broker and strategic advisor, eliminating the traditional choice between transactional brokers and fee-based consultants. This hybrid approach delivers:

- Commission-based pricing (no client fees) with consultant-level strategic guidance

- Portfolio management across multi-site operations

- Ongoing market monitoring and renewal optimization (not one-time transactions)

- Utility bill auditing and cost recovery services typically offered only by consultants

Clients receive comprehensive energy management without consultant retainer fees or the limited scope of traditional brokerage.

When to Hire an Energy Broker.

Strategic timing maximizes broker value:

- 60-90 Days Before Contract Expiration: Optimal window for market analysis and supplier RFP process

- During Market Volatility: Brokers monitor futures curves to time fixed-rate execution

- Portfolio Expansion: Adding locations or increasing load triggers re-evaluation of aggregated pricing

- Utility Bill Anomalies: Unexpected cost spikes warrant audits and supplier performance reviews

- Sustainability Mandate Shifts: Transitioning to renewable supply requires PPA structuring expertise

Why Use An Energy Broker?

There are many advantages to hiring an energy broker for purchasing electricity or natural gas in a deregulated market. Most of the value a broker can deliver has to do with procuring low-cost energy for savings. After all, that’s the bottom line right? Energy brokers understand commodity markets and have supplier relationships to secure a low rate for your business that can save you on your utility costs. Furthermore, energy brokers understand how commodity markets trade and can continually monitor future prices to offer savings contract over contract.

In addition to price savings, having a reputable energy broker in your corner makes your job easier. When you have a utility billing issue, question, or you’re ready to shop for a new rate, simply calling your broker makes things convenient and simple. Companies that do not use energy brokers are forced to take these tasks on internally. If you are thinking about working with a broker, here are some tips on how to choose an energy broker for your business. Here are some advantages to working with a broker:

Energy Usage Evaluation

Did you know that you can qualify for lower energy supply rates based on your business’s energy usage patterns? An experienced energy broker will be able to evaluate your energy load profile and match you with the best supplier and price structure for savings. Without an understanding of load factor, energy usage, or peak demand, it can be challenging to find the best energy plans for your business or organization.

Market Guidance

Shopping for energy in a deregulated market is more than just finding the best rate for your business. It’s also knowing when to start shopping for a renewal rate. As a commercial enterprise, you can lock-in energy rates for the future when the market is low. An experienced energy broker can help you understand energy market prices and conditions, and can help you renew your energy contract at the right time.

Contract Negotiation

Energy brokers can also help you negotiate with energy suppliers for the best contract terms. Not all energy supply contracts are equal. Some have specific contract language that can be detrimental to your business if you are not careful. A knowledgeable energy broker will help you to understand the details of your contract and can even fight to help you get favorable terms with a supplier.

Utility Bill Audits

Errors on commercial utility bills are quite common. But, knowing when and if you are overpaying can be challenging if you are not familiar with utility tariffs and billing calculations. Some energy brokers offer utility bill auditing services to identify billing errors, correct mistakes, and even lobby for refunds. Contact us today to learn about our expert utility audit service.

Expert Advice

Commercial energy bills are complex, and understanding the anatomy of an energy bill can be a real challenge for most business owners. An energy broker can help you understand your energy bill, how it is calculated, and the best ways to reduce your energy expenses. Brokers can also answer your energy-related questions so you can better manage your budget.

These are some of the additional benefits you will get from using an energy broker:

Industries Served & Specializations.

Diversegy’s energy brokerage services extend across high-consumption sectors requiring specialized procurement strategies. Each vertical demands tailored contract structures—fixed vs. index pricing, bandwidth provisions, capacity charge strategies—that generic brokers often overlook.

Becoming An Energy Broker.

So you’re interested in becoming an energy broker? Great news! You’ve picked an exciting industry with lots of potential to have a very rewarding career. Now, there are several ways you can enter the market as an energy broker. We will explain each in detail below:

Start As An Agent

One way of entering the energy broker world is to start as an energy sales agent. Energy agents are individuals who act as energy brokers but do not need to go through the rigorous licensing process. In fact, energy agents can align with a licensed energy brokers and can sell energy under that broker’s license. Becoming an agent is quite simple and your broker will train you on everything you need to know to be successful. Here is some information on our Energy Agent Sales Program.

Become A Sub-Broker or Channel Partner

If you have an organization with multiple salespeople and you are thinking about setting up your own broker shop, a great first step might be to become a sub-broker under a larger licensed broker organization. There are many benefits to structuring your energy broker business this way including:

- Avoid rigorous regulatory compliance

- Get overnight access to deregulated markets with no licensing

- Sell for multiple energy suppliers without having to pass application processes

- Get better payment terms with upfront commissions to improve cash flow

- Gain access to support staff without having to hire employees

Starting an energy brokerage company is harder than ever. With more stringent supplier application processes, and less favorable commission payment terms, it is quite hard to get a new energy brokerage started. An alternative is to align with a larger broker who has a sub-broker program. These programs offer many benefits and allow you to have a turn-key energy brokerage company. Learn more about our Broker Partner Program Here.

Get Licensed

If you have the experience, financial backing, and ability to get your own energy broker license, we encourage you to do so. Be aware that this process is cumbersome and tedious and your application will be heavily scrutinized by each regulatory body. In addition, you will need to have staff keep up with ongoing compliance and reporting as well as handle the operations of your energy brokerage. In addition, you will need to forge relationships with energy suppliers and maintain enough deal flow with each supplier to keep your contract active. If you are interested in getting a license, here are the license requirements by state. Please refer to this key when referencing the chart:

- License Required = an energy broker’s license is required to sell either commodity

- No License Required = the state is deregulated for this commodity, but a broker’s license is not required to operate

- Limited Deregulation = the state offer limited deregulation and due to this a broker’s license is not required

- No Deregulation = the state is not deregulated for this particular commodity

| State | Electric Broker License | Nat. Gas Broker License |

|---|---|---|

| California | No license required | No license required |

| Colorado | No deregulation | Limited deregulation |

| Connecticut | License required | No license required |

| Delaware | License required | No deregulation |

| Florida | No deregulation | No license required |

| Georgia | No deregulation | No license required |

| Illinois | License required | No license required |

| Indiana | No deregulation | Limited deregulation |

| Iowa | No deregulation | Limited deregulation |

| Kentucky | No deregulation | Limited deregulation |

| Maine | License required | License required |

| Maryland | License required | License required |

| Massachusetts | License required | License required |

| Michigan | No license required | No license required |

| Montana | No deregulation | No license required |

| Nebraska | No deregulation | License required |

| New Hampshire | License required | License required |

| New Jersey | License required | License required |

| New Mexico | No deregulation | Limited deregulation |

| New York | No license required | No license required |

| Ohio | License required | License required |

| Oregon | License required | No deregulation |

| Pennsylvania | License required | License required |

| Rhode Island | No license required | No license required |

| South Dakota | No deregulation | Limited deregulation |

| Texas | License required | Limited deregulation |

| Virginia | License required | No license required |

| Washington D.C. | License required | License required |

| West Virginia | No deregulation | Limited deregulation |

| Wyoming | No deregulation | Limited deregulation |

Becoming A Better Energy Broker.

The retail energy broker market is complex and competitive. Energy brokers and sales agents span the gamut: from a new college grad working from his basement to the most sophisticated energy professionals advising companies spending millions per month in electricity costs. Understanding how to differentiate yourself is paramount to having a successful career as an energy broker professional. The articles below are for experienced energy brokers looking to take their game to the next level.

Improve Your Skills

Tips for improving your energy broker skills:

- Understanding Load Factor

- How To Take Advantage Of Bandwidth Contract Clauses

- Tips For Selling During High Market Volatility

- Making a Game Plan For Your Energy Broker Business

- How To Generate An Effective Prospect List

- How To Effectively Cold Prospect

- How To Properly Get A Bill

- How To Manage Your Leads

- Sorting Lead Data in Excel or Google Sheets

- The Pros of Being a Commercial Energy Broker

- Important Things to Know About Selling Deregulated Energy

- Everything You Need To Know About Diversegy’s Energy Broker Sales Platform

- What Are Energy Broker Regulations

- 3 Sales Techniques To Successfully Sell Energy Contracts

- How to Make $100K per Year Selling Electricity

- The 411 on Energy Brokers: Important Things to Know When Choosing an Energy Supplier

- The Scariest Things About the Energy Broker Business

- Energy Broker Marketing Materials: What You Should Leave Behind

- How To Prepare a Proper Energy Quote

- How To Properly Submit An Energy Price Request

- Properly Submitting a Signed Contract

- Using Energy Market Knowledge To Close More Sales

- The Best Sales Follow Up Methods: Email vs. Phone vs. In-Person

- 5 Tips For Making Better Connections With Customers

- 5 Things That Will Help You Be a Better Energy Broker

Electricity Costs Are Spiking: Here’s How Large Energy Consumers Are Responding

Electricity prices are rising faster than many large energy consumers have ever experienced, driven by structural changes in power and capacity markets. For organizations with significant electricity spend, the challenge is no longer just securing a competitive rate, but managing long-term price risk and budget uncertainty. This guide explains how large energy buyers are responding with structured hedging strategies to control costs, reduce price exposure, and stabilize energy budgets.

Battery Energy Storage Systems (BESS): Smarter Commercial Energy Management

Battery Energy Storage Systems (BESS) are rapidly becoming a cornerstone of smarter commercial energy management as businesses face rising electricity costs, demand charges, and grid volatility. From peak shaving and backup power to demand response and wholesale market participation, BESS allows commercial and industrial facilities to actively control energy costs while improving resilience and flexibility.

Energy Procurement for Multi-Site Businesses

Managing energy procurement across multiple locations introduces complexity that goes far beyond price. Different utilities, tariffs, contract terms, and regulatory rules can quickly turn energy into an administrative and financial burden. Without a centralized strategy, multi-site businesses often face misaligned contracts, missed market opportunities, and unnecessary exposure to risk. This guide explains how centralized energy procurement helps multi-site organizations streamline contracts, reduce costs, and manage market volatility with a structured, portfolio-level approach.

What’s In Your Briefcase? Tools Every Energy Broker Should Have

Tools and technology are important for energy brokers in the modern era. Here are some of the most common tools used by our most successful energy brokers.

Commercial Energy Storage Systems

Commercial energy storage systems are becoming a game changer, offering new possibilities for efficiency and sustainability. This article delves into the cutting-edge advancements in commercial energy storage, examining how they are revolutionizing the way businesses store and manage power.

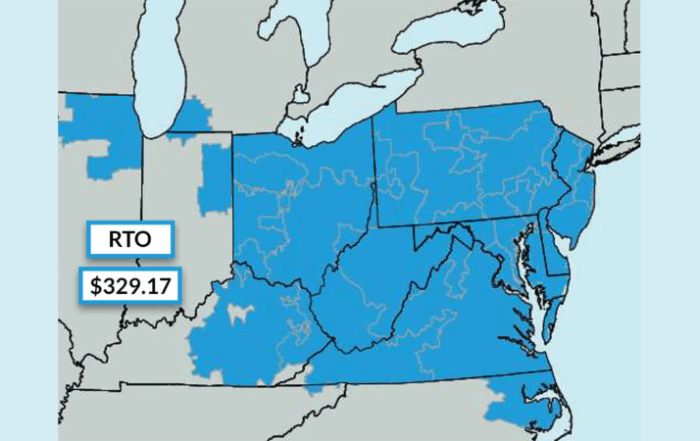

PJM 2026/27 Base Residual Auction Results: Record Capacity Prices in PJM

On July 22, 2025, PJM Interconnection released the results of its 2026/2027 Base Residual Auction (BRA), clearing at a record-high FERC-imposed cap of $329.17 per megawatt-day. This 22% increase from the previous year signifies escalating demand and tightening capacity across PJM's 13-state region, leading to continued elevated electricity prices for industrial and commercial energy users.